Enterprise Products (EPD) is a best-in-class Master Limited Partnership. MLPs have high appeal for income investors, because they have certain tax advantages, and typically offer high dividend yields. You can see the entire list of 134 MLPs here. Enterprise Products has a 6%+ dividend yield, which makes it part of a select group of stocks. The High Dividend Stocks list Excel sheet has 416 stocks with 5%+ dividend yields. Not only that, but Genesis has increased its dividend for 47 quarters in a row. Enterprise is also a Dividend Achiever. The Dividend Achiever Excel list has 265 stocks that have increased their dividends for 10+ consecutive years. The recent drop in oil and gas prices has kept a tight lid on Enterprise Products’ share price, but the company has minimal exposure to commodity prices. This article will discuss why the stock could be an attractive income investment.

Business Overview

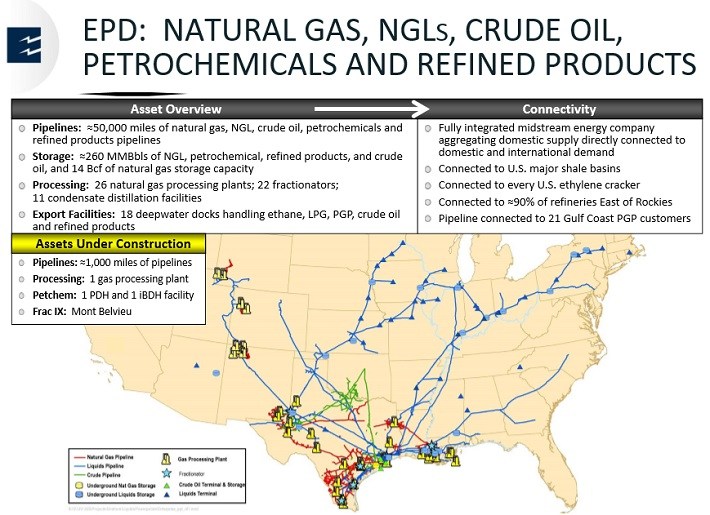

Enterprise Products is a midstream MLP, which means it operates pipelines and storage terminals. It has a massive network of assets, stretching across the U.S.

Source: June 2016 JP Morgan Energy Conference, page 6

The company’s assets consist of 49,300 miles of natural gas, NGL, crude oil, refined products, and petrochemical pipelines. It also has 260 million barrels of NGL, refined products, and crude oil storage capacity, along with 14 billion cubic feet of natural gas storage capacity. These assets operate similarly to a toll road, in the sense that the company generates fees based on volumes going through its pipelines and storage terminals. As a result, Enterprise Products is only modestly affected by falling oil and gas prices.

Enterprise Products operates four business segments:

Leave A Comment