Greetings,

We begin with the latest global manufacturing reports from Markit. Given the flash PMI (Purchasing Managers’ Index) reports were released about a week ago, most of these results were not unexpected. However here are some highlights worth discussing.

1. Below is what JPMorgan had to say regarding the overall global manufacturing activity.

Source: Markit

2. The news wasn’t entirely gloomy however. Manufacturing in several smaller economies such as Poland and Switzerland surprised to the upside.

3. The manufacturing report out of the UK on the other hand was highly disappointing.

Source: Markit

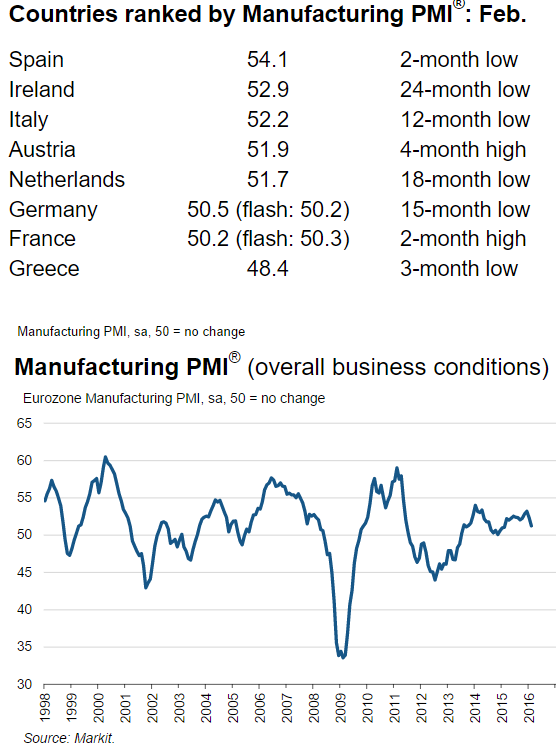

4. The report from the Eurozone shows softer manufacturing activity but large variations across the member states. German manufacturing growth is definitely slowing.

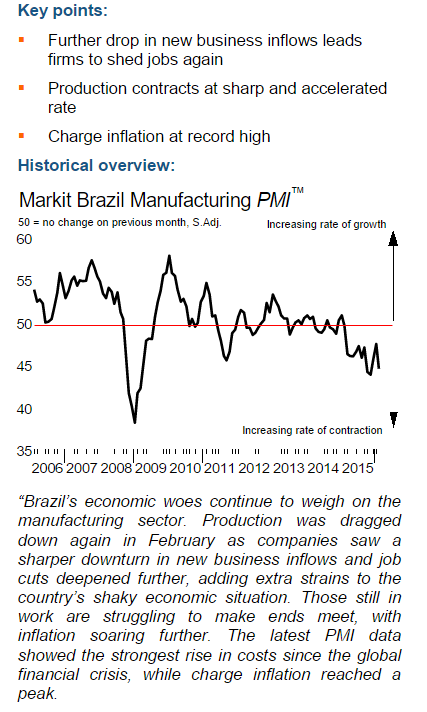

5. Brazil continues to struggle, as the manufacturing sector sheds more jobs. The stagflation has been extraordinary – just take a look at the commentary below.

Source: Markit

6. Here is a summary for the EM regions from Capital Economics.

Source: @CapEconEmerging

7. The situation in the US is not encouraging, with Markit referring to “signs of distress” in the manufacturing sector.

Source: Markit

In spite of the gloomy Markit report (above), we had some positive news on US manufacturing. The ISM PMI report (Institute for Supply Management), while showing the the manufacturing sector is still contracting, was materially better than expected. Production, employment, and the backlog of orders improved.

It was also helpful to see manufacturers’ customer inventories stabilize after being highly elevated.

The markets took this as a sign of stabilization for the United States – pretty much ignoring the Markit manufacturing report (traditionally the US ISM report carries significant weight vs. other PMI measures). Treasury yields rose and the S&P500 futures jumped 2.5%.

Source: barchart

As a side note, the ISM manufacturing employment sub-index has diverged sharply from the government’s payroll figures. The ISM surveys don’t seem to pick up the trend in job creation (or there is a problem with the government’s figures).

Leave A Comment