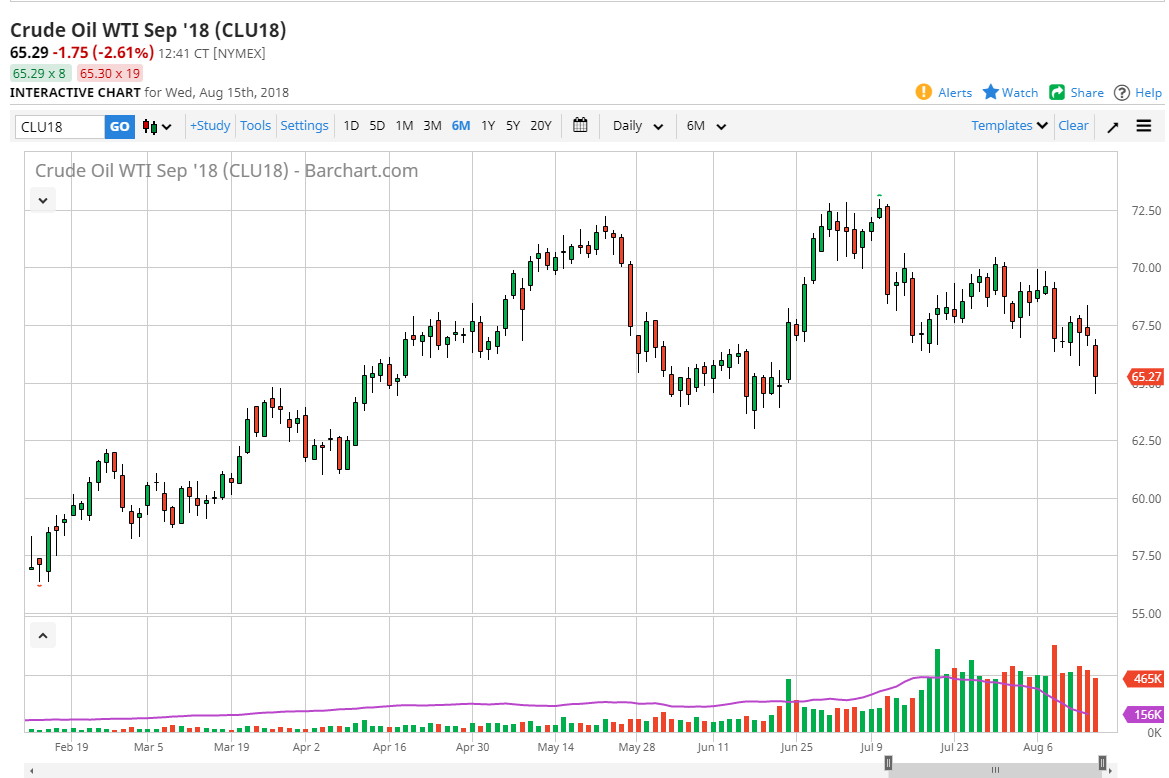

WTI Crude Oil

The WTI Crude Oil market was hammered on Wednesday, as the greenback gained against almost anything and everything. Because of this, we reached and even broke down below the psychologically important $65 level, where we then found a bit of buying. Regardless, I think at this point it’s not until we break above the shooting star from the Tuesday session that you can consider going long of this market for any real length of time. I anticipate that short-term rallies will continue to offer selling opportunities and that we could very well go lower. Watch the US Dollar Index, it seems to be one of the main things driving this market. Oh, and beyond that, we ended up having a much larger inventory build than expected. Those are the two major reasons why this market is starting to fall significantly. If we break down below the lows of the Wednesday session, we probably go looking towards the $63 level next.

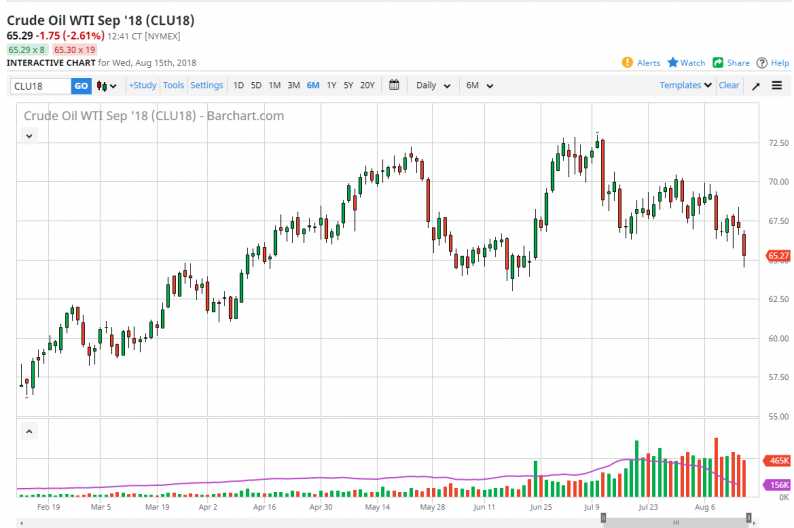

Natural Gas

Natural gas markets fell during the day, before recovering some of the losses. However, the market looks a bit “toppy”, if for lack of a better term. There is a lot of resistance at the $3.00 level, which starts at the $2.95 level. I believe it is only a matter of time before the sellers come back in and start selling, so I would look at short-term charts for exhaustive candles to start selling. This could be a nice opportunity as the market could find itself unwinding all the way back down to the $2.70 level underneath. Alternately, if we break above the $3.00 level, there is still resistance to the $3.05 level. Clearing that level could send this market into a frenzy to the upside, but that seems very unlikely at this point.

Leave A Comment