Questions continue to come in about systematic approaches to tactical allocation portfolio changes – methods not based on biases, media frenzy, forecasts, chart patterns, valuation or fundamentals.

Probably the simplest approach, and one that is about as objective and non-judgmental as systems can be, is to hold those risk assets that are doing best, unless none of them are doing better than T-Bills; in which case hold T-Bills until the risk assets start doing better than T-Bills.

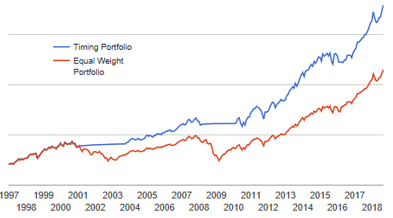

The most reliable aspect and driver of returns of the approach is minimizing major drawdowns, as shown by the flat lines in the blue timing portfolio when the red benchmark portfolio experienced major drawdowns.

Secondarily, the approach may increase total return. However, each trade triggers a tax event, so only those cases where the average holding time between trades is over 1 year avoid ordinary income taxes on the trades; and those that have the longest position hold times benefit most by compound growth.

The approach can be used in an outright decision to hold risk assets or risk-free T-Bills (or other “cash”), or it can be used for guidance in a strategic allocation portfolio to make overweight and underweight decisions.

The approach is not tax efficient for regular taxable accounts, but in some cases the outperformance may be worth the tax cost. Trading systems such as this are best used in tax-deferred accounts.

Relative and absolute momentum can be done at an extremely simple level, such as rotating between one specific risk asset and T-Bills (e.g. the S&P 500 and T-Bills).

That method could be used in layers, with more than one pair of two assets (e.g. S&P 500 and T-Bills as one pair, and emerging markets stocks and T-Bills as another).

It is also possible with the method to choose one or more risk assets within a larger group of risk assets or T-Bills (e.g. the two strongest momentum risk assets out of five or T-Bills).

Working with simple pairs of one risk asset versus T-Bills is more likely to create longer position hold times, and therefore be more tax efficient for regular taxable accounts than alternating between risk assets or T-Bills. Alternating between risk assets creates more frequent trades and would be more suitable for in tax deferred accounts.

The method helps avoid the severity of Bear markets, but it also needs Bears to generate enough of a performance difference to make the effort and potential tax cost worthwhile.

The approach does not work with all assets. Testing is required to see if it worked in the past.

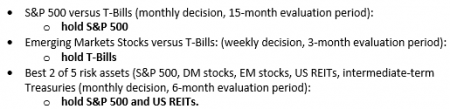

Here are some actual 09/03/18 relative return and absolute momentum indicated holdings:

It is possible to operate this approach by visual inspection of charts, but for more precision and to avoid seeing what you may want to see, using quantitative data is preferable.

Leave A Comment