Although USD/JPY ended the day marginally higher (we’re talking 10 pips or so), the fundamental and technical picture hasn’t changed. U.S. data continues to disappoint with the Empire State manufacturing index dropping 10 points in July. This decline was much larger than anticipated and highlights the disconnect between U.S. data and Fed policy. U.S. policymakers may be talking rate hikes but so far, data has done more to refute rather than confirm their views. After last week’s shockingly weak retail sales and consumer price reports, we believe USD/JPY has more room to fall, especially with U.S. rates declining and no major U.S. data on the docket this week.

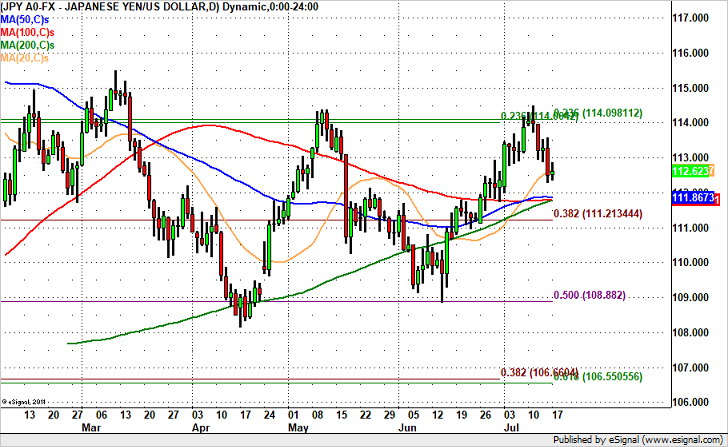

Technically, it could be a bumpy ride. There’s a lot of resistance below 113 and 114 (double Fib resistance) but there’s also multiple moving average support hovering between 111.75-111.85. We think USD/JPY will drop to 112 and maybe dip below there but buyers could swoop in at that level. That shouldn’t be a problem for our swing trade as we entered at 112.80 with a target well above support at 111.85.

Leave A Comment