The headlines say construction improved month-over-month but was on the lower end of expectations. The rolling averages declined.

Analyst Opinion of Construction Spending

The rolling averages declined – and last month was moderately revised downward. Also, note that inflation is grabbing hold.

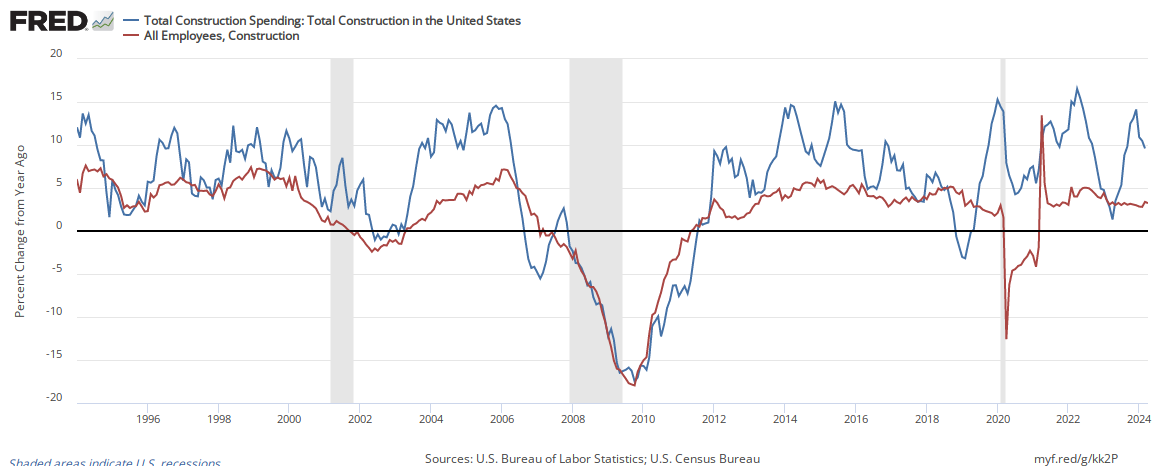

The employment gains currently are generally correlating with construction spending.

Econintersect analysis:

US Census Analysis:

Construction spending (unadjusted data) was declining year-over-year for 48 straight months until November 2011. That was four years of headwinds for GDP.

This month’s headline statement from US Census:

Construction spending during August 2018 was estimated at a seasonally adjusted annual rate of $1,318.5 billion, 0.1 percent (±1.6 percent)* above the revised July estimate of $1,317.4 billion. The August figure is 6.5 percent (±2.0 percent) above the August 2017 estimate of $1,237.5 billion. During the first eight months of this year, construction spending amounted to $862.0 billion, 5.3 percent (±1.3 percent) above the $818.7 billion for the same period in 2017.

PRIVATE CONSTRUCTION – Spending on private construction was at a seasonally adjusted annual rate of $1,001.7 billion, 0.5 percent (±1.0 percent)* below the revised July estimate of $1,006.9 billion. Residential construction was at a seasonally adjusted annual rate of $548.9 billion in August, 0.7 percent (±1.3 percent)* below the revised July estimate of $553.0 billion. Nonresidential construction was at a seasonally adjusted annual rate of $452.9 billion in August, 0.2 percent (±1.0 percent)* below the revised July estimate of $453.9 billion.

PUBLIC CONSTRUCTION – In August, the estimated seasonally adjusted annual rate of public construction spending was $316.7 billion, 2.0 percent (±2.8 percent)* above the revised July estimate of $310.5 billion. Educational construction was at a seasonally adjusted annual rate of $72.3 billion, 1.0 percent (±4.4 percent)* above the revised July estimate of $71.7 billion. Highway construction was at a seasonally adjusted annual rate of $99.0 billion, 1.7 percent (±6.9 percent)* above the revised July estimate of $97.3 billion.

Leave A Comment