Although it’s taken almost a week for the FED rate rise and NFP to spook the markets, fear has now taken hold, and signaled also on the VIX which has spiked higher.

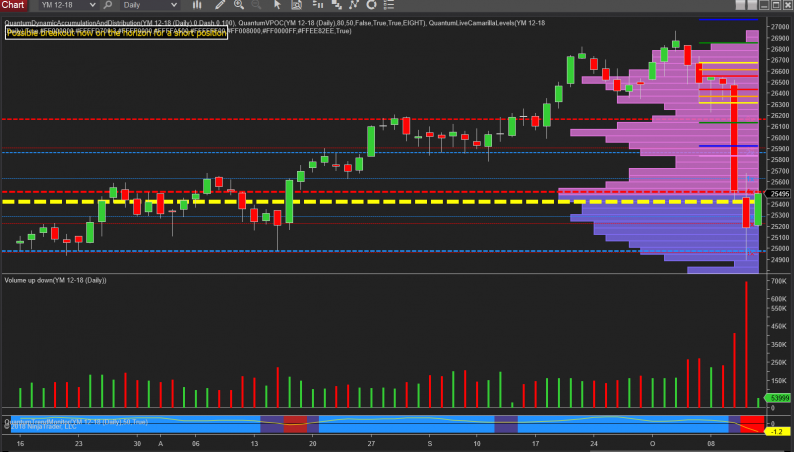

Yesterday on the US markets was a cataclysmic one in terms of volume, and this could best be described as extreme! Clearly, within the price action, there is both extreme selling and extreme buying as defined by the deep wicks both top and bottom. Whilst this could be considered an ‘equal’ tug of war driven by heavyweight teams on both sides, nevertheless, the buyers are in control overnight on Globex and into early morning London. Much of the bullish sentiment came late in the session following the very strong move lower, with the recovery equally strong towards the close. Volume is already building on the up candle and with the VPOC now anchored at 25,400 the 25,800 level above is now the one to watch given the low volume node which now awaits in this region.

The VIX mirrors the price action inversely and given it only reached low 20’s I would have expected a more extreme move after the previous day’s price action, so a potential congestion and reversal now on the horizon. We may see a V-shaped rally, but more likely a congestion phase to build with more volatility in due course, before a longer-term recovery is established.

Leave A Comment