For a short while on Wednesday it looked like the market might get over a major hump… but only for a short while. Once the minutes from the most recent meeting of the Federal Reserve’s chiefs were posted, the bulls turned tail rather quickly. The slight gain that toyed with the idea of getting the S&P 500 over its 20-day moving average line turned into a loss of 0.55% by the time Wednesday’s closing bell rang. Traders just don’t think the market can stand up to the stepped-up inflation the Fed sees in store.

That’s the excuse traders are offering anyway, or at least the ones the media is telling traders they need to use. Truth be told though, the cause-effect relationship being batted around isn’t really the reason stocks rolled over. Rather, this rollover looks like it was going to happen no matter what. The market just needed a good excuse to get the ball rolling.

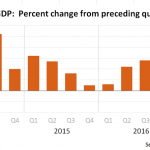

But, first things first. In short, the Federal Reserve sees a rate-hike plan that was slightly more accelerated than previously thought. The good news is, that inflation is being driven by robust economic growth. The bad news is, that growth spurs inflation, and inflation gets in the way of …. everything, doesn’t it?

Truth be told, there is some truthiness to the premise. Rising prices make it more difficult for companies and consumers to purchase all goods, slowing an economy down. Sometimes the slowdown is so abrupt it throws economic prosperity into reverse.

Sometimes.

Just bear in mind that more often than not, inflation can remain “too high” for months if not years on end, buoyed by a strong economy that offers consumers and companies more money to spend on higher-priced goods.

The graphic below tells the tale. The top plot is the S&P 500, in the middle you’ll find the annualized inflation rate (CPI), and on the bottom, you’ll find U.S. corporate earnings for a far back as the data exists. Note the lack of correlation that inflation has with earnings, and with the market for that matter. By that same token, notice that weak inflation didn’t always rekindle economic growth that spurs bull markets.

Leave A Comment