Q4 Earnings Estimates Look Great

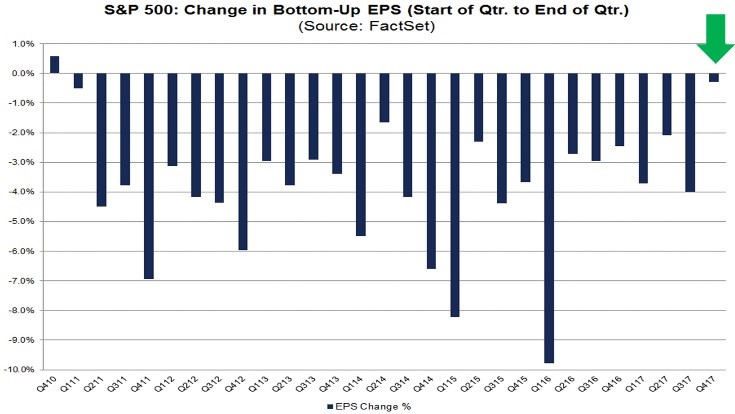

This has been a remarkable pre-earnings period because the estimates have only moved down 0.3%. As you can see from the chart below, the earnings estimate change has been the best since when they were increased by 0.6% in Q4 2010. Q4 2010 was when the economy was just recovering from the financial crisis which explains why estimates were increased as analysts started out cautious. You can see last quarter wasn’t great because analysts had to scramble to adjust for the negative impacts the hurricanes brought. This great Q4 pre-earnings period has occurred because 4 sectors saw an increase in expectations. The energy sector saw an increase in earnings estimates by 25.4% which was the best improvement since Q3 2005. Materials, technology, and utilities were the other sectors which improved. It’s interesting to see the sectors with the worst changes were consumer discretionary and industrials. There may have been a few firms which had a bad Christmas season. Industrials earnings growth going from 10.1% to 1.7% is surprising given the reports such as Markit and ISM which show the manufacturing industry is doing really well. The weakness is related to margins as the revenue expectation has improved from 6.2% on September 30th to 7.4% today.

Usually when the earnings estimates decrease throughout the quarter, they are setting up for a beat because the bar is lowered. This time the bar has barely been lowered. You can argue this means the beats won’t be large. This point has some credibility as Q4 2010 was expected to have 32.8% growth, but growth was only 19.5%. Q1 2016 had the worst pre-quarter drop, but results surprised to the upside as they came it at -6.7% which was better than the -8.8% expected.

One point worth noting is positive guidance has been strong. As you can see from the chart below, 30 companies have issued positive guidance which is more than the average which is 28. 75 firms issued negative guidance which is below the 5 year average of 80. I think these results would have occurred in Q3 if there weren’t two devastating hurricanes. Last quarter 44 firms issued positive guidance.

Leave A Comment