In this week’s Commitments of Traders Report, there are several significant changes in speculator positioning across major currencies and commodities. For the second week in a row, speculators made significant adjustments to their positions in the Swiss franc, Japanese yen, and the British pound. The biggest change this week (as a proportion of open interest) can be seen in Canadian dollar net positions. Ahead of Trump’s October 1 deadline for NAFTA negotiations, net positions in Canadian dollar futures and options increased by 10,988 contracts.

Looking at extremes in positioning, the long US dollar index net position remains at a bullish extreme based on 12-month averages. Short Australian dollar and short gold remain at a bearish extreme based on 36-month averages. This week, the speculator short position in the British pound is no longer at an extreme.When the net speculator position is more than two standard deviations smaller or larger than the trailing 12-month or 36-month average, we flag the position as an extreme.

The purpose of this weekly report is to track how the speculator community is positioned across various major currencies and commodities. When net long positions become crowded in either direction, we flag extended positioning as a risk. Crowded positions do not suggest an imminent reversal, but should be considered as a significant risk factor when investing in the same direction as the crowd. This is shown below:

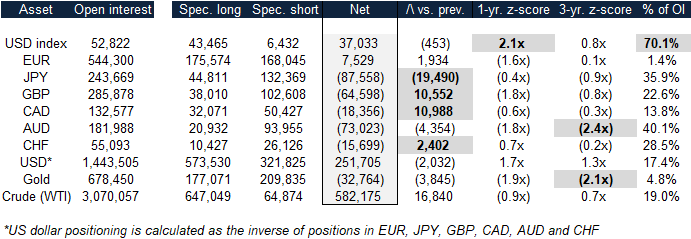

CFTC COT speculator positions (futures & options combined) – September 25, 2018

Source: CFTC, MarketsNow

Notable extremes, significant changes in weekly positions, and large net positions as a proportion of open interest are highlighted in gray above. Extremes in net positions are highlighted when speculator positioning is more than two standard deviations above trailing 1-year and 3-year averages. Weekly changes are highlighted when they are significant as a proportion of open interest. Finally, net positions as a proportion of outstanding interest are highlighted when they are large relative to historical averages. 1-year and 3-year z-scores are visually represented below:

Leave A Comment