My Swing Trading Approach

I came into Friday with one long position, which was an ETF that acts as a short position on the S&P 500. I closed out SPXU at $33.55 for a +4% profit. I am now 100% cash entering today, and looking to play a potential bounce if the market will allow for it.

Indicators

Sectors to Watch Today

Utilities continue to attract buyers, with a massive rally on Friday. All other sectors traded lower, including Staples which looks like it is rolling over. Energy with a potential bull flag off of the 10-day moving average. Discretionary is experiencing a full fledged rollover as price breaks below its 200-day moving average and below recent consolidation. Technology remains an absolute mess, without a clear, discernible path forward.

My Market Sentiment

Bond markets are closed today for the holiday, which may help the market find a bounce today, even if it is temporary. Support levels are really starting to break down for this market, and only the lightest exposure to the long side should be considered. Bears are still in control, but if shorting, be weary of the afternoon bounce.

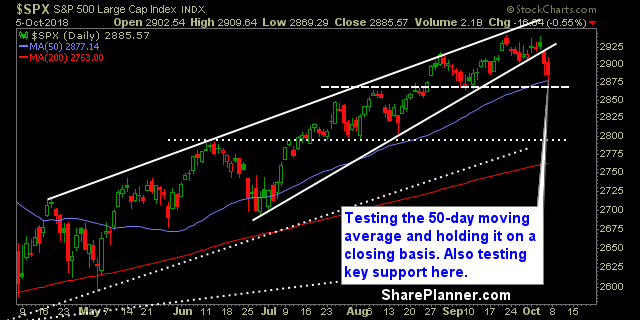

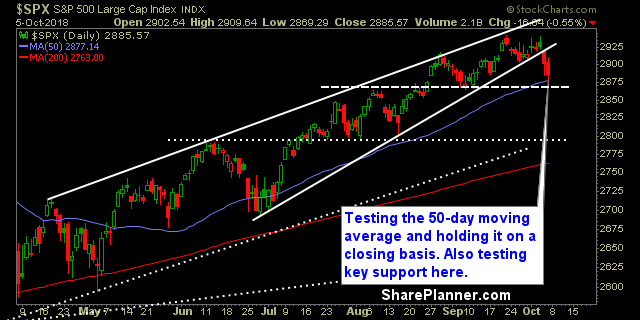

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment