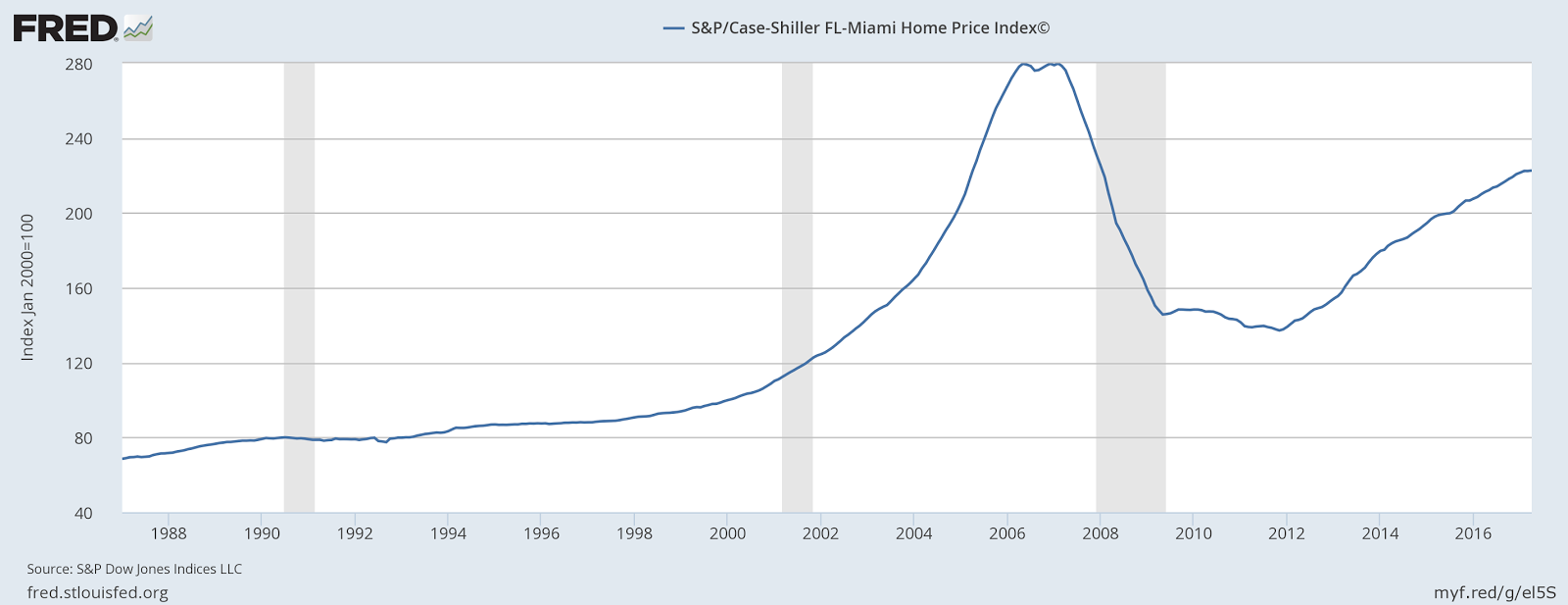

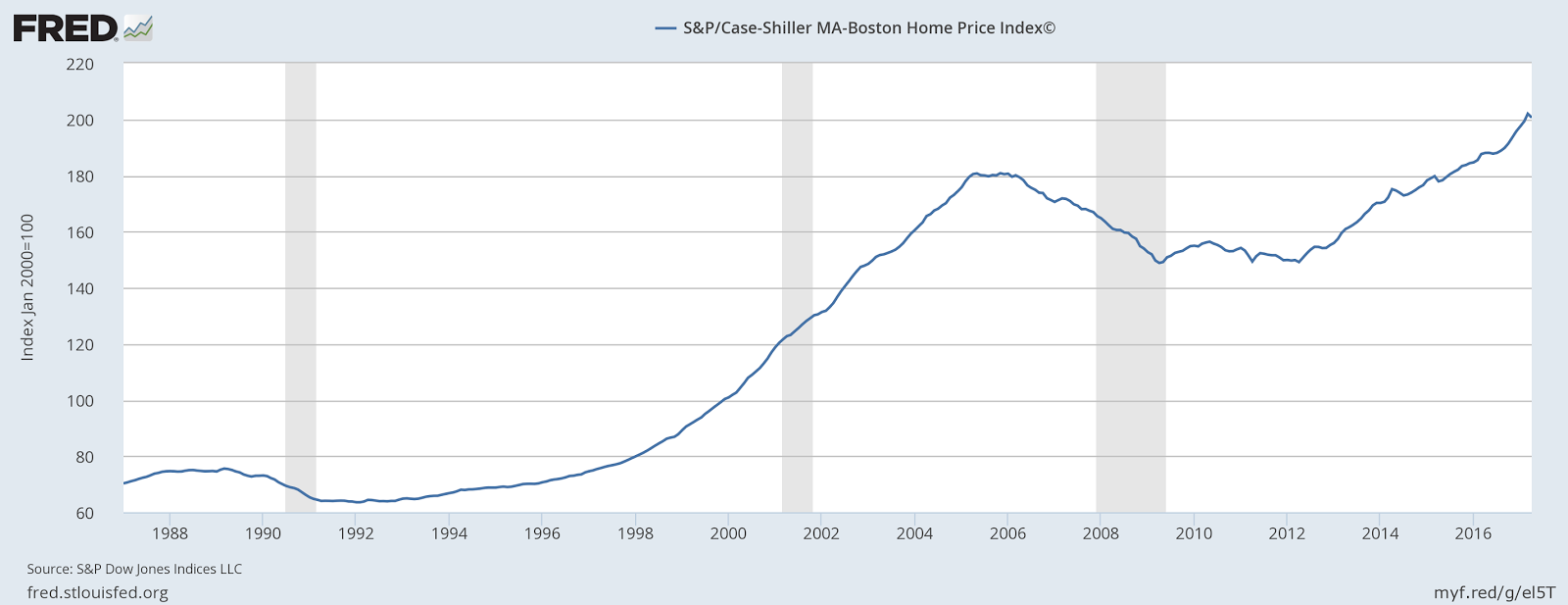

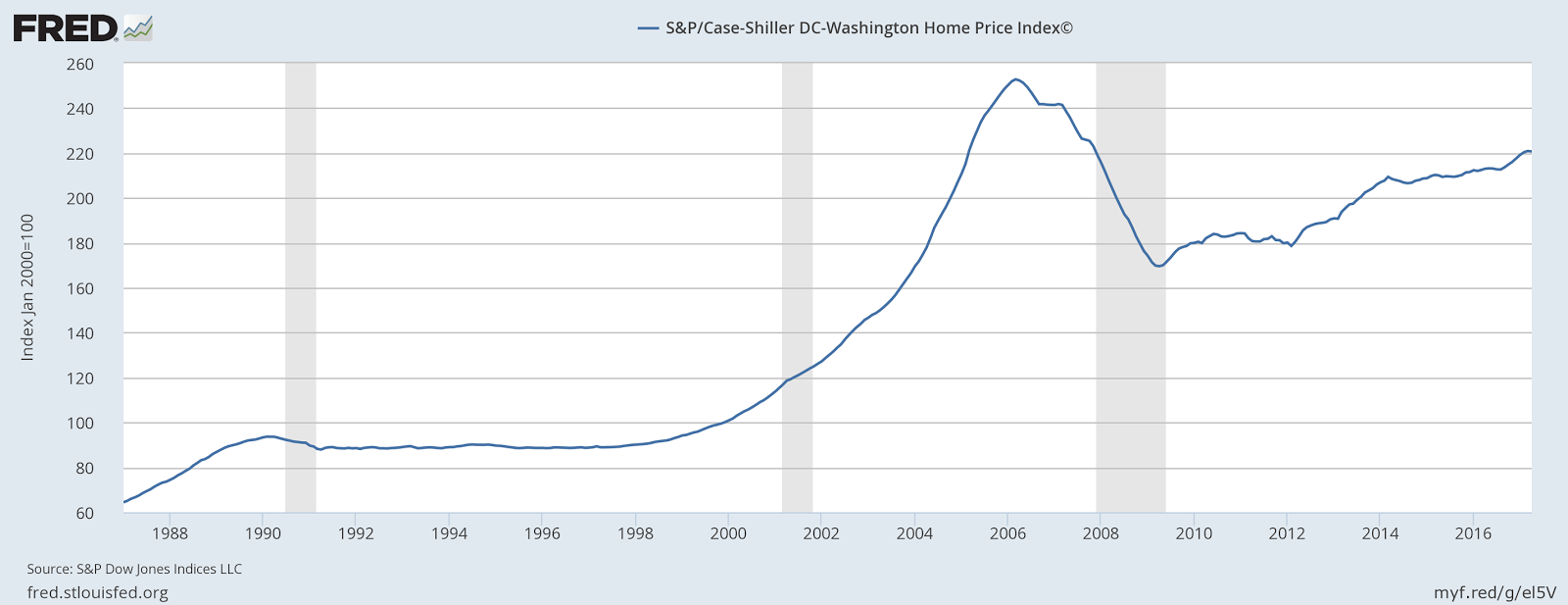

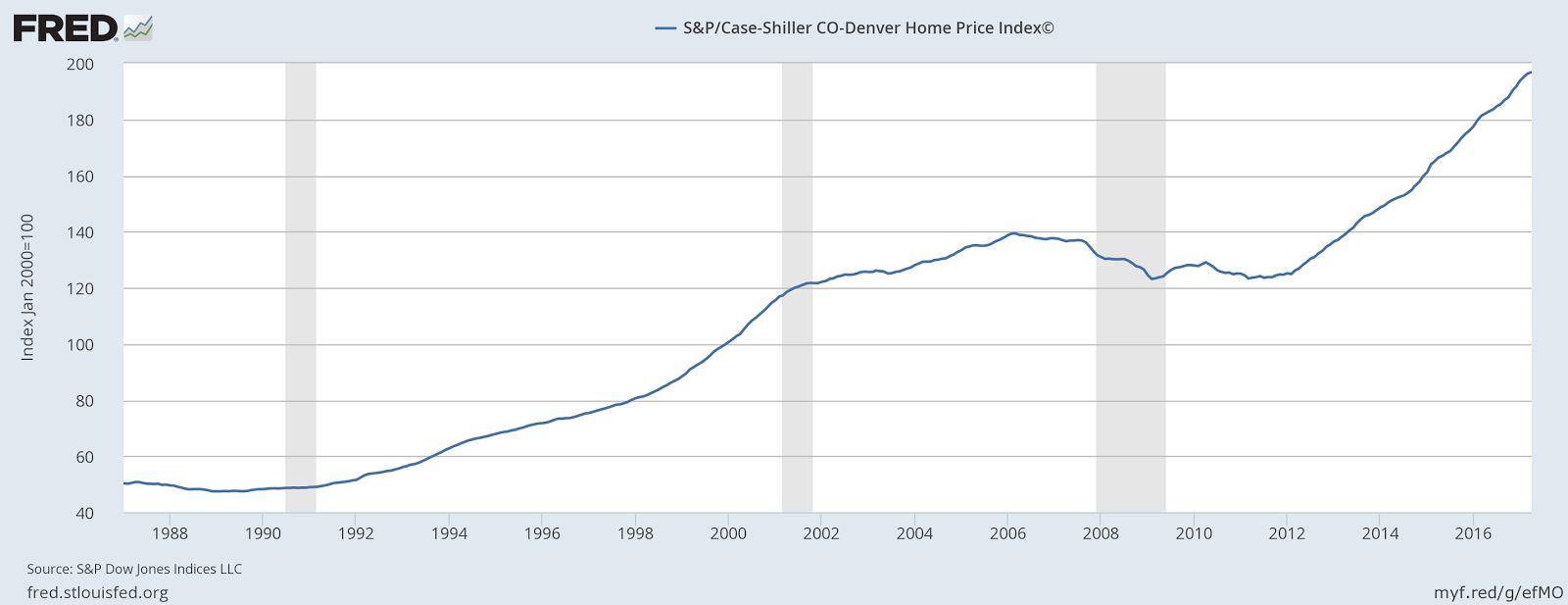

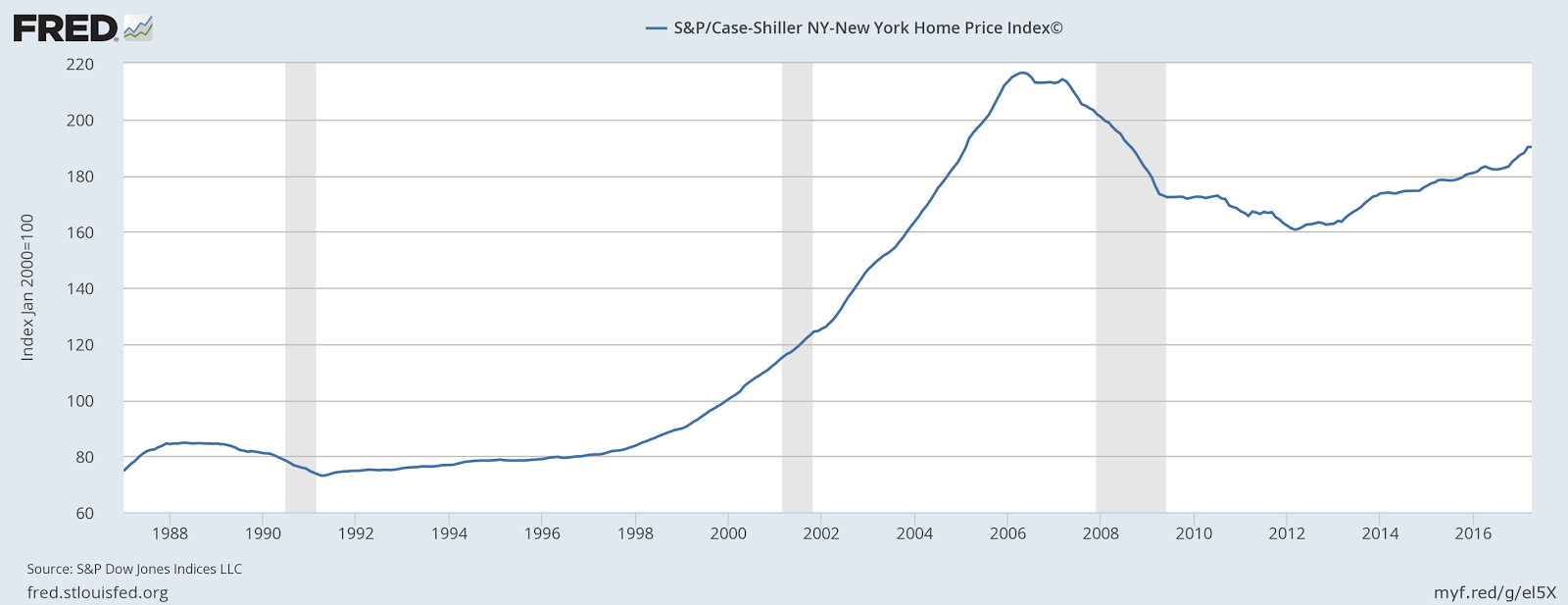

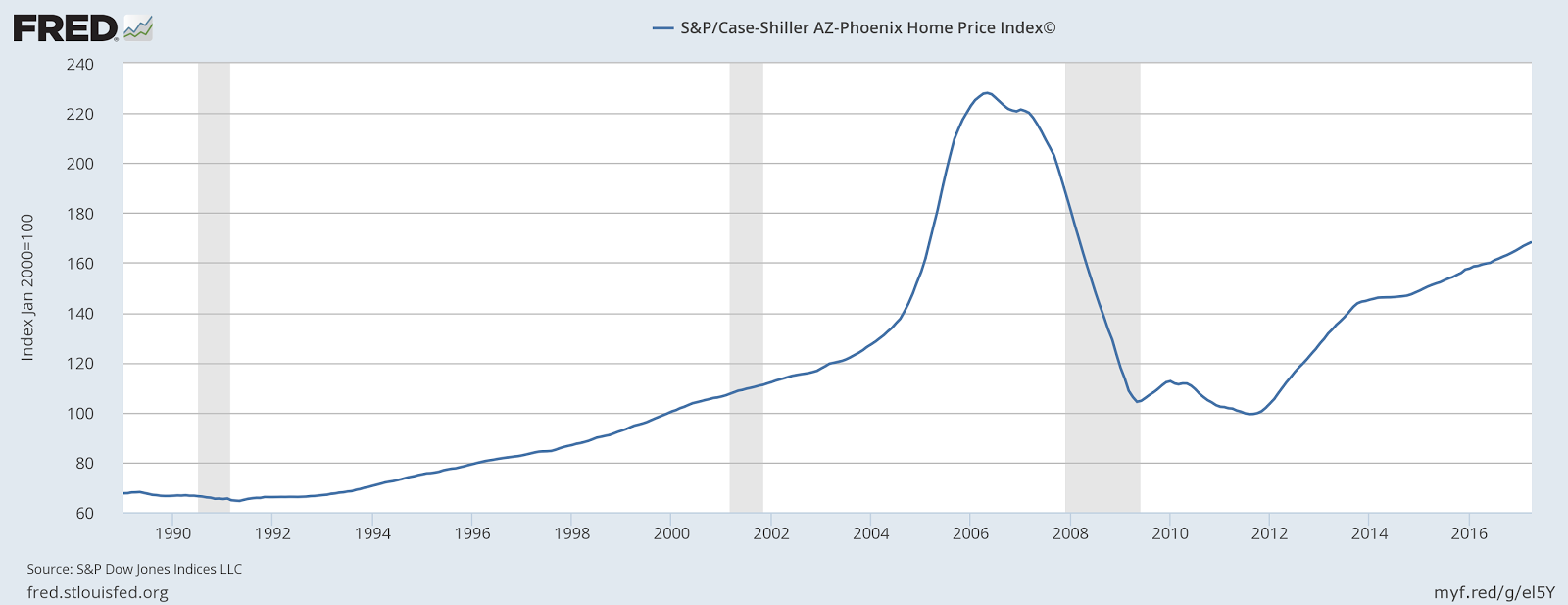

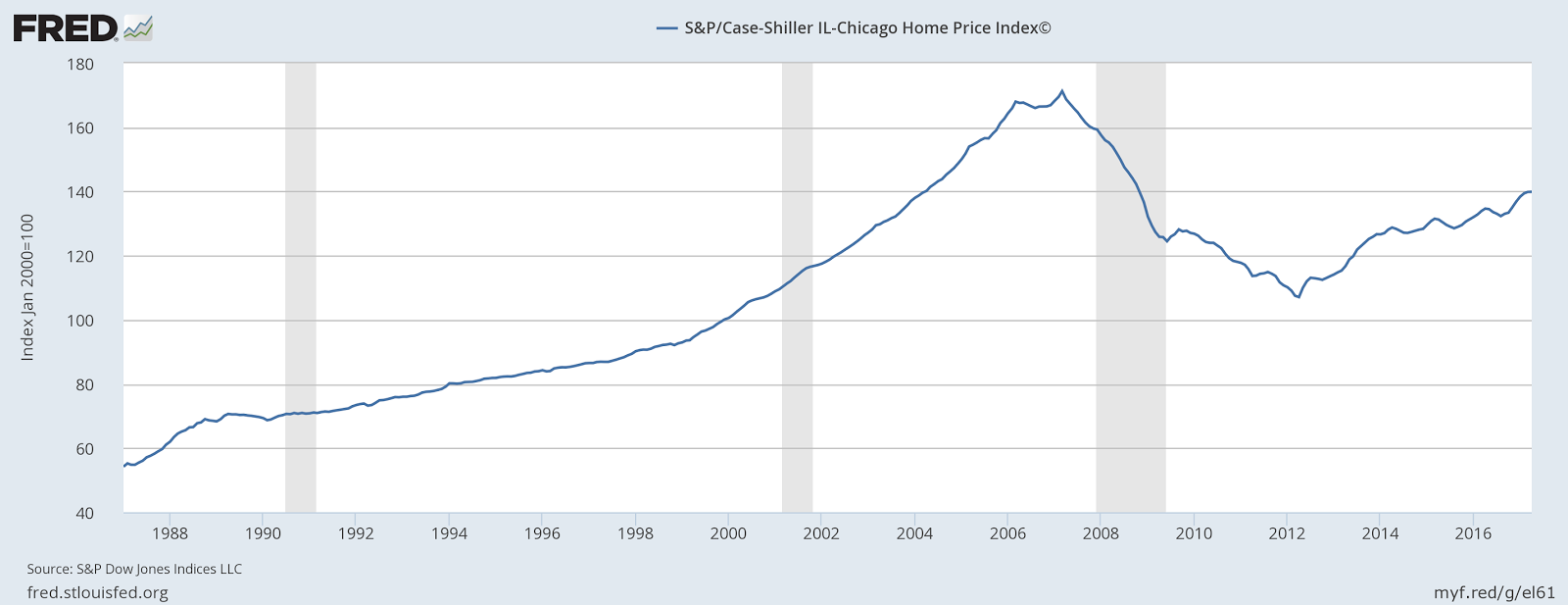

We discuss some of the Methodology of the Case-Shiller Home Price Index in this Housing Market video, and then go over 20 cities and compare and contrast how each has fared since the Housing Market Crash.

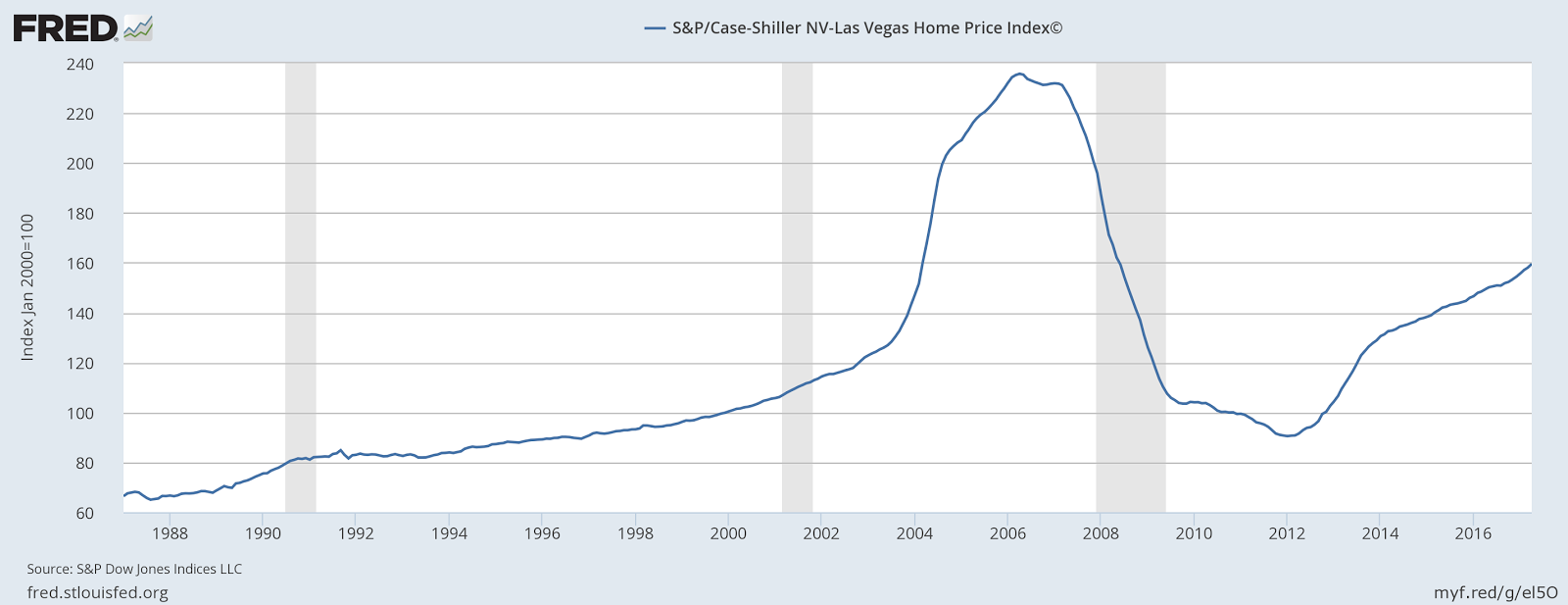

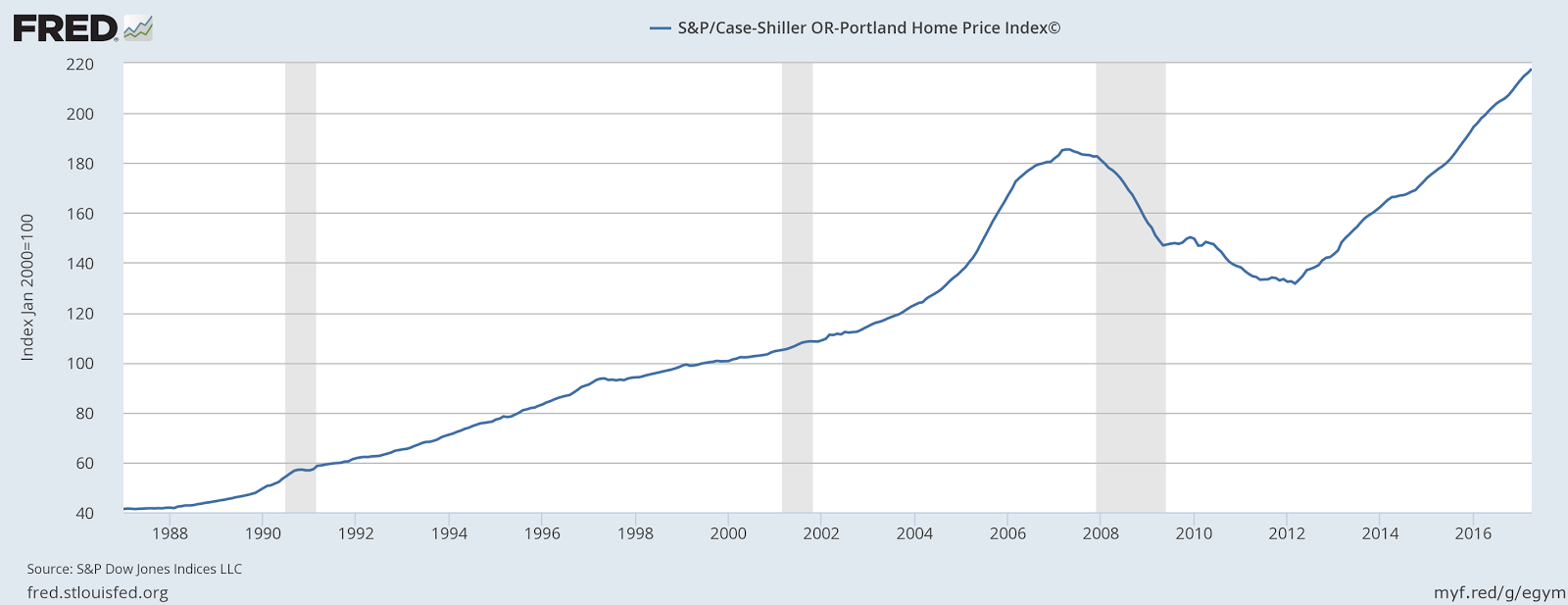

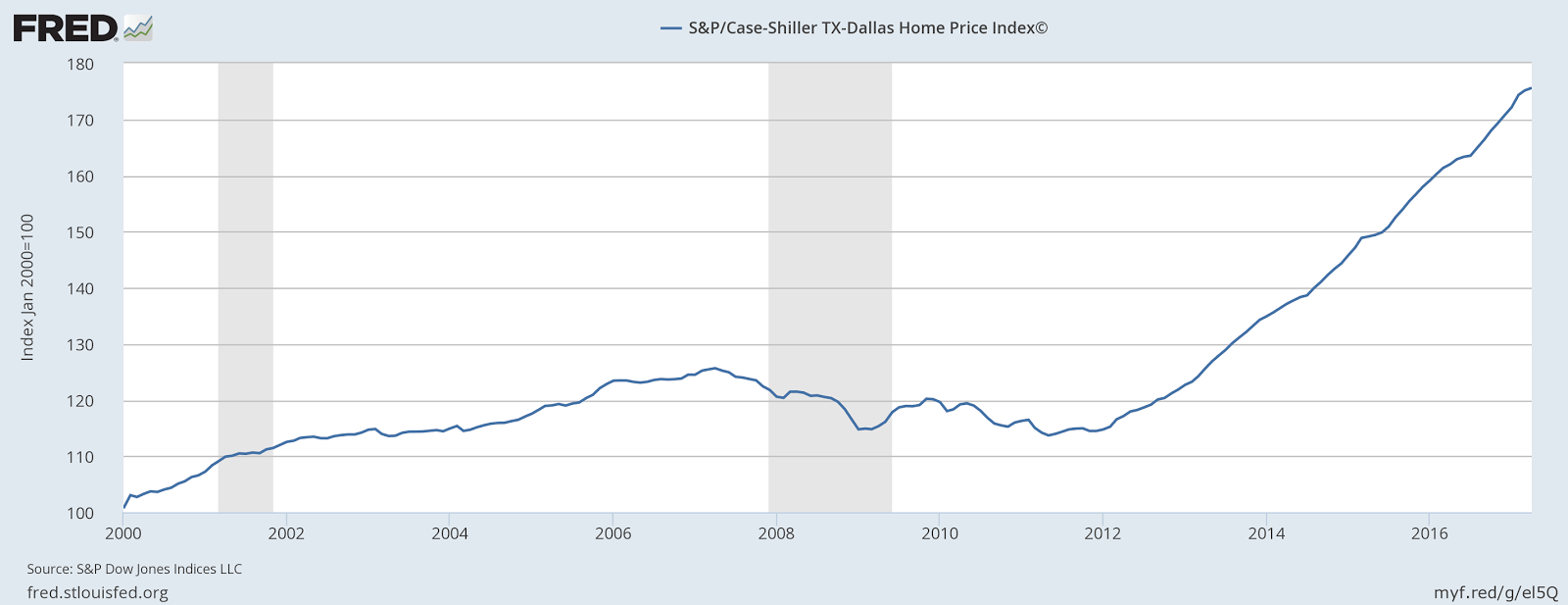

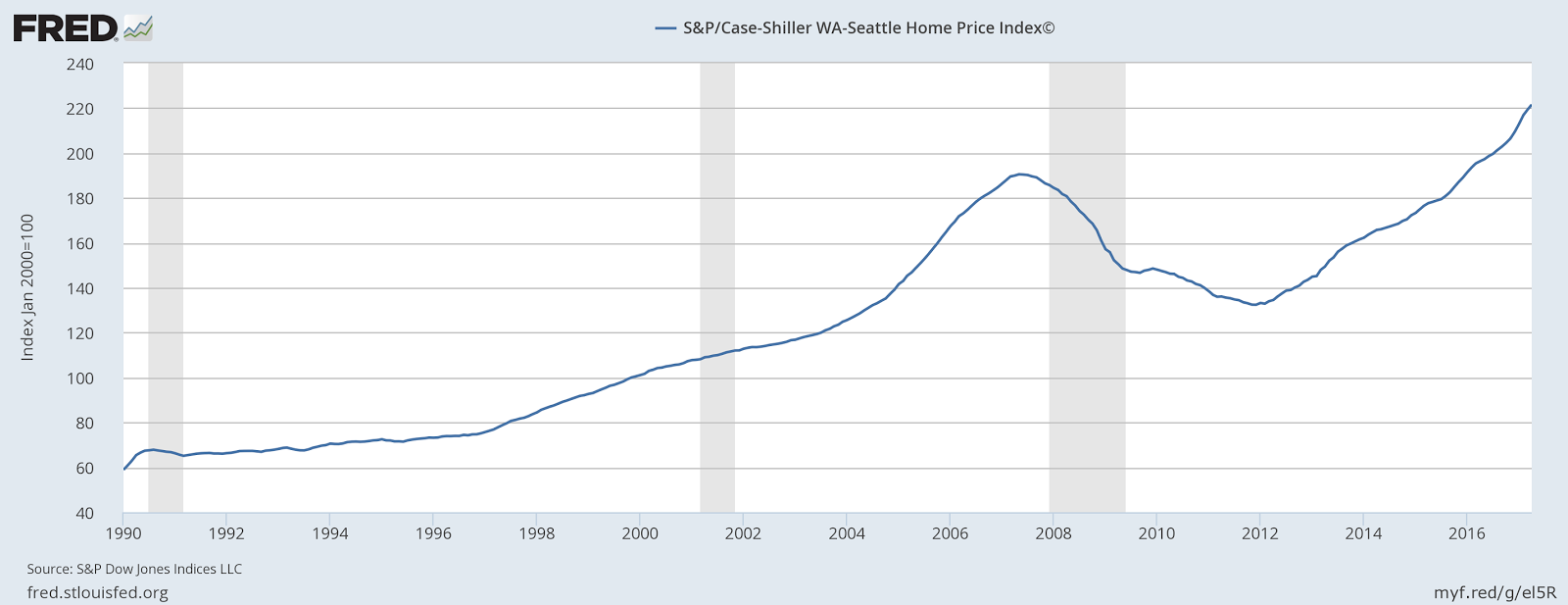

Seattle, Portland, Dallas and Denver are some really hot Housing Markets. Las Vegas still has a long way to go to reach the Pre-Housing Crash levels, a lot of significant damage done to the Florida Housing Markets as well, and it has taken longer to recover. What this undertaking illustrates is just how local the Real Estate Market is even within the larger backdrop of an overall healthy job market and economy. All Housing Markets are better since the Financial Crisis and the Housing Crisis, however some homeowners who bought at the top in cities like Miami and Los Angeles may still be under water in their mortgages. Whereas, Housing Markets like Denver, Dallas, Portland, Seattle, Boston and San Francisco are experiencing new highs in these markets. And I would even go so far to point out that the Dallas Housing Market may be in bubble territory, it seems likely for a pullback sometime over the next five years as more housing inventory comes onto the market, and the local economy starts reflecting lower oil prices, and a pullback in Shale Drilling activity.

Video Length – 00:13:06

Leave A Comment