The dollar was broadly weaker after dovish comments from Fed Governor Lael Brainard amid reverberations from reports of Donald Trump Jr.’s contact with a Russian lawyer; European equities rebounded with oil while S&P futures were 0.2% higher at 2,428; Treasury yields are 1-2bps lower across the curve with the 10y at 2.346% ahead of Yellen’s much anticipated testimony this morning (House today, Senate tomorrow) for further clues on the trajectory of monetary policy while the Bank of Canada is expected to hike rates later.

The release of emails by President Donald Trump’s son that said Russia backed his father’s presidential campaign curbed demand for fresh dollar longs, according European traders cited by Bloomberg. The U.S. currency was also weighed down by dovish comments from Federal Reserve’s Lael Brainard.

As Bloomberg further notes, investors now look for Yellen to offer some guidance on the timing of a potential shrinking of the Fed’s balance sheet and also on the outlook for inflation and interest rates.The greenback traded mixed versus its Group-of-10 peers and pared losses as measured by the Bloomberg Dollar Spot Index after some profit-taking in euro longs and as the pound dropped toward $1.28. The U.S. currency orbited the 1.29 level versus the loonie before the Bank of Canada’s much awaited policy decision.

Comments overnight from two of Yellen’s colleagues calling for caution on further interest rate rises have pushed back the probability of a hike again before the end of the year to 50 percent, according to the CME’s Fed watch data.

“The Yellen testimony remains the key event risk in today’s session but we remain optimistic about the dollar’s outlook and putting on a long position against the sterling is the best way to execute that view,” said Adam Cole, head of FX at RBC.

Some more thoughts on Yellen’s speech from DB’s Jim Reid: “For today, will Mrs Yellen choose to reinforce the recent more hawkish global central bank speak or will she attempt to pull things back a little? DB expect her to reinforce the message from the June 14 post-FOMC press conference and continue to guide the market towards an announcement of the beginning of balance sheet normalisation at the September 20 meeting as well as a rate hike by year-end. There will be plenty of eyes on Yellen’s comments around inflation too and our US economists expect the Chair to stick to the script that the recent pause is likely due to transitory factors. So it’s worth seeing if there is any change from this mantra.”

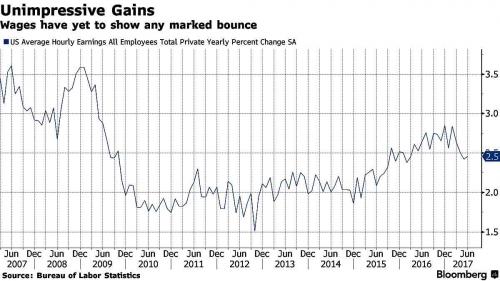

A pushback on further Fed tightening will be questions about the trajectory of US wages, and specifically why growth remains so anemic.

Distractions from the White House come as Federal Reserve Chair Janet Yellen prepares to give two days of testimony that will be dissected for clues on when she will start shrinking central bank bond holdings, while the Bank of Canada is expected to hike interest rates Wednesday. The release of emails by the younger Trump about his controversial meeting may give the Fed pause as it seeks to dismantle a decade of monetary stimulus, according to market strategist Bill Blain of Mint Partners, a global brokerage firm in London. “The pressure on markets and gridlock on Washington spending plans is probably enough to keep the Fed from doing anything extraordinary,” Blain said in a note to clients.

While the Federal Reserve chair is expected to say that the Fed remains on a hawkish course of steadily rising rates, any signals on how the bank is viewing a retreat in inflation and muted wage growth will be closely watched.

The Euro Stoxx 50 gained 0.6 percent, led by automakers and energy companies, and the FTSE 100 rose 0.7 percent. S&P 500 futures were steady.

Crude oil and WTI has tested the $46.00 handle this morning finding upside momentum from the latest API inventory data last night which showed the biggest draw down in crude stockpiles since September 2016 (-8.13mln vs Exp. 2.45mln) with Cushing coming in at -2.028mln, the largest draw since February 2014 according to Amplify Trading. As ever, the US output number will be key in this afternoon’s DoE release and in the interim period we have the OPEC monthly oil market report coming out shortly after midday, a report that should give insight into compliance levels and the strength of global demand.

Alongside the Dollar’s decline, the aussie and yen outperformed G-10 peers; emerging market currencies were led higher by won. Sovereign yields drifted lower following yesterday’s Trump Jr revelations; T-note yield down two basis points at 2.34%. The Nikkei slipped 0.6% while in China the PBOC injected liquidity for a second day; The yuan strengthened after official central bank publication called for wider trading band and less government intervention; H-shares and Hang Seng rally. WTI crude holds onto API-inspired overnight gains; Dalian iron ore 0.8% higher. The pound rebounded after U.K. payrolls data beat estimates and unemployment fell to a 42-year low. That offset an earlier decline following a report a key Bank of England policy maker isn’t in favor of higher rates.

Leave A Comment