Magnolia Oil & Gas Corp. (MGY – Free Report) may be in the right place at the right time as crude has hit a multi-year high. This Zacks Rank #1 (Strong Buy) is expected to see rising earnings heading into 2019.

Magnolia Oil & Gas is an independent oil producer (“E&P”) with assets located in the Eagle Ford Shale and Austin Chalk formations in South Texas. It has a market cap of $3.5 billion.

Acquiring Harvest Oil’s South Texas Assets

On Aug 21, Magnolia announced it was acquiring Harvest Oil & Gas Corporation’s South Text Assets for $135 million in cash and 4.2 million shares of the company’s Class A common stock valued at $56 million as of Aug 20.

The acquisition was expected to close on Aug 31.

The company said it would be immediately accretive. It would add 15 net locations to the core Karnes County inventory and about 114,000 net acres to the Giddings Field position.

In the first half of 2018 it produced 4,800 barrel of oil equivalent per day (boe/d) with 1,400 boe/d in Karnes County being 69% oil/83% liquids and 3,400 boe/d in Giddings Field at 27% oil/53% liquids.

Estimates on the Move Higher

With crude trading above $75 at 4-year highs, the analyst earnings estimates are being adjusted.

In the last 60 days, one has moved higher, but also one estimate was lowered, for 2018. The Zacks Consensus Estimate is looking for $1.50.

2 estimates have also been raised in the last 2 months for 2019, with the 2019 Zacks Consensus at $1.60, which is up 6.9% from 2018.

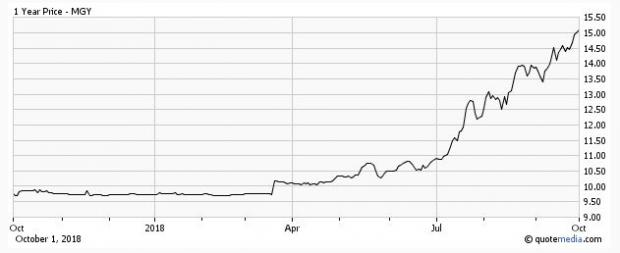

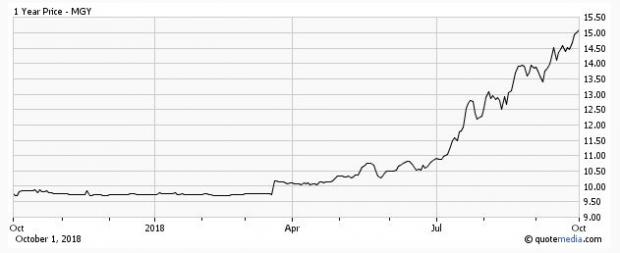

Shares Up But Valuation Still Attractive

The shares have been on a tear since the company rebranded itself at the end of July, Formerly TPG Pace Energy, it combined with EnerVest to become Magnolia as of Aug 1, 2018.

The shares have added 20% since the re-naming.

But they’re still attractively priced, with a forward P/E of just 10.

If the oil analysts are right that WTI will go to $80, then the smaller E&P companies are where investors will want to be.

Leave A Comment