Written by Jim Welsh

Macro Tides Monthly Report 10 April 2017

U.S. Economy Consumer confidence as measured by the Conference Board is at the highest level since 2000. The National Federation of Small Business Optimism Index hasn’t been this high since 2004. (Chart below courtesy of dshort.com, larger image after the page break.)

Please share this article – Go to the very top of the page, right-hand side for social media buttons.

The large rally in the stock market has likely been a contributing factor, but the prospect of less regulation has buoyed small business owners. The prospect of the government taking a little less out of their paycheck has made consumers feel better, but they haven’t started spending the expected increase in net pay yet. The increase in optimism is readily apparent in Bloomberg’s U.S. Economic Surprise Indicators. However, it also shows that hard data, based on current economic activity, hasn’t improved much. In the past, optimism has waned and declined back to reality, as it did in 2014 and likely repeated in 2017.

I expected economic growth to slow in the first quarter for a number of reasons. The Atlanta Federal Reserve’s GDP Now estimate for first quarter GDP is 0.6% as of April 7, down from 2.1% in the fourth quarter. In the December issue of Macro Tides, I wrote,

“Investors will become impatient when they realize the economy is not going to benefit from Trump’s proposed changes until the second half of 2017 at the earliest, and the legislative progress isn’t as smooth as currently expected. If the economy slows a bit in the first quarter, investor’s impatience could become disappointment. It is going to take a number of quarters before individual and corporate tax rates, a reduction in the burden of excessive regulation, and infrastructure spending lift growth as much as expected.”

In the November issue of Macro Tides, I reviewed the health of the auto sector. I noted that car sales financed by sub-prime auto loans were up 11% in 2015 and a stunning 124% since 2010, according to Equifax. According to Experian Automotive, leasing made up more than 32% of sales in 2016, up from 13.5% in June 2009. Since 2007 the average amount financed has risen 23%, but aggressive leasing deals and low-interest rates have allowed the monthly payment to only increase by 6%. This helps explain why leasing has become so popular.

A glut of 3.1 million cars were expected to come off a lease in 2016, with another 3.5 million piling up in 2017. This was expected to weigh on used car prices and it has. In February used car prices were down 8% from a year ago and at the lowest level since 2010, according to the National Automobile Dealers Association (NADA) Used Car Guide.

To offset the pressure from used car prices, car manufacturers have increased incentives to more than 10% of the sticker price for a record 8 months in a row. As noted in the March issue of Macro Tides, car manufacturers increased incentives to a record $3,830 per vehicle in February, up 10% from February 2016. Despite the hefty sales incentives, sales have plunged from an annual rate of 18.7 million vehicles in December to 16.53 million in March.

As sales have slowed, inventory has built up on dealer’s lots and is now the highest since 2004. In a healthy sale, environemnt car dealers will have an inventory level of 60 to 70 days. In March, GM had 98 days of inventory, while Ford had 80 days. For the industry as a whole, inventory day levels are the highest since July 2009.

I expected banks to increase lending standards since the delinquency rate for auto loans has been creeping higher since 2014 despite a growing economy. Other than auto and student loans, the delinquency rate for other forms of consumer credit has been falling since 2010. This has led banks to increase lending standards and lower auto lending. The combination of tighter lending standards and higher interest rates will increase the cost of leasing and auto financing in general and result in lower vehicle sales.

These factors will also weigh on buyers who still owe money on their existing car. In 2016, 32% of new car buyers owed on average $4,322 on their trade in. Banks and auto financing arms of the manufacturers have been willing to roll the unpaid balance into the loan for the new car. Does anyone want to guess how long that game will continue? As I forecast last November,

“The coming slowdown in car manufacturing will turn what has been a positive growth sector into a modest drag on GDP growth in coming quarters.”

In March, ISM manufacturing production fell sharply in all likelihood due to less production in the automotive sector. Given the level of inventories in March, it will be hard for the car manufacturers not to cut production of sedans in coming months. While the ISM Manufacturing PMI gets all the headlines, a further decline in production will eventually spill over and cause the ISM Manufacturing PMI to weaken.

After the election, the majority of economists and strategists forecast that the yield on the 10-year Treasury bond would rise to at least 3.0% and probably higher. I didn’t agree with this assessment. As I have discussed in my Weekly Technical Review and March Macro Tides, I thought the yield on the 10- year Treasury Bond would fall from 2.6% to 2.3% and possibly as low as 2.2%. To date, the yield has fallen from 2.62% to 2.33% which has helped keep mortgages from rising in recent months. There are other factors that are likely to be headwinds for housing.

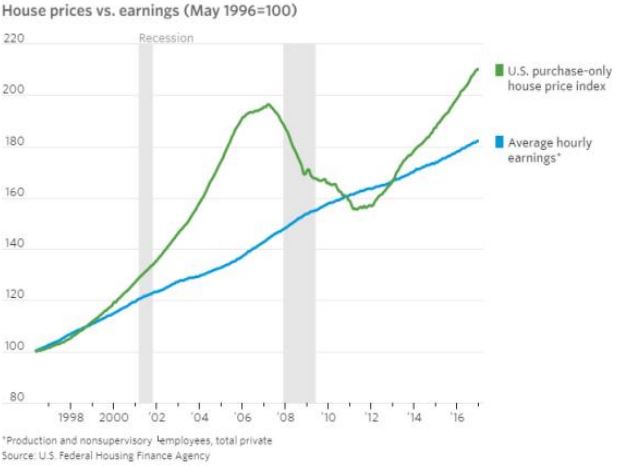

Housing prices have been rising far faster than average hourly earnings since 2012. Although the gap between home prices and earnings doesn’t look quite as elevated as it was in 2006-2007, the ratio of median home prices to median income is actually more extreme now. In November 2007, the median home price was $249,100 and median income was $58,003, according to the Census Bureau. The ratio of median home prices to median income was 4.3 in November 2007. In February 2017, the median home price was $296,200, median income was $58,714, and the ratio was 5.0.

Housing prices will be vulnerable to another meaningful decline during the next recession, which will contribute to the next recession being deeper and less responsive to lower interest rates.

To fully appreciate how extreme the current level is one needs to view the relationship between median home prices and median income going back to the mid 1960’s. The following is an excerpt from my monthly analysis in the September 24, 2007 issue of The Financial Commentator. (name was changed from The Financial Commentator to Macro Tides in 2010)

“Between 1968 and 2000, the ratio of the median home price to median house hold income fluctuated in a narrow rage of 2.8 and 3.2. During this 32 year period, increases in home prices were supported by a rise in household income. This relationship provided underlying support for home prices, even when recessions developed in 1970, 1974, 1982, 1990, and 2001. However, between 2000 and 2006, the ratio rose from its long term average of 3.0 to 4.5. This means median home pirces have the potential to fall 33% should the ratio fall back to its long term average. If national median home prices sink by 20% in coming years, it would slash $4 trillion from homeowners wealth.”

Leave A Comment