Fundamental Australian Dollar Forecast: Neutral

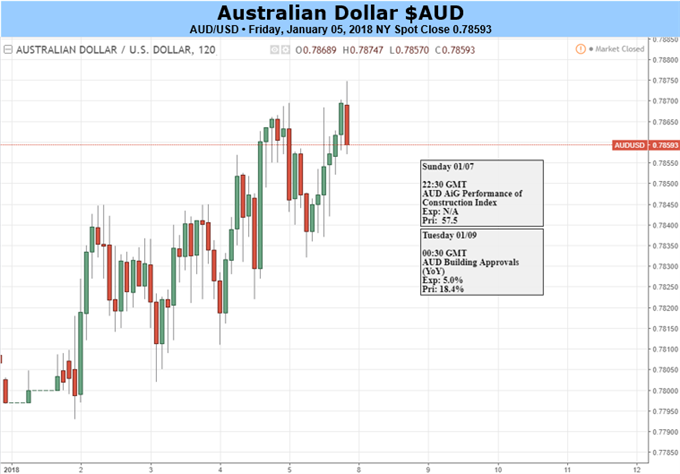

The Australian Dollar has rallied especially strongly against its generally beleaguered US counterpart in the past three weeks and it’s not easy to see why that should be.

The most obvious monetary and fiscal factors seem to favour the greenback. After all Congress has passed the most sweeping tax reform seen for decades. Then there’s the Federal Reserve. It expects to raise interest rates three times in 2018 and a fourth increase is hardly unlikely should the economy continue to rev. The Reserve Bank of Australia by contrast is not expected to increase its own, record-low Official Cash Rate from 1.50% in the coming twelve months.

If these prospects play out, then the US Dollar will have a clear yield advantage over the Aussie for the first time in almost twenty years. Then there’s the RBA itself. It clearly doesn’t want to see its currency much stronger. Indeed, it still barely loses a chance to warn that a higher Australian Dollar makes its inflation target harder to hit and could weigh on growth.

So why is the Aussie lording it over the greenback and can it continue to? Well, much of this is a global US Dollar weakness story. The US Dollar has been the victim of suspicions that other parts of the developed economy may see tighter monetary policy than was thought, notably the Eurozone where recovery seems to continue apace. There have also been some doubts expressed as to whether the Fed will really be as hawkish this year as it has been in recent months.

There’ve been, more local other supportive factors too. Commodities have had an excellent run and Australia is one of their largest exporters. The Bloomberg Commodity Index has been on a tear since the Fed last raised interest rates. Can this last in an environment where China’s growth is expected to slow this year? Well, maybe.

Leave A Comment