I’m not talking about China.

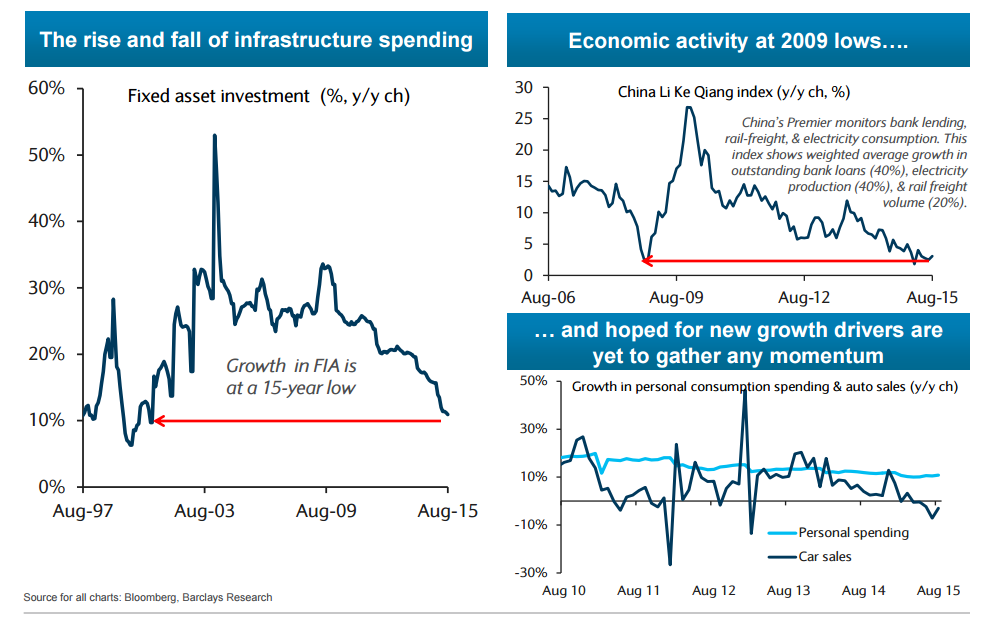

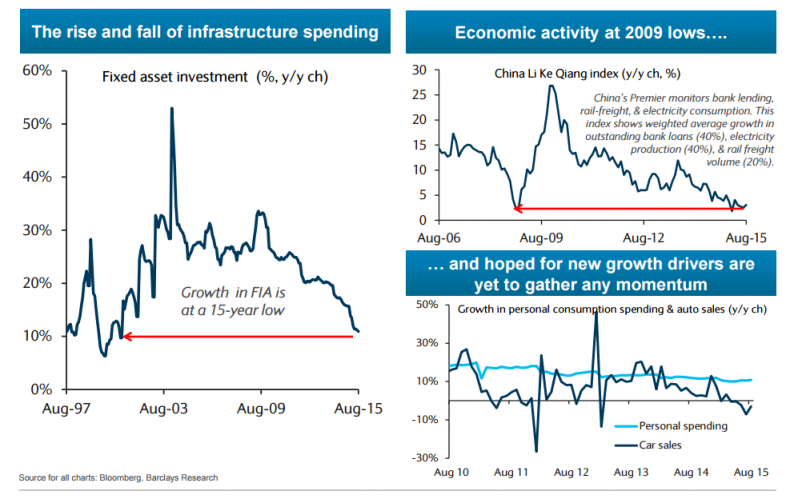

We did that already in our Live Member Chat Room and you can follow this link to find out all about what’s going on over there. China is still conducting their Plenary Meeting this week and we’ll get the details of their next 5-year plan by the week’s end – no point in speculating but, on the whole, we’re expecting disappointment as the reality hits investors that you can’t fix a $10Tn economy while simultaneously pretending it doesn’t need fixing.

You’ll hear a lot of people telling you how much Europe’s PMI has improved (Asia’s was terrible!) in October but, in reality, it still sucks compared to 2011 and, keep in mind, this is the Global Economy WITH over $3Tn in stimulus from China, Europe, the US and Asia – what would it look like without these massive inflows of FREE MONEY?

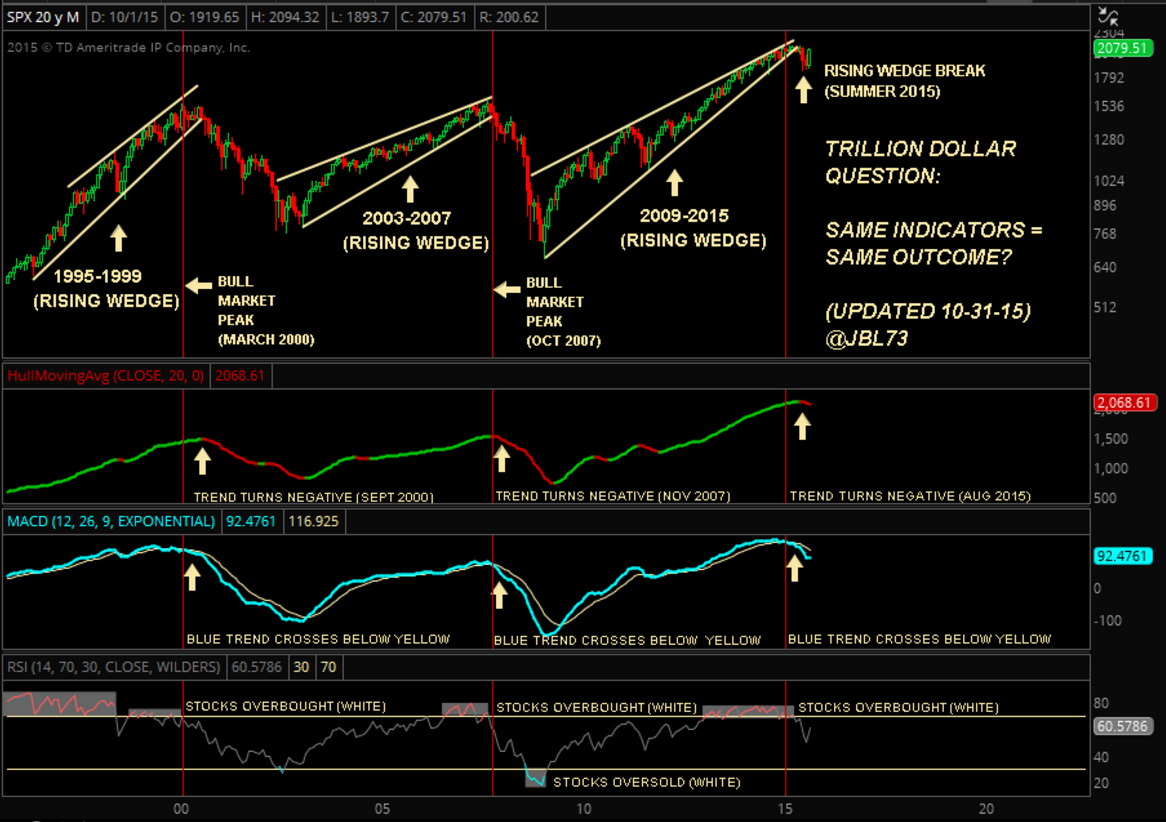

There are a lot of moving parts to the Global economy and it’s easy to forget the context, especially when we’re in year 6 of QE programs, which means there are hundreds of thousands of traders who began their careers post-crash who have never known any other kind of economy. Sure, 5% of the Global GDP is always used to prop up the equity markets and force down bond rates each year. It’s bound to continue another 5 years. After all, what can possibly go wrong?

We get our own PMI report this morning at 9:45 followed by ISM at 10. Tomorrow we’ll have Economic Confidence (8:30) and Factory Orders (10:00) and then, on Wednesday, Fed speak begins with Brainard at 5:30, Harker (8:45), Yellen (9:45), Dudley (2:30) and hawkish Fisher (6pm) gets the last word of the day. Seems like they are afraid of something on Wednesday – probably it’s Mortgage Applications at 7am or maybe they are trying to get ahead of Thursday’s Productivity Report (8:30) or Friday’s Non-Farm Payrolls (8:30).

Whatever it is, it’s something as we have Harker again on Thurs (8:30) and Dudley again (8:30), Fisher again (9:10), Evans (10:40), Tarullo (12:45) and Lockhart (1:30) plus Bullard (7:30) and Brainard (4:15) on Friday. That is, by far, the most Fed speakers (13) scheduled in a single week all year and that usually happens on weeks when the market is going to get some very bad news.

Leave A Comment