By now, it’s a very familiar question: how high can the Fed hike rates before it causes a major market “event.”

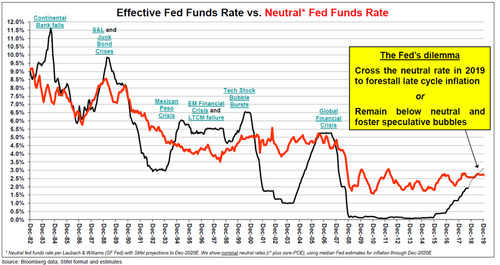

Two weeks ago, Stifel analyst Barry Banister became the latest to issue a timeline on how many more rate hikes the Fed can push through before the market is finally impacted. According to his calculations, just two more rate hikes would put the central bank above the neutral rate – the interest rate that neither stimulates nor holds back the economy. The Fed’s long-term projection of its policy rate has risen from 2.8% at the end of 2017 to 2.9% in June. As shown in the following chart, every time this has happened, a bear market has inevitably followed.

A similar argument was made recently by both Deutsche Bank and Bank of America, which in two parallel analyses observed last year that every Fed tightening cycle tends to end in a crisis.

Now, it’s the turn of BCA research to warn that ultimately the fate of risk assets depends on the relative size of the inflationary impulse being spawned by the Fed vs the remnant disinflationary impulse from monetary policies over the past decade.

In a report issued on Friday, BCA’s strategists make the key point that the performance of bonds – and stocks – in an inflation scare would depend on the relative size of the inflationary impulse compared with the disinflationary impulse that resulted from sharply lower risk-asset prices.

They make the point that if central banks were more concerned about the inflationary impulse, which at least for Fed chair Powell appears to be the case for now – Janet Yellen’s “lower for longer revised forward guidance” notwithstanding – they would have to keep tightening – in which case, bond yields would be liberated to reach elevated territory. Conversely, if the bigger worry was the disinflationary impulse, which arguably is the case from a legacy standpoint, central banks would quickly reverse course, and bond yields would return to the lowlands. Thus, the disinflationary impulse from lower risk-asset prices would end up as the bigger issue.

Leave A Comment