Goldman Sachs has just carried out a survey of 2,000 consumers. The survey revealed that consumer optimism is at record highs- while pessimism is at record lows. This is since the survey started back in 2005.

“The impact of strong demand drivers and strong consumer sentiment is evident in consumer spending,” writes Goldman’s consumer analyst Matthew Fassler. He adds, “We remain con?dent in the trajectory of the consumer recovery, as drivers of spending remain solid. We note signs of moderating momentum from May through July, and soft patches in housing, but remain constructive on the outlook for discretionary.”

As a result, the firm highlighted several consumer stocks on its elite Conviction Buy list.

Wyndham Hotels & Resorts – GS upside potential of 44%

With over 8,000 hotels to its name, Wyndham Hotels (NYSE: WH) is the largest hotel franchisor in the world.

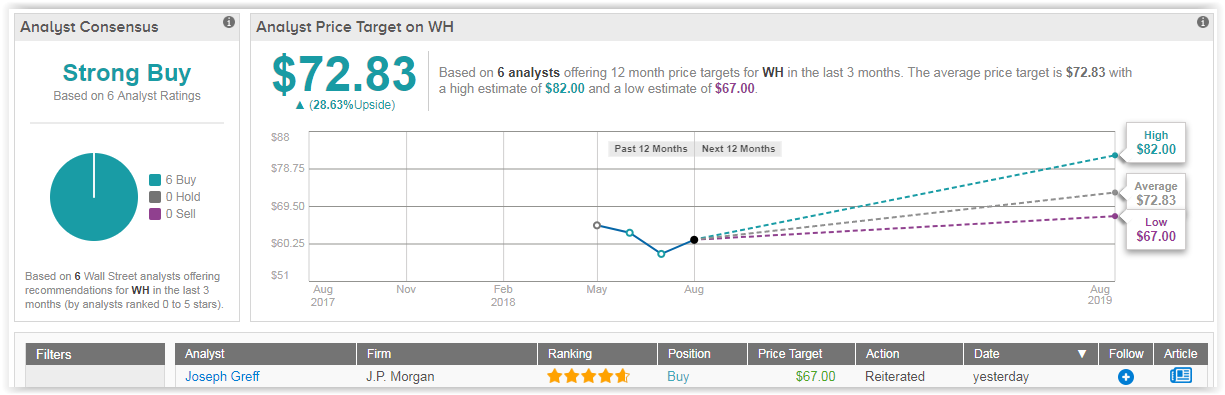

Note that Goldman’s Stephen Grambling added WH to the firm’s Conviction List in June. This came with a Street-high $82 price target. Wyndham is well-positioned to reap the benefits of revenue-per-available-room out-performance, a momentum that he expects will continue into next year.

And as we can see WH has received only buy ratings in the last three months. This includes a recent bullish rating from top Oppenheimer analyst Ian Zaffino (Profile & Recommendations).

Following strong Q2 results, Zaffino concludes that Wyndham offers “robust growth, substantial free cash flow, an experienced and dedicated management team.” Plus he believes the $1.95 billion acquisition of La Quinta will make it the leader in the mid-scale segment. However, the analyst is sticking with a slightly more cautious price target of $69 (22% upside potential).

View WH Price Target & Analyst Rating Details

Aramark Holdings – GS upside potential of 38%

If you haven’t heard of Aramark (NYSE: ARMK) before, listen up! This is the company behind the food, facilities and uniform services of organizations around the world. Customers span everything from hospitals to schools.

Leave A Comment