Gold prices rose $3.35 an ounce on Tuesday, recovering some of the losses from the previous day, as a weaker dollar helped lure bargain hunters back into the market. World stock markets were mostly higher yesterday. U.S. stocks edged higher, supported by strong corporate earnings reports. The risk-on investing attitude in the world marketplace and expectations for further interest rate hikes in the United States continue to work against the safe-haven gold.

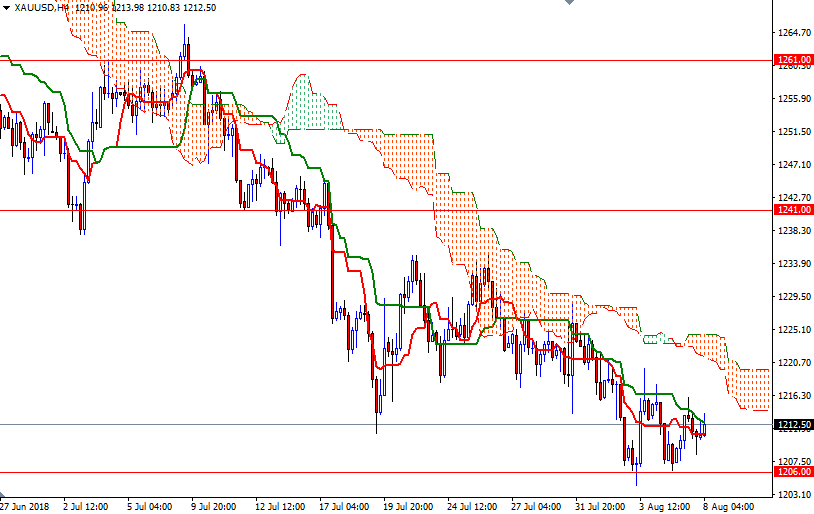

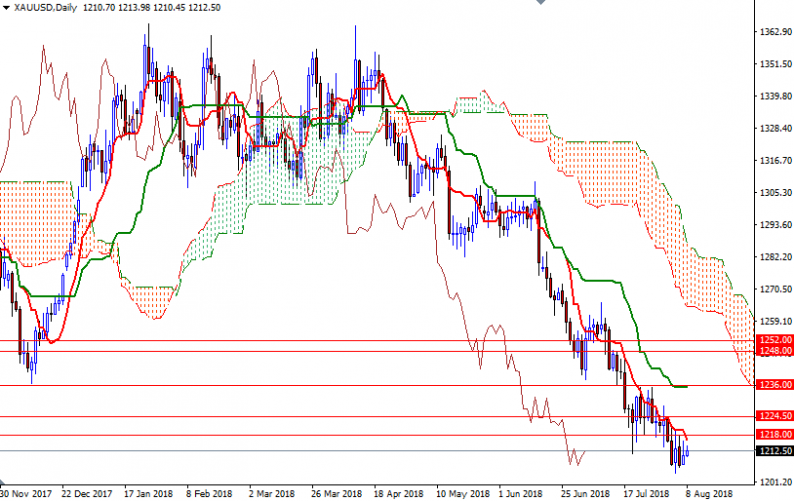

From a chart perspective, the bears have the overall technical advantage, with the market trading below the weekly and the daily Ichimoku clouds. The key levels remain unchanged as XAU/USD is trapped within the trading range of the past 4 sessions. The bulls have to overcome the initial barrier in the 1220-1218 area to gain momentum for 1226-1224.50. The top of the 4-hourly cloud sits in this zone so the market has to get back above 1226 for a stronger recovery. A daily close above 1226 could pave the way for a test of 1236.

To the downside, the initial support comes in at 1206. The bears will need to capture this strategic camp to make an assault on the 1200-1198 zone, the confluence of a horizontal support and the bottom of the monthly cloud. If this support is broken, XAU/USD will be targeting 1194. Closing below 1194 on a daily basis opens up the risk of fall to 1182.

Leave A Comment