A broad consensus has emerged that the dollar needs to take an extended breather if ex-U.S. risk assets are going to have any hope of stabilizing.

There’s nothing particularly novel about that assessment. Persistent dollar strength in the face of Fed tightening is obviously EM negative and the fact that years of accommodative DM policy helped push investors down the quality ladder and out the risk curve means that when the hunt for yield slams into reverse, the unwind is likely to be more dramatic than it might have been otherwise. You’re seeing that play out in real-time across developing economy assets.

Where the discussion gets a bit more nuanced is when you take into account the fact that the very same policies which have pushed the dollar higher and piled pressure on emerging markets are also in large part responsible for the resilience of U.S. equities to turmoil in ex-U.S. assets. The tax cuts and late cycle fiscal stimulus more generally have led directly to record corporate profits, a buyback bonanza and ongoing strength in the U.S. economy, all drivers of U.S equity performance.

Meanwhile, U.S. trade policy also plays USD positive and EM negative. The threat that tariffs will dent global growth and exacerbate the deceleration in China’s economy is clearly a drag on sentiment in developing economies while the prospect that protectionism will drive up consumer prices stateside prompts the Fed to lean ever more hawkish, lending further support to the greenback as rate differentials move further in favor of the dollar.

At the same time, Italian political risk and the prospect that the European banking sector could see some spillover from Turkey continues to weigh on the euro. The policy divergence between the Fed and the ECB is also a factor and the UST-bund spread is still sitting at its widest in decades. Trade frictions between the Trump administration and the E.U. (especially over autos) have also been a headwind for sentiment in key sectors across the pond, leading to underperformance versus U.S. assets.

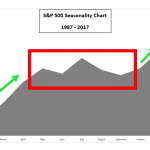

Now, though, the concern is that with U.S. stocks sitting at new highs, spillover from the malaise playing out overseas could come calling just as the effects of stimulus begin to wane, leading to a kind of Wile E. Coyote moment for the S&P and the Nasdaq.

JPMorgan’s Marko Kolanovic talked at length about this in his latest note out late last month. For Kolanovic, the “unprecedented” divergence between U.S. stocks and the rest of the word will resolve itself in one of two ways:

- ‘Risk on, USD down’ outcome with EM and value assets staging a rally and USD selling off, while US stocks continue going higher (but lagging).

- Alternatively, we could see a “Risk off, USD up” convergence, with US markets selling off and catching up with the poor performance of Europe and EM assets, e.g. driven by a continuation of the trade war and further USD strength (for now we will ignore a spectrum of ‘in-between’ outcomes).

Leave A Comment