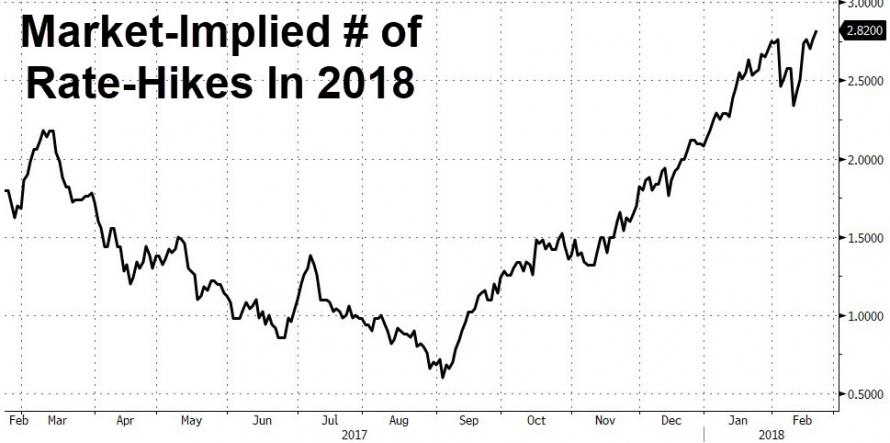

Market-implied expectations for the number of rate-hikes in 2018 surge to new cycle highs (2.82 hikes) ahead of the minutes (and the dollar had crept higher with them).

Since The Jan 31st Fed meeting, everything is lower (gold least, stocks most)…

And The Minutes did not disappoint with regard to a hawkish tilt…

Definitely has the sound of a Fed with several members that are worried about being ‘behind the curve’, but there was a goldilocks-like expectation among some that growth will rise but there’s no need for more rate hikes.

To be sure, the Fed is confident that the economy is gaining momentum, as a number of participants said they had marked up their growth forecasts since the previous month, encouraged by firm global growth, supportive financial markets and the potential for US tax cuts to boost the economy more than expected. Still, others said the “upside risks” to growth may have increased, according to minutes of the gathering.

Meanwhile, the Fed still has no idea why wages aren’t rising faster as the following excerpt reveals:

During their discussion of labor market conditions, participants expressed a range of views about recent wage developments. While some participants heard more reports of wage pressures from their business contacts over the intermeeting period, participants generally noted few signs of a broad-based pickup in wage growth in available data. With regard to how firms might use part of their tax savings to boost compensation, a few participants suggested that such a boost could be in the form of onetime bonuses or variable pay rather than a permanent increase in wage structures. It was noted that the pace of wage gains might not increase appreciably if productivity growth remains low. That said, a number of participants judged that the continued tightening in labor markets was likely to translate into faster wage increases at some point.

Leave A Comment