A couple of weeks ago we took a look at the brewing weakness in small cap stocks. Though the S&P 600 had been the hottest index for the prior twelve months, the weight of those gains was starting to bear down. Though the S&P 500 large cap index and the S&P 400 mid cap index were still inching higher, small caps were waning.

In the meantime, that weakness from small caps seems to be infecting more and more stocks. In fact, although the S&P 500 and Nasdaq Composite still appear to be doing just fine, a closer look under their proverbial hoods reveals that most stocks are struggling. Only the biggest and most influential names are continuing to thrive. But, they can’t do it alone.

But, first things first.

Below is an updated version of the chart we primarily reviewed back on September 19th. Not only has the small cap index continued to slide, the mid cap index has bumped into a headwind as well.

But as long as the large caps are doing well, that’s enough? After all, they account for about three-fourths of the total market cap.

In a normal environment, that argument would hold water. We’re not in a normal environment though. You just have to turn over some unusual stones to realize how hollow this lingering strength is from the S&P 500 and the Nasdaq Composite.

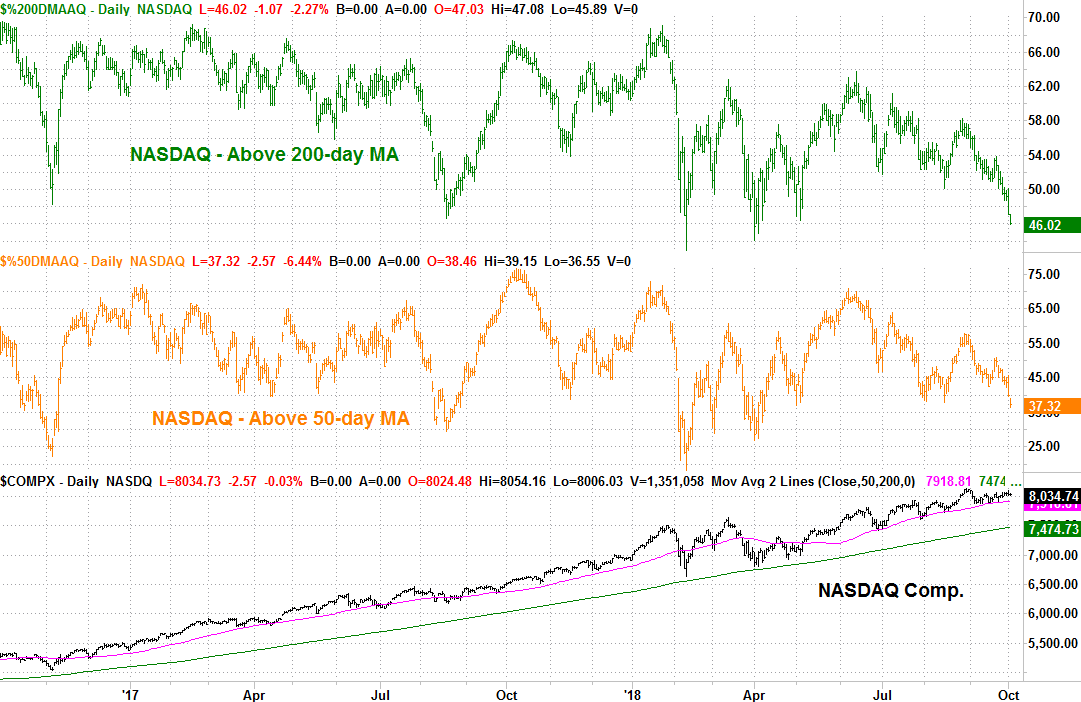

The graphic below plots the percentage of Nasdaq-listed names that are still above their 200-day moving average line, and above their 50-day moving average line. Given that the Nasdaq remains above both of those moving average lines, one would expect most stocks that make up the composite to be in the same boat. That’s not the shape of things though. Right now, most stocks that make up the Nasdaq Composite are below both the 50-day and the 200-day moving average lines.

What gives? The answer isn’t strictly an intuitive matter, but it does require some intuition to confirm the suspicion. In simplest terms, the market’s very biggest and most influential names that are ‘tech-like’ if not actual technology names are doing amazingly well, even if few other stocks are.

Leave A Comment