TRADING THE NEWS: AUSTRALIA GROSS DOMESTIC PRODUCT (GDP)

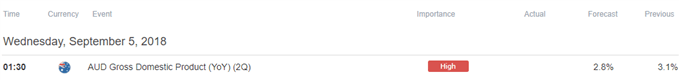

Australia’s Gross Domestic Product (GDP) report may fuel the recent weakness in AUD/USD as the growth rate is expected to slow to 2.8% from 3.1% during the first three months of 2018.

Signs of a less-robust economy may encourage the Reserve Bank of Australia (RBA) to keep the official cash rate (OCR) at the record-low throughout the remainder of the year, and the central bank may continue to tame bets for higher borrowing costs especially as ‘once-off declines in some administered prices in the September quarter are expected to result in headline inflation in 2018 being a little lower’.

In turn, a marked slowdown in economic activity may produce headwinds for the Australian dollar as the RBA sticks to a wait-and-see approach, but another above-forecast GDP print may curb the recent weakness in AUD/USD as it puts pressure on Governor Philip Lowe & Co. to start normalizing monetary policy.

IMPACT THAT THE AUSTRALIA GDP REPORT HAS HAD ON AUD/USD DURING THE PREVIOUS QUARTER

1Q 2018Australia Gross Domestic Product (GDP)

AUD/USD 15-Minute Chart

Updates to Australia’s Gross Domestic Product (GDP) report showed the growth rate increasing 3.1% per annum during the first three months of 2018 following the 2.4% expansion in the fourth quarter of the previous year. The above-forecast print may encourage the Reserve Bank of Australia (RBA) to adopt an improved outlook for the region, but the central bank appears to be in no rush to lift the official cash rate off (OCR) of the record-low as ‘the low level of interest rates is continuing to support the Australian economy.’

Nevertheless, the better-than-expected GDP report sparked a limited reaction, with AUD/USD pulling back from the 0.7650 region to close the day at 0.7616.

AUD/USD DAILY CHART

Leave A Comment