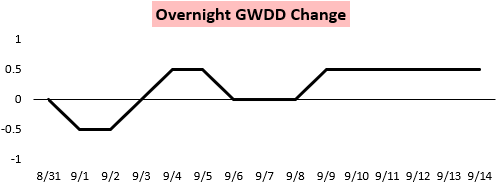

The October natural gas contract settled up around a percent and a half on the day as overnight forecasts added a significant amount of cooling demand, showing heat may sustain into the middle of September.

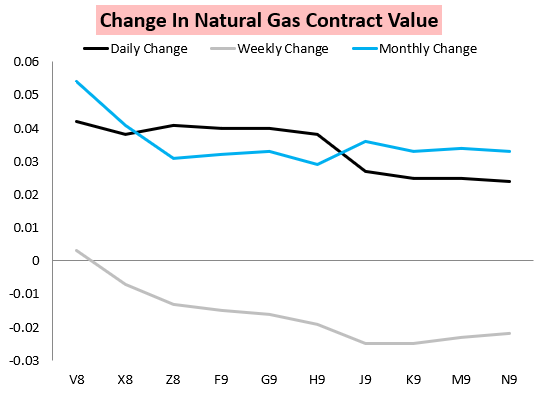

Most natural gas contracts were still down weakly on the week, though this heat and strong cash prices helped the October contract log a tiny weekly gain.

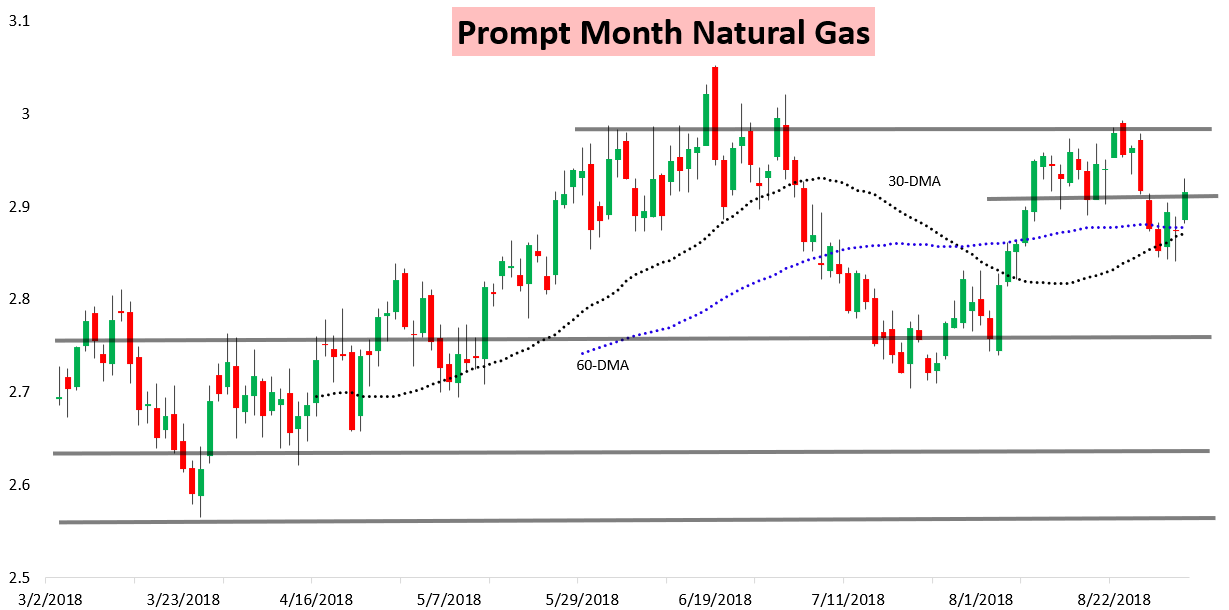

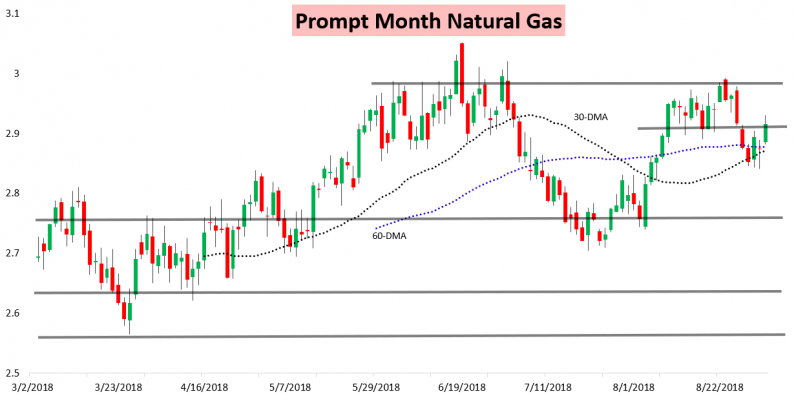

In our Afternoon Update yesterday we warned that, “…medium-term heat and strong cash prices appear enough for a bit of short-term upside towards $2.9 or even $2.92 tomorrow…” and followed up this morning by outlining that heat could increase that ceiling a bit more ahead of the weekend.

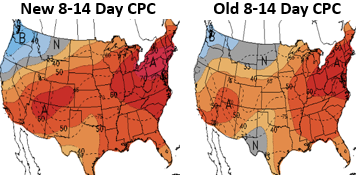

Sure enough, the October contract briefly broke above our $2.92 level to test $2.931 before settling right back around $2.92. Afternoon Climate Prediction Center forecasts show the sizable day-over-day heat addition that was responsible for much of this.

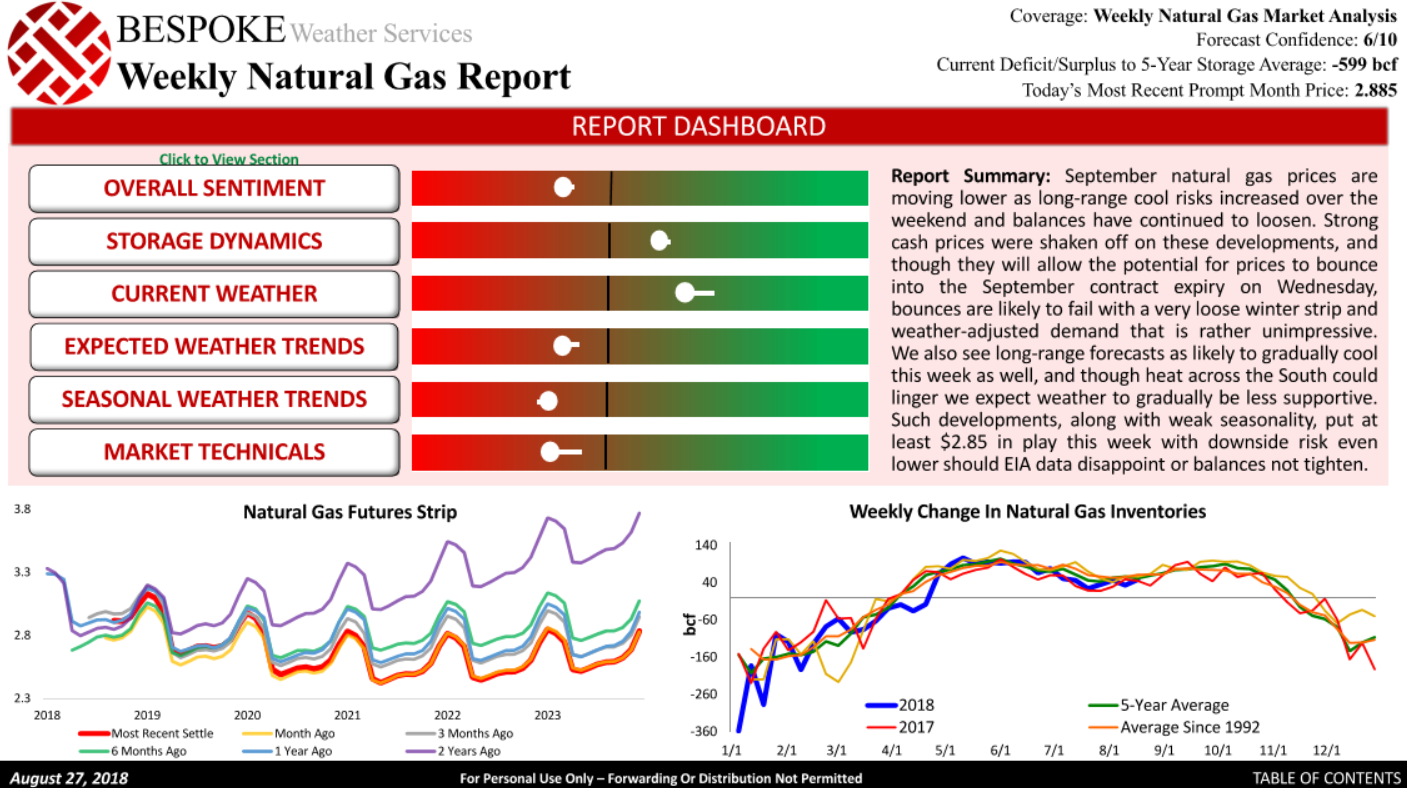

Overall, most of the developments we forecast in our Weekly Natural Gas Report back on Monday played out well. We saw prices as likely to fall back on loosening balances and cooler long-range forecasts early in the week, then warned of a spike into the Wednesday contract expiry like occurred. We even correctly identified the bearish risks around the EIA print, as it missed just 4 bcf higher to our expectation and even higher to the market consensus, though it was the hotter forecast trends that allowed prices to recover into the end of the week and kept weekly losses from being larger.

Of course as we move through September we begin to look more closely at heating demand over cooling demand as well, and our seasonal forecasts begin to get that much more important as we look further out into winter and determine potential temperature biases. Already our Seasonal Trader Report looks out through December, and next week we release our preliminary January forecast as well after properly identifying the temperature biases in each of the key winter months in advance this last winter.

Leave A Comment