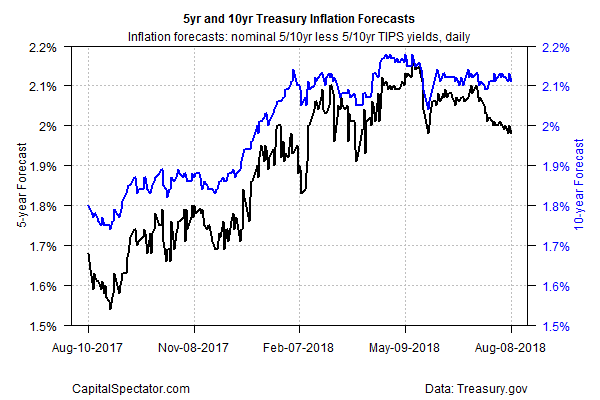

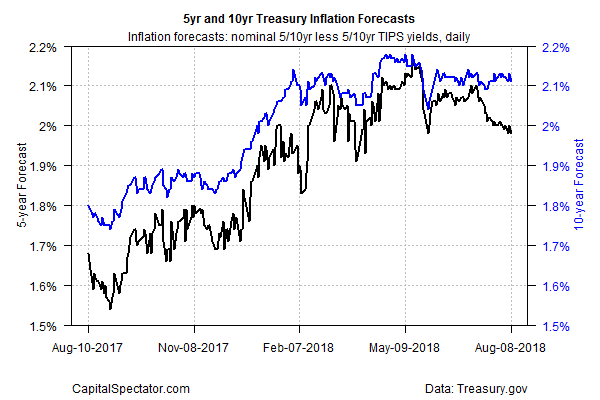

Economists are expecting that US consumer inflation will hold steady in tomorrow’s July update while Fed funds futures are pricing in another rate hike at next month Federal Reserve meeting. Yet the implied inflation outlook via 5-year Treasuries bears watching in the days ahead as it suggests that a new round of disinflation could be brewing. If so, the case may be weakening for another dose of monetary tightening.

The dip in the 5-year’s forecast could be noise, of course. Inflation-indexed Treasuries are thinly traded vs. standard government bonds. Meantime, the slide in the inflation estimate so far is mild. Nonetheless, the recent dip via the nominal 5-year maturity less its inflation-indexed counterpart stands out vs. the relatively steady inflation estimate based on the 10-year maturities. It’s unclear if there’s an attitude adjustment unfolding on the inflation front, but the 5-year spread seems to be leaning in that direction.

As of yesterday’s close (August 8), the 5-year Treasury market’s implied inflation forecast dipped to 1.98%, matching Monday’s level — the two lows mark the lowest level since late-May. The slide is only slight to date, but if it persists in the days and weeks ahead it will be harder to dismiss the decline as noise. All the more so if the 10-year inflation estimate joins the descent.

Perhaps Friday’s hard data on inflation will lend a new clue. Tomorrow’s monthly update on the consumer price index (CPI) at the headline level for July is on track to print at a 2.9% year-over-year rate, unchanged from the previous month, according to Econoday.com’s consensus forecast. CPI’s core trend (excluding food and energy) is projected to remain modestly softer at a 2.3% annual pace, also unchanged from the previous release. In both cases, the forecasts exceed the Federal Reserve’s 2% inflation target, which suggests that the central bank will see another rate hike as justified. Weaker-than-expected numbers, however, would suggest that the 5-year forecast’s dip is something other than short-term trading noise.

Leave A Comment