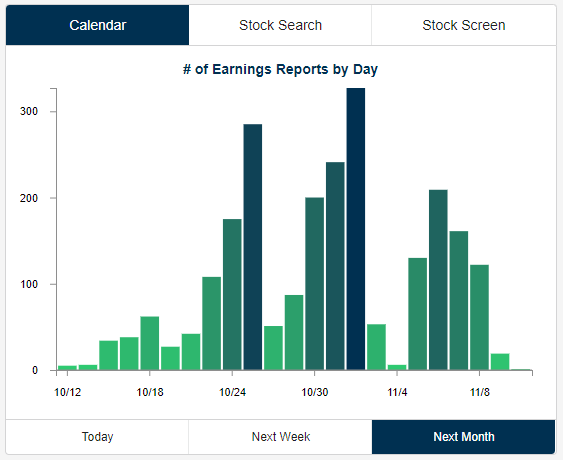

Earnings season began this week, but as shown in the chart below, things don’t really pick up until next week and beyond.

Next week, companies with a combined $5.5 trillion in market cap will report Q3 numbers, while $11.2 trillion in market cap will report the following week.

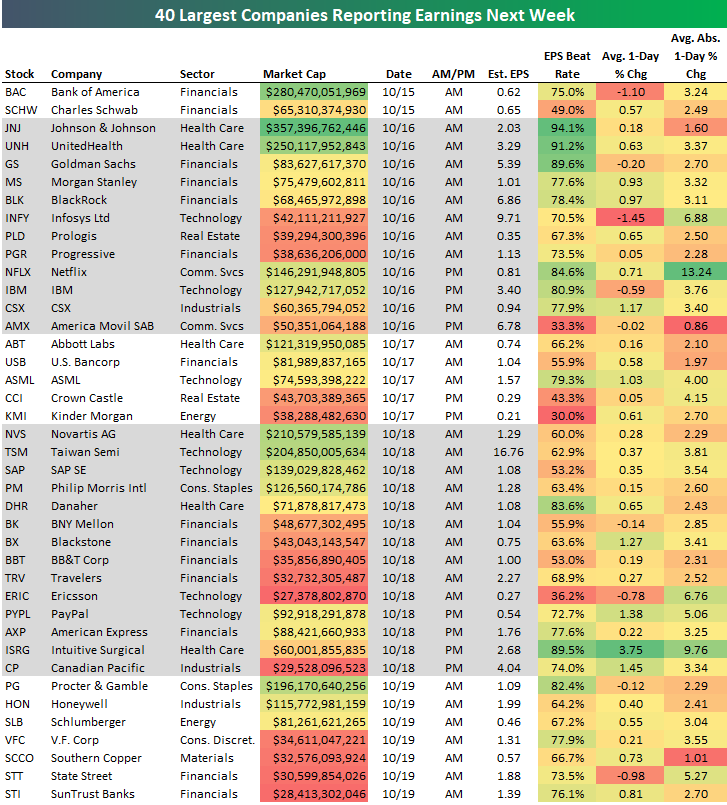

Below is a list of the 40 largest companies set to report their Q3 numbers next week. For each company, we include key info like its historical earnings beat rate, its average one-day price change in reaction to earnings, and its average absolute one-day price change in reaction to earnings.The average absolute number tells you how volatile a stock normally is on its earnings reaction day.

On Monday we’ll hear from two more big Financial sector firms — Bank of America (BAC) and Charles Schwab (SCHW). Johnson & Johnson (JNJ), Goldman (GS), UnitedHealth (UNH), and Morgan Stanley (MS) are set to report on Tuesday morning, while Netflix (NFLX) and IBM will headline Tuesday after the close.Netflix is by far the most volatile of the big companies reporting earnings next week with an average absolute move of +/-13.24% on its earnings reaction days.

Wednesday is relatively slow on the earnings front as Abbott Labs (ABT) is the only $100+ billion company reporting that day. On Thursday we’ll hear from PayPal (PYPL), American Express (AXP), and Intuitive Surgical (ISRG) after the close. Finally, Procter & Gamble (PG), Honeywell (HON), and Schlumberger (SLB) will round out the week with reports on Friday morning.

Of the names listed, JNJ, UNH, GS, ISRG, and NFLX have the highest earnings beat rates, while CSX, BX, PYPL, ISRG, and CP have historically experienced the biggest gains on their earnings reaction days.

Leave A Comment