Well you can add the Organization for Economic Cooperation and Development (OECD) to the (very) long list of folks who think US stocks are out of control.

On Wednesday, the OECD released their latest global outlook and the commentary on equities is “cautious” (to put it mildly).

Their assessment mirrors the narrative emanating from virtually every analyst and economist on the planet. Simply put, valuations are sky-high and bear little resemblance to economic reality.

Further, prices seem to reflect overly optimistic assumptions about the impact of policy proposals that have very little chance of becoming law, let alone delivering the type of benefits we’d need to see to justify current valuations.

Read the excerpts from the section on equities below…

Via OECD

Equity prices have risen apparently in excess of fundamentals.

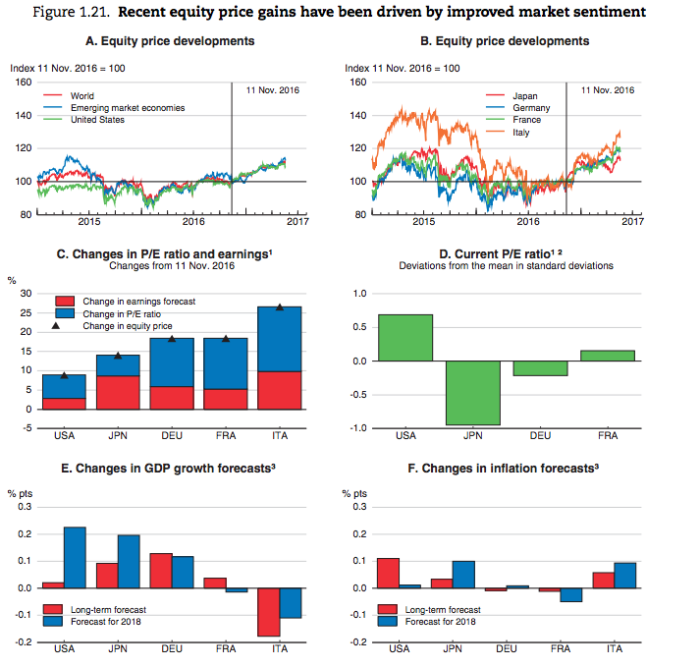

Global equity prices have increased on average by more than 10% since November last year, reaching historic highs in the United States and Germany (Figure 1.21). The recent rise has been driven mainly by improved risk tolerance, following heightened risk aversion in early 2016. Prices have increased by more than expected earnings and despite an increase in bond yields. However, the positive assessment of corporate earnings might be too optimistic given small changes in short and long-term consensus projections for GDP growth and inflation over the past six months, pointing to risks of equity price corrections if earnings growth disappoints.

In the United States, S&P500 price-to-earnings (P/E) ratios, based on expected earnings, now significantly exceed the 30-year average.

The recent increase should be viewed in the context of very strong projected earnings growth, of around 20% in the coming 12 months. Such high growth in expected earnings may, however, exaggerate the expected benefits of possible policy initiatives, including corporate tax cuts. The rise in a widely-used metric of market valuation – the Shiller cyclically-adjusted P/E ratio which discounts recent earnings developments – to its highest level since the dot-com boom is also a worrying development. Despite this, the increase in stock prices has been accompanied by low expected stock market volatility, as measured by the VIX index.

Equity prices are vulnerable to downward revisions in earnings expectations, a faster-than-expected rise in government bond yields and investor sentiment shifts. A big correction in equity prices could weigh on economic activity via wealth effects and the financial conditions for firms (though such effects appear to have weakened in recent years). Heightened financial market volatility could also spill over to other assets and countries, with negative feedback loops. In the United States, perceived risks of a significant decline in S&P500 equity prices one-month ahead, as measured by the SKEW index, have recently risen to a record high.

Leave A Comment