In today’s post, we will answer one question and one question only:

Is it possible for the S&P 500 to perform well during a period of relative weakness in small caps?

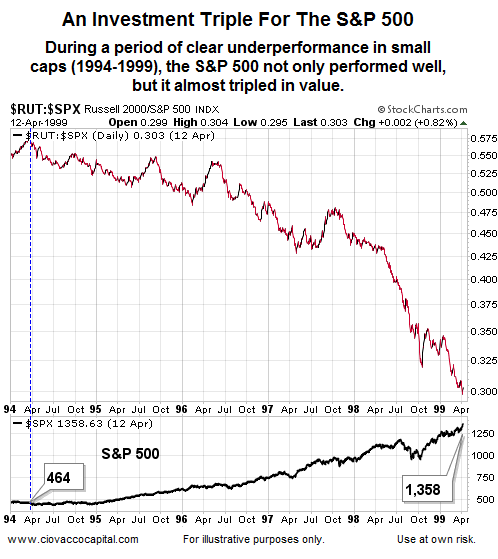

As shown in the chart below, the answer is “yes, the general stock market can perform just fine when small caps are lagging”. The top portion of the chart shows the performance of small caps relative to the S&P 500 Index. The bottom portion shows the S&P 500 moving from 464 to 1,358 during a period of relative weakness in small caps.

The chart is not a commentary on 2015, nor is it a comparison of 1994-1999 and 2015. Remember, the purpose of the exercise was to answer one question. Any indicator or input that can give false signals for over five years and causes an investor to miss a giant move in the S&P 500, is not a particularly helpful indicator for monitoring the health of the S&P 500. The comments above are based on indisputable facts from market history.

Leave A Comment