In this series, we scale-back and take a look at the broader technical picture to gain a bit more perspective on where we are in trend. The Canadian Dollar rallied to a 15-week high against the US Dollar last week (USD/CAD lower) with a near-term recovery in price likely to offer opportunities in the days ahead. Here are the key targets & invalidation levels that matter on the USD/CAD weekly chart.

USD/CAD WEEKLY PRICE CHART

Notes: USD/CAD is trading just above confluence support at 1.2880– a region defined by the 38.2% retracement of the 2017 advance, the August low and the 2012 trendline. This key barrier is backed closely by the 1.2830 where 52-week moving average converges on former pitchfork resistance.

Its decision time for the Loonie – a break below these levels would be needed to suggest a more significant high is in place with such a scenario eyeing subsequent confluence support objectives at 1.2567/79 – (61.8% retracement, 2018 open and 2017 trendline support). Interim resistance stands with the yearly high-week close at 1.3130 with bearish invalidation up at the June trendline, currently ~1.3190s.

Bottom line: The risk remains weighted to the downside in USD/CAD while below 1.3130 with a break below confluence support at 1.2830 needed to fuel the next leg lower in price. That said, price is coming off support here and a near-term recovery may offer more favorable short-entries in the days ahead. From a trading standpoint, I’ll favor fading strength but tread lightly- it’s the end of the month & quarter with heavy event-risk on tap.

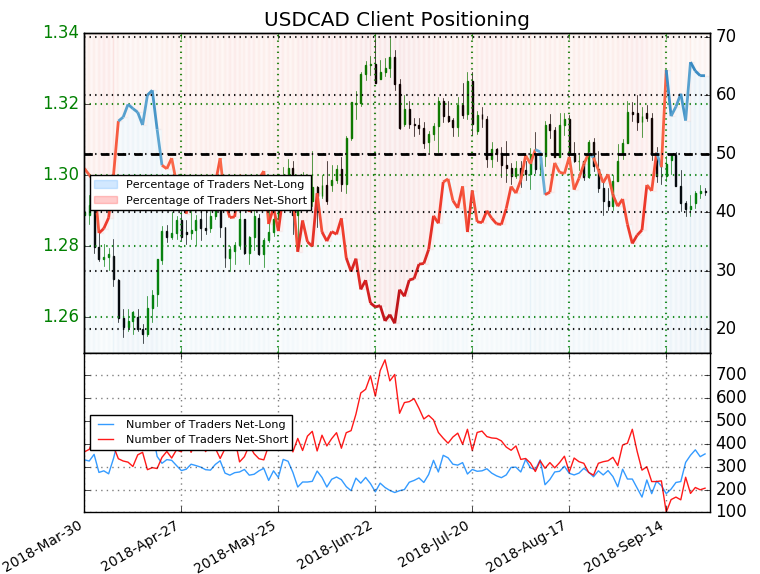

USD/CAD TRADER SENTIMENT

Leave A Comment