Amid a recent exuberant short-squeeze-driven bounce, the ‘real’ valuation of the Russell 2000

remains at insanely high levels…

and gravely decoupled from credit markets…

But as Dana Lyons’ explains the market likes to do whatever will fool the most people. So while this level should at least be an interesting one in producing a battle between the Russell 2000 bulls and the bears, it would also be an ideal spot for the market to unleash its shenanigans.

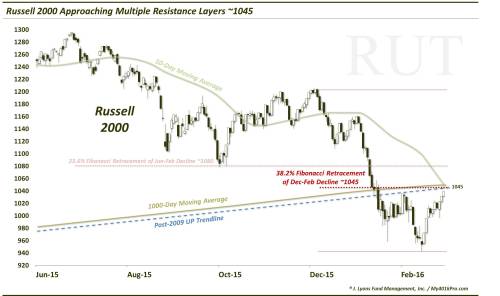

The Russell 2000 Small-Cap Index is nearing a level containing multiple layers of potential resistance.

Earlier this week, we posted a discussion regarding the prospects for the current stock market rally (”Is The Stock Rally Glass Half Full Or Half Empty?”). Our view was that, despite a growing (or growling) consensus that a resumption of the selloff, or an outright crash, was imminent, several factors lined up in favor of a continuation of the advance – at least in the near-term. This included favorable readings in some of our proprietary breadth indicators, positive momentum action and unusually elevated levels of bearish fund flows. It’s only been 3 days since that post, but after a Wednesday AM scare, stocks have indeed continued their late-February march upward. This latest move is taking some indexes close to potentially significant resistance levels. That includes the Russell 2000.

Multiple layers of potential resistance lie in the vicinity of 1045-1050 on the Russell 2000 chart (trading at 1039 as I type). These layers include:

Zooming out, we can see the significance of the trendline test and the 1000-MA, especially.

These levels represent solid challenges to the Russell 2000 rally on their own. Collectively, they should provide a substantial hurdle for the index upon reaching the 1045 area. Assuming the index reaches this level, we can see 4 potential outcomes.

Leave A Comment