Gold prices settled at $1200.82 an ounce on Friday, falling 0.49% on the week and 1.86% over the month. The bearish technical posture combined with little risk aversion among traders drove prices to near 2017 lows. The U.S. dollar was underpinned by interest rate hike expectations. Fed Chairman Jerome Powell’s comments led many in the market to believe that the Fed will increase interest rates two more times this year and continue hiking next year.

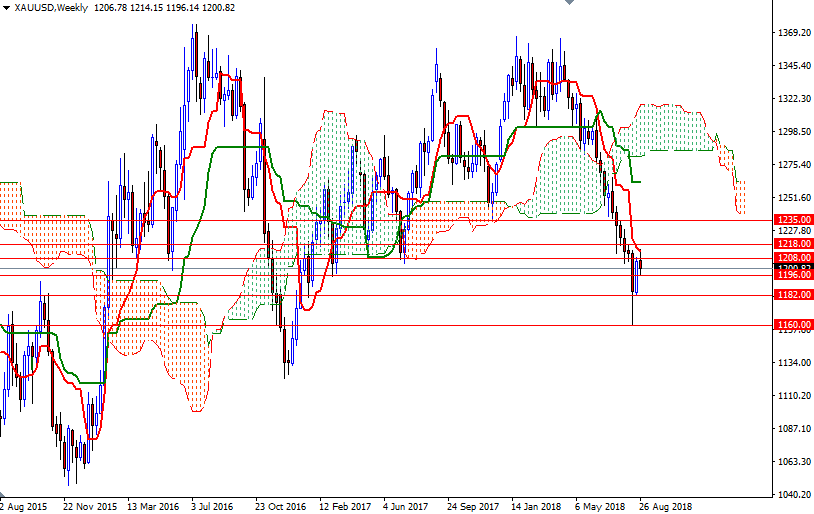

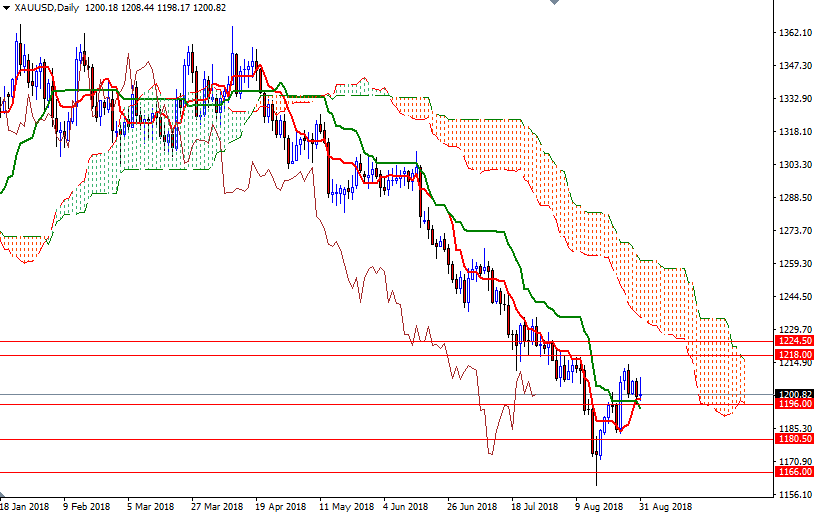

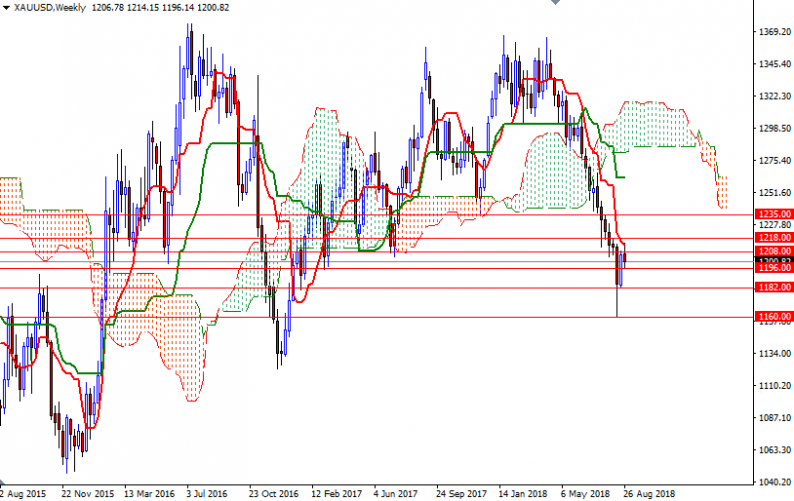

XAU/USD is trading below the Ichimoku clouds on the weekly and the daily charts. The Chikou-span (closing price plotted 26 periods behind, brown line) is also below the cloud. Technically, the bears have the overall technical advantage, though they are showing signs of exhaustion lately. The market is above the 4-hourly cloud; plus, we have a positive Tenkan-Sen (nine-period moving average, red line) – Kijun-Sen (twenty six-period moving average, green line) cross on the daily chart.

If the bulls successfully pass through the initial barrier at 1218, it is likely that the market will grind higher towards the daily cloud (before selling pressure takes over again). In that case, XAU/USD could test a strategic resistance in the 1226-1224.50 zone. A break through there brings in 1238/5, the 38.2% retracement of the bearish run from 1365.10 to 1160.05. Closing above this solid resistance on a daily basis suggests that the market is aiming for 1248/7. To the downside, keep an eye on the nearby supports such as 1196/5 and 1192. If the bears drag prices below 1192, the 1282-1180.50 area could be the next port of call. A weekly close below 1180.50 implies that the key support at 1160 is in danger. The bears need to capture this camp to challenge the bulls waiting in the 1250/45 zone. Once below there, the market will be aiming for 1237.

Leave A Comment