Just a trio of charts with a few words on each. Oil has had a tremendous rise for half a year; I think crude could get as high as $67 or so, but it seems to me it’s time for a temporary breather and small retrace.

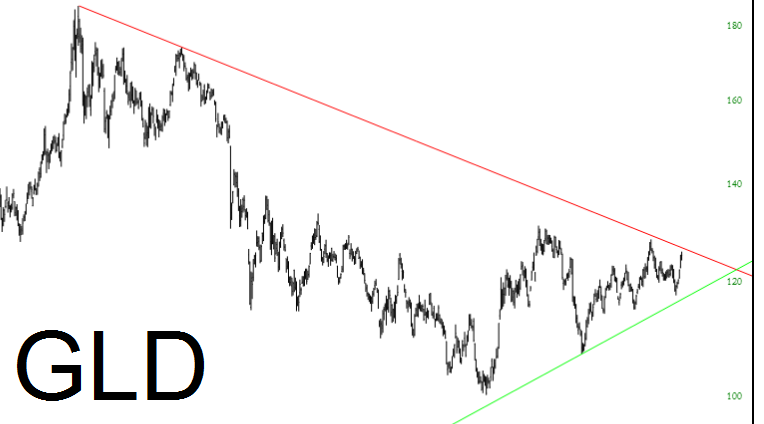

Gold simply can’t seem to make up its mind. As prices march toward that apex, it needs to resolve one way or another. Gold’s volatility is started to resemble the VIX.

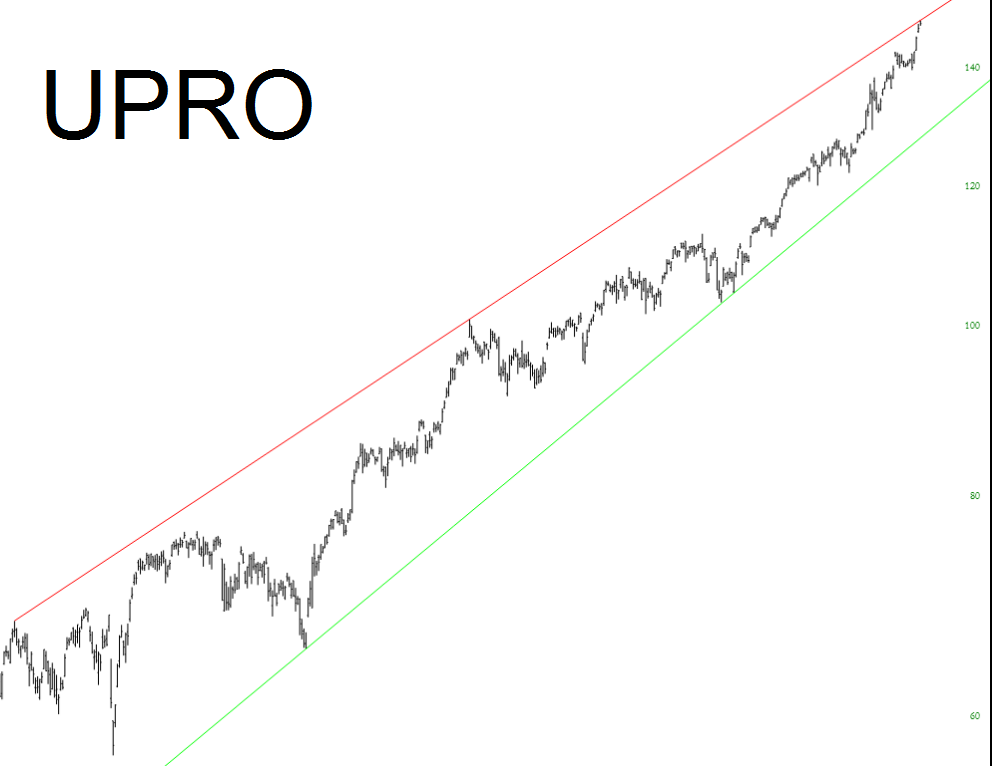

The broad market in general is at Trumpian loftiness. This is the ultra-leverage S&P ETF below, and as the long-term trendlines indicator it is – – in sharp contract to what they were saying on CNBC yesterday – – “cheap” (and, yes, they said it was CHEAP, ladies and gentlemen.)

Leave A Comment