Ticker

Last

High

Low

Daily Change (pip)

Daily Range (pip)

USD/CAD

1.3001

1.3007

1.2965

33

42

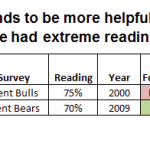

The near-term strength in the Canadian dollar may persist over the coming days as the region’s employment report is expected to show the economy adding another 11.3K jobs in June.

A further improvement in labor market dynamics is likely to heighten the appeal of the loonie as it boosts the outlook for growth and encourages the Bank of Canada (BoC) to lift the benchmark interest rate off of the record-low. Recent comments from Governor Stephen Poloz suggest the central bank is more inclined to move away from its easing-cycle as the rate cuts from 2015 ‘have done their job,’ and BoC may gradually alter the monetary policy outlook over the coming months especially as the ‘the Canadian economy’s adjustment to lower oil prices is largely complete.’

With that said, a major shift in market behavior appears to be underway as USD/CAD snaps the upward trend from 2016 and takes out the lows from earlier this year.

USD/CAD Daily

Chart – Created Using Trading View

Leave A Comment