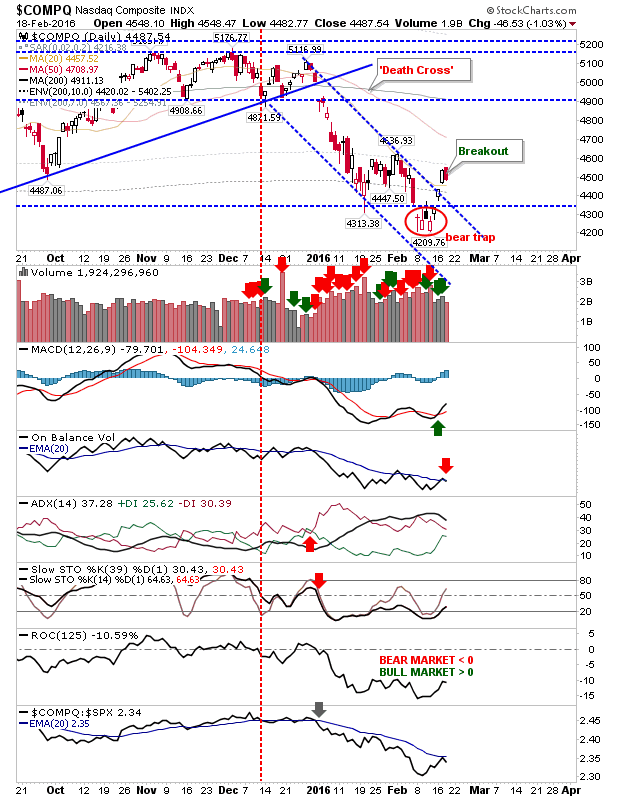

It was inevitable, given the action over 2016, that bears were going to make an reappearance. Today’s selling fell in line with near term profit taking with volume down on recent buying.

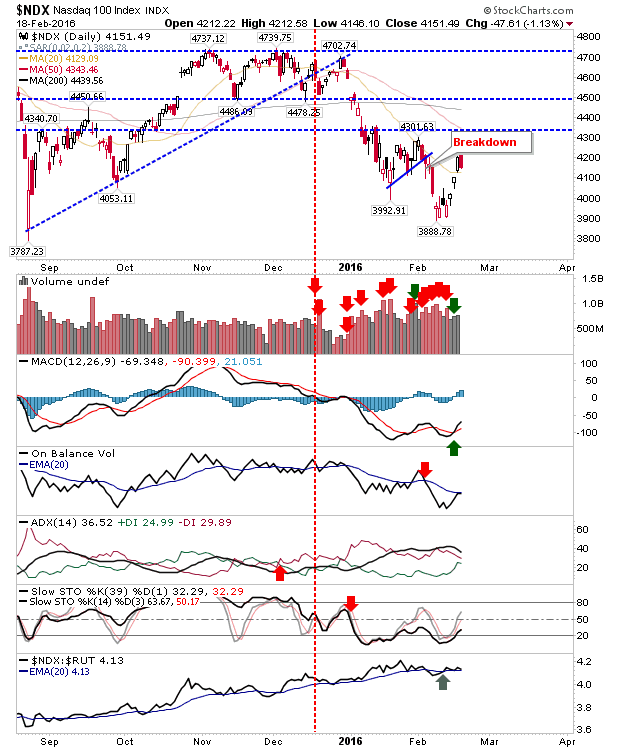

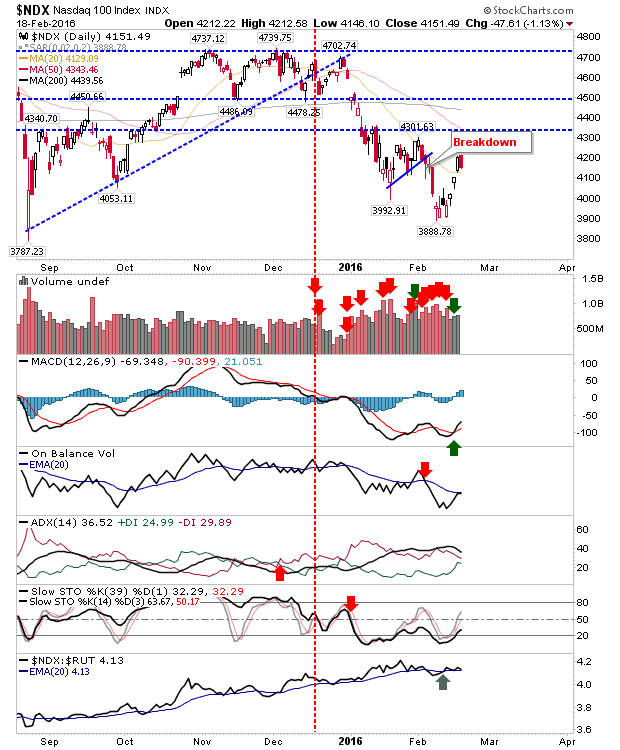

The Nasdaq 100 experienced the worst of the selling, but buyers will be looking at a move down to 4,000 to buy value. More higher volume accumulation days would help build confidence.

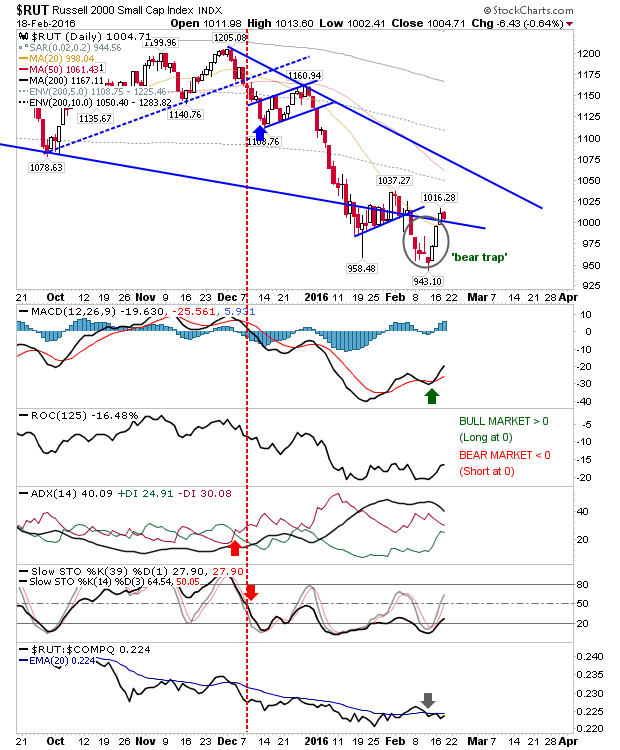

The Russell 2000 has done well to rebuff the heavier selling which has marked this index over the last part of 2015. Action over the last couple of weeks has the look of a ‘bear trap’, and today’s narrow action should be favourable for bulls. If there is a push into the ‘bear trap’ it will be important for buyers to accelerate by creating a spike low.

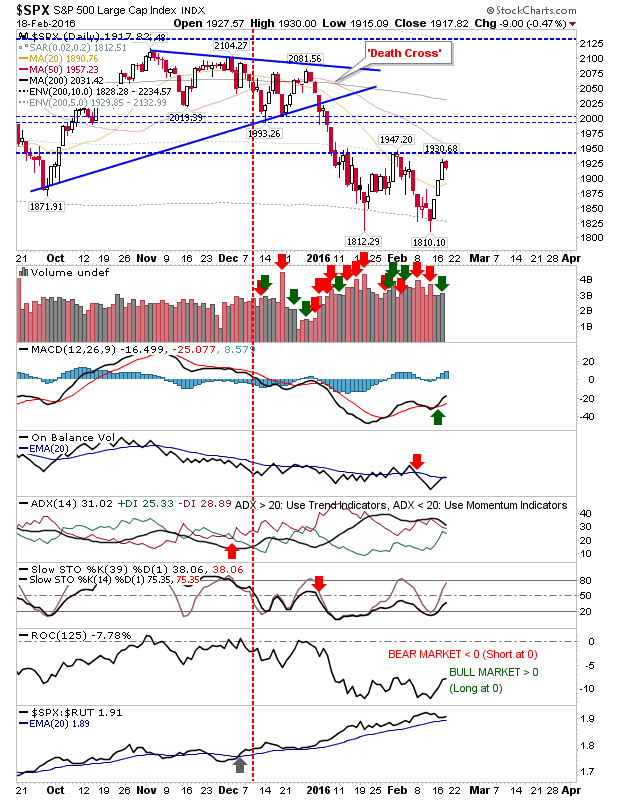

The S&P is sitting just below 1,940 and is on the verge of confirming a double bottom. The 50-day MA is fast approaching from above in a convergence with 1,940. A break of this combined resistance zone would firm up an intermediate term bottom and open up for a move to the 200-day MA.

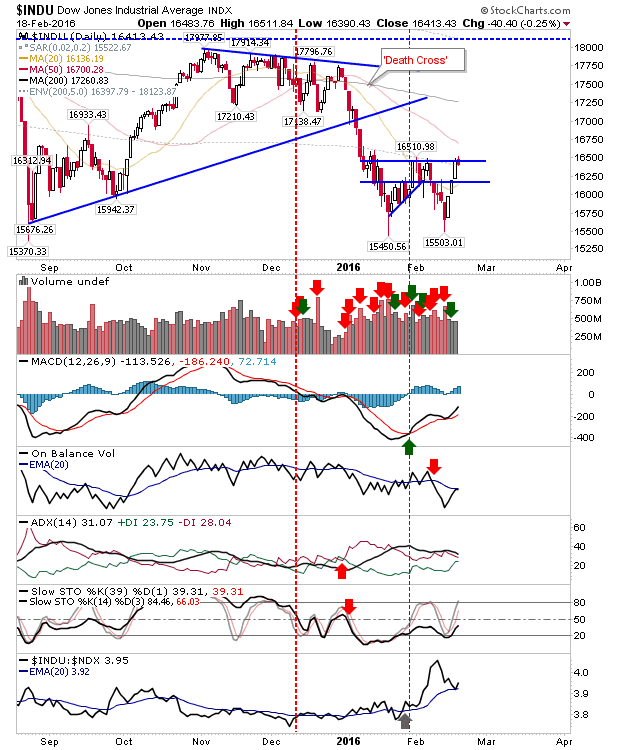

The Dow is just shy of confirming its double bottom. If there is a negative it’s that On-Balance-Volume is trending downwards which will offer overhead supply on the break.

The Nasdaq is ready to test it’s bear trap as it looks to recover from its downward trend in On-Balance-Volume.

Friday may see some continuation in the bearish sell off, but should this occur it will likely be viewed as a buying opportunity. Followers of ChartDNA will be looking for a more bearish outcome into next week, but this may not necessarily be accompanied by big point losses. Healthiest action may to be to move sideways – consolidating the three day advance – but maintaining the range of Wednesday’s High/Lows.

Leave A Comment