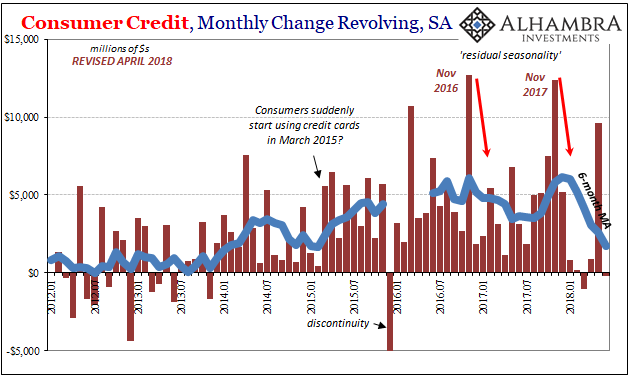

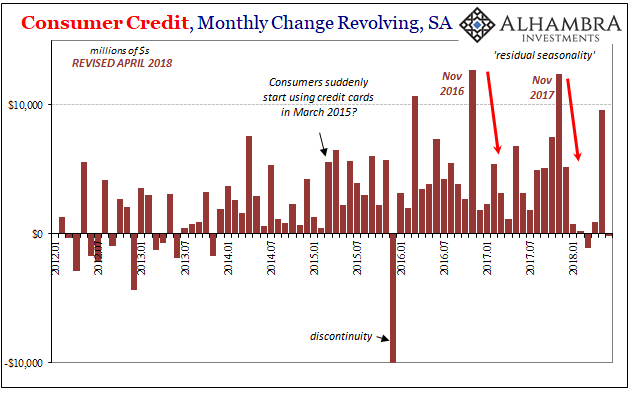

Americans are eschewing credit cards in 2018. Outside of a big jump in revolving credit balances in May, through June 2018 the Federal Reserve reports only small gains in the total aggregate balance. Given, however, the propensity of this data to be significantly revised, we can’t really be sure as to what’s happened.

With the data we have now, there are two possible conclusions neither of which exclude the other. The first is tax cuts. The average increase through June is the lowest it has been since 2015. This wouldn’t appear to be a trivial difference, though again revisions could make them so.

It is possible maybe even likely that workers who are taking home more pay as a result of last year’s tax reform are using the additional funds to pay down existing debt; debts that have been run up over the last three years as the labor market slowed and incomes with it.

That would be consistent with any number of surveys showing that Americans were as likely to pay down debt with their higher work receipts. It’s not the result Economists were hoping for, but it is at least consistent for once.

The other possible explanation is the same as it has been for years. Income growth has stalled and for a very long time. Under previous benchmarks for aggregate income, that meant the US savings rate had plunged to unusually low levels, therefore suggesting that consumers might be taking a break from debt out of necessity rather than by choice.

The subsequent benchmark revision to income, the one that completely erased that prior savings rate, was mostly related to “underreported” proprietors’ income as well as dividends and interest. In other words, this newfound income wasn’t something that applied to most consumers as workers.

From that, we can infer their own savings rate as different from the overall one with its “underreported” proprietors’ income would still be far more like it was before the benchmark switch. Small business and capital account owners are doing somewhat better than thought, but laborers and workers are not.

Leave A Comment