Gold prices fell $11.85 an ounce on Thursday, extending Wednesday’s losses, as gains in equities and a stronger dollar curbed demand for the metal. In economic news, the Commerce Department reported that gross domestic product increased at a 4.2% annualized rate. Orders for durable goods surged 4.5% in August, according to the Department of Commerce. The dollar was also boosted by weakness in the euro which suffered from concerns about the Italian government’s economic plans.

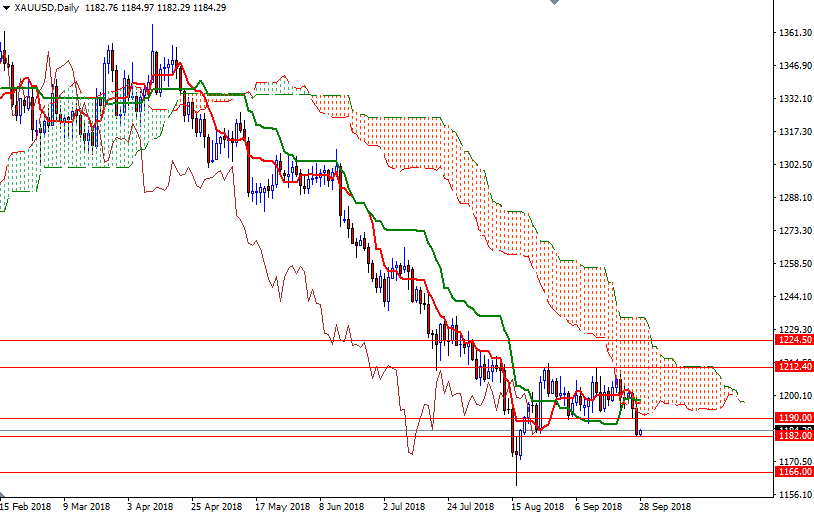

XAU/USD retreated to the 1182-1180.50 zone after prices pierced below the key support in 1192/0. The market is trading below the 4-hourly and the hourly Ichimoku clouds. In addition, the Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) are negatively aligned.

To the upside, the initial resistance stands in 1188/7. If prices can get back above 1188, it is likely that the market will visit the broken support in the 1192/0 area. The bottom of the daily Ichimoku cloud sits in this area so the bulls have to penetrate this barrier to march towards 1197/5. However, if XAU/USD dives through 1182-1180.50, the market will be targeting 1176. A break below 1176 could trigger a drop to 1173/2.

Leave A Comment