USD/CAD DAILY PRICE CHART

Technical Outlook: USD/CAD broke below the monthly opening-range lows on January 24th with the decline taking price to fresh four-month lows into the start of February trade. Daily support rests just lower at 1.2244 where the 78.6% retracement of the September advance converges on 2017 slope support.

A break below this confluence region would be needed to keep the short-bias in play with such a scenario targeting subsequent support objectives at the 2017 low-day close at 1.2156 and the 2017 low / Fibonacci confluence at 1.2025/56. Daily resistance is eyed at the 1.2388-1.2416 range with broader bearish invalidation up at 1.2581/97 – a region defined by the monthly open, the yearly opening-range high and the 100-day moving average.)

USD/CAD 240MIN PRICE CHART

Notes: A closer look at price action sees Loonie trading within the confines of a well-defined descending channel formation extending off the January highs with the upper parallel further highlighting resistance at 1.2388. The immediate focus is on a break of the 1.2241-1.2388 range to offer near-term guidance.

Bottom line: Although the broader outlook remains weighted to the downside, the immediate decline is vulnerable while above 1.2241. From a trading standpoint I’ll favor fading strength while within this formation with a break below channel support likely to fuel accelerated losses towards subsequent support objectives at 1.2025/56. Keep in mind we get the release of U.S. NFPs (Non-Farm Payrolls) tomorrow with the event likely to fuel increased volatility in the USD crosses.

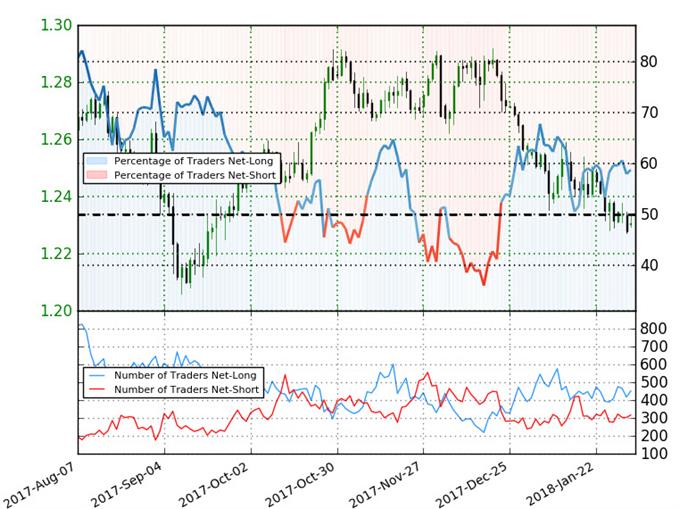

USD/CAD IG CLIENT SENTIMENT

Leave A Comment