Pfizer Inc. (PFE) is not the most exciting stock to own, since it is not likely to produce huge growth rates. But this does not necessarily mean it is a bad investment. Far from it, particularly for income investors. Pfizer offers investors a steady stream of dividends and a high yield, backed by a strong and highly profitable business model.

Pfizer is a good example of a slow-and-steady dividend stock. It has a long history of steady growth, and dividends. The company has been in operation for more than 100 years. Combined with its 3%+ dividend yield, these two qualities earn Pfizer a place on our list of “blue-chip” stocks. You can see the full list of blue chip stocks here.

Pfizer has a dividend yield of approximately 3.9%, which is more than double the average stock in the S&P 500. And, thanks to a robust product pipeline, it has the financial strength to raise its dividend each year. The stock also has a modest valuation right now, which could make it attractive for value and income investors.

Earnings Overview

Pfizer is one of the largest U.S. pharmaceutical companies, with a market capitalization of $210 billion. It researches and manufactures drugs for a variety of therapeutic areas. Pfizer operates two reporting segments:

Common therapeutic areas for Pfizer are internal medicine, oncology, immunology, inflammation, and rare diseases. Pfizer’s global portfolio is based mostly on biopharmaceuticals, but it also includes vaccines.

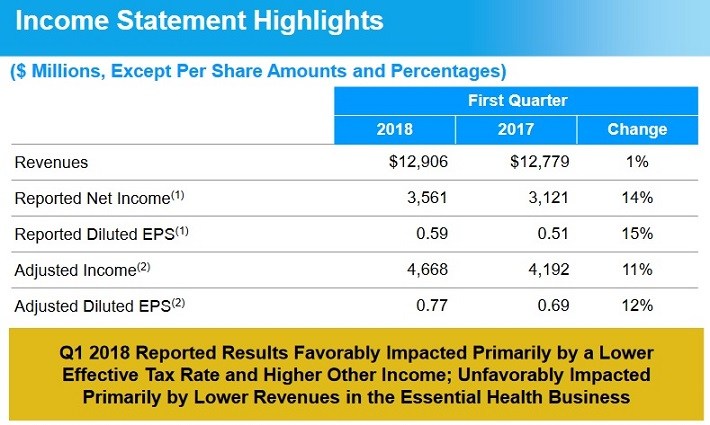

On May 1st, Pfizer released first-quarter financial results. Overall, the results were strong. Revenue of $12.91 billion missed expectations by $240 million but rose 1% from the same quarter a year ago.

Source: Earnings Presentation, page 7

Adjusted earnings-per-share of $0.77 beat expectations by $0.02, and increased 12% year-over-year. Double-digit earnings growth was a strong performance for a mega-cap like Pfizer, and it was largely due to the company’s Innovative Health segment.

Leave A Comment