In what is becoming a daily occurrence, crude took another dive earlier this morning as volume surged.

This has been going on all week and has been variously attributed to technical selling around key levels and all sorts of other shit like that, but the bottom line is: there is a crisis of confidence in this market.

If crude couldn’t sustain a bounce after the API/ EIA data, then you’ve got to wonder what’s going to be good enough.

It’s also not exactly encouraging that the downdraft we’ve seen over the past couple of days comes on the heels of a really nice run, which was itself a move that came after crude plunged into a bear market last month. The point: nothing seems to be working to get this market sustainably higher.

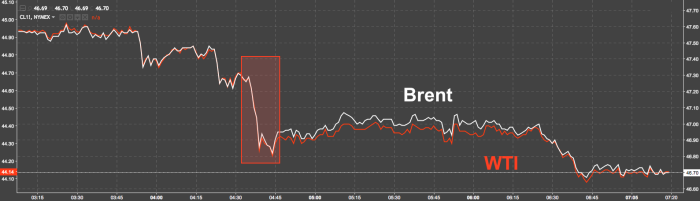

Anyway, a couple of hours ago, September Brent traded 4.6k lots, with prices slipping to day-low $46.75/bbl while WTI also dropped sharply, hitting day-low $44.20/bbl.

Things have only gotten worse since.

“The fact that it could not hold despite the draws in the DOEs is not good for sentiment,” Petromatrix Managing Director Olivier Jakob dryly noted this morning.

Leave A Comment