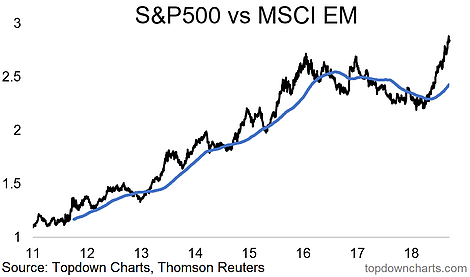

Here’s an interesting standout chart from one of my charm packs. It shows the relative performance of the S&P500 against the MSCI Emerging Markets index. Basically, US equities are on a parabolic tear in relative terms as EM equities have come under fire from multiple headwinds, and US equities have benefited from a capitulation on the relative value trade as solid earnings (and tax cuts) offset concerns about high valuations. With the big reset in relative valuations, and clear downturn in sentiment and positioning (based on my tactical indicators, and anecdotal evidence on fund allocations), there’s a decent chance we see a short-term reversal, but the tailwinds for America and headwinds to EM are likely to persist at least through year-end and likely into 2019. There will be a time to take the other side of this trade, but a few elements still need to fall into place to make it a higher conviction contrarian trade idea.

Leave A Comment