Do Yields Matter Now?

The stock market fell modestly on Monday as the S&P 500 was down 0.67%. Because the market has had such a spectacular year, this is the worst day so far. The 99 day streak without a 0.6% decline, which was the longest streak ever, ended. Some are blaming the increase in the 10 year bond yield for the decline in stocks. The 10 year bond yield hit above 2.7% for the first time since April 2014. This means for the first time in years, the bond market believes nominal GDP growth will be strong. This worries those who believe in the TINA thesis because yields will provide competition for stocks. It worries me because yields are rising with inflation expectations. I think the 10 year will be a problem for the stock market when it gets above 3% which would be close to the highest point since 2011. While the size of the market decline wasn’t sharp, the NYSE breadth (the amount of stocks up versus the amount down) was horrible. It was the weakest since August 2017.

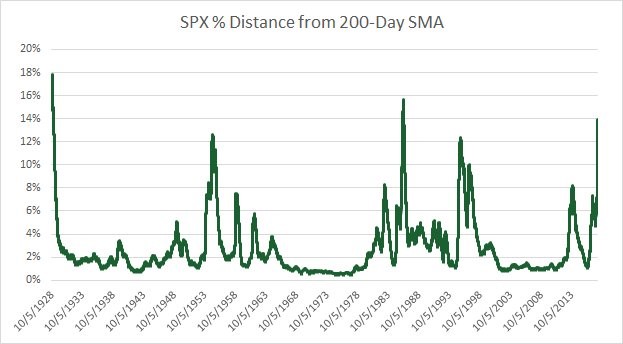

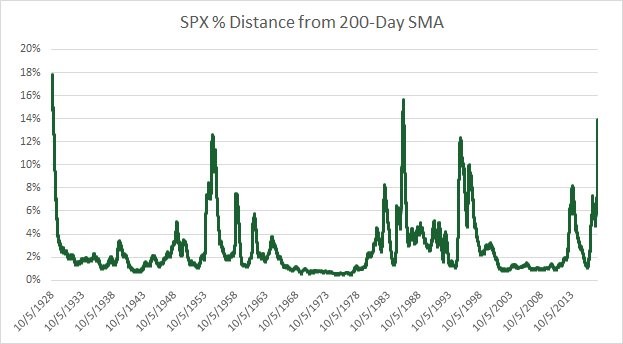

Momentum Still Excessive

A day where the overall index falls less than 1% isn’t enough for me to think the market isn’t overbought anymore. As you can see from the chart below, the S&P 500’s distance from the 200 day moving average has rarely been higher. Stocks were only more overbought in the 1920s and the 1980s. This overbought ratio is why so many traders were worried about Monday’s performance even though it wasn’t that bad. The traders who haven’t experienced a 5% correction, because that hasn’t happened in over 400 days, are nervous and the investors who know the market is ripe for a correction are licking their chops.

Headline GDP Miss, But Good Underlying Growth

The GDP report showed the economy grew 2.6% in Q4 which was below the expectation for 3.0%. This was much worse than the 3.2% growth seen in the prior quarter. However, the report was very good if you ignore the headline and get into the details of it. The personal consumption was up 3.8% which signals consumer spending was very strong during the holiday season like I expected. The final sales to private domestic purchasers was up 4.6% quarter over quarter which was the fastest growth rate since Q3 2014. It’s not a surprise the consumer was strong; the labor market was strong and sentiment was high. Non-residential fixed investment was up 6.8% which shows firms are investing more in capex. I’m worried that the capacity to utilization rate will hit a ceiling this year.

Leave A Comment