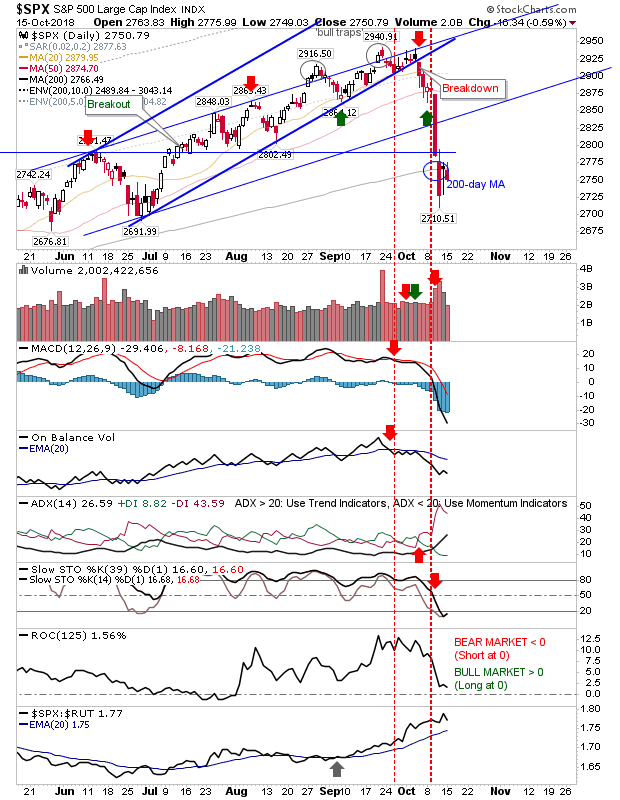

There was no real surprise to see the gains from Friday come back a little as Thursday’s lows play a siren song. The most likely outcome is a consolidation pennant as prices focus off last week’s lows – this might take a week to play out but the surge in volatility may see some pushback to stabilize price action.

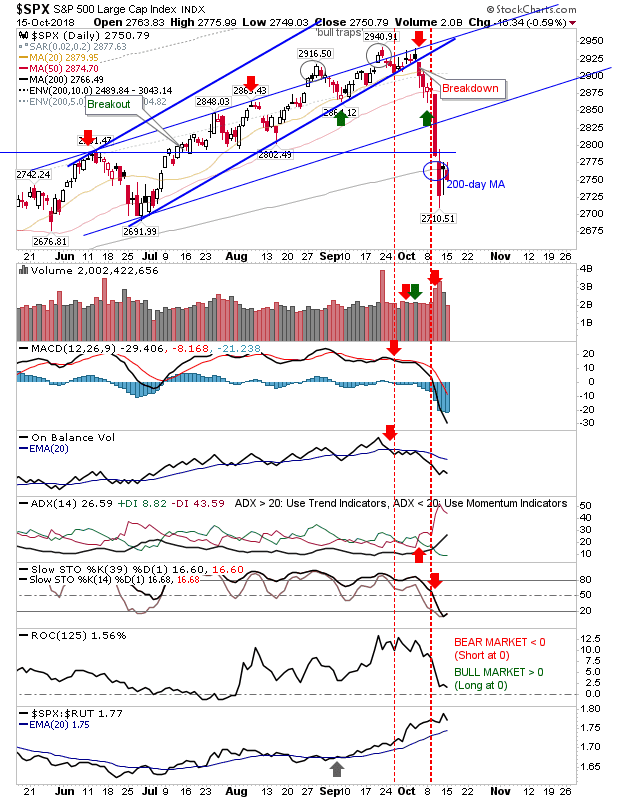

The S&P finished just below 200-day MA as it inches back to 2,710 lows. I would be looking for more small losses or a neutral doji. The best of the action is the strong relative performance (against Small Caps) which runs contrary to price action itself.

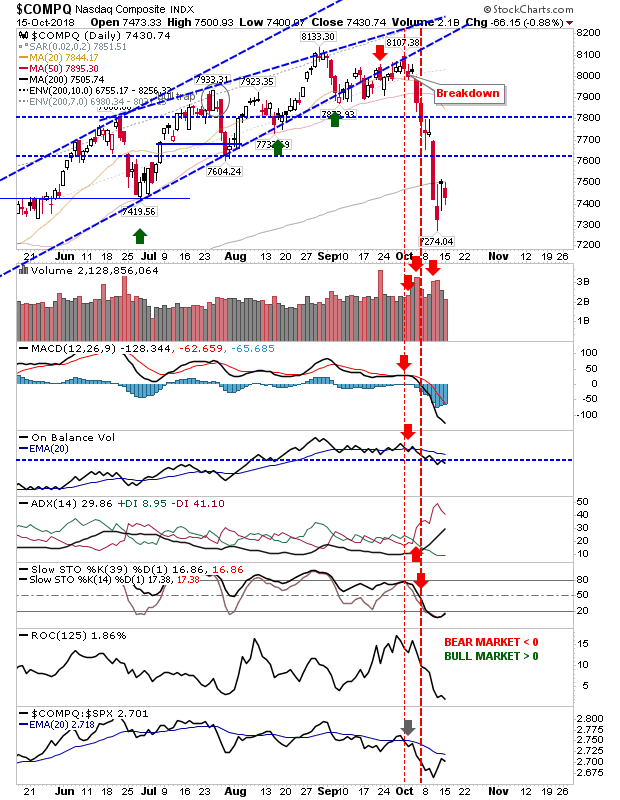

The Nasdaq also moved away from its 200-day MA as the lows pull prices towards it. Relative performance is trying to claw back the loss but it’s not there yet.

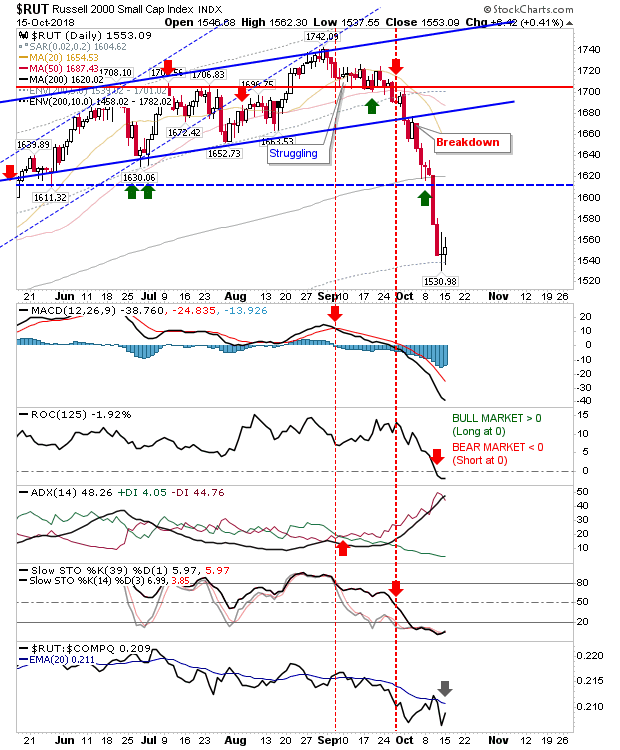

The Russell 2000 is trying to make a stand but the damage is extensive (but with more in the tank). The key loss today was the undercut of the zero line in ROC – another tick in the bear market column. Relative performance is shaky, if erratic.

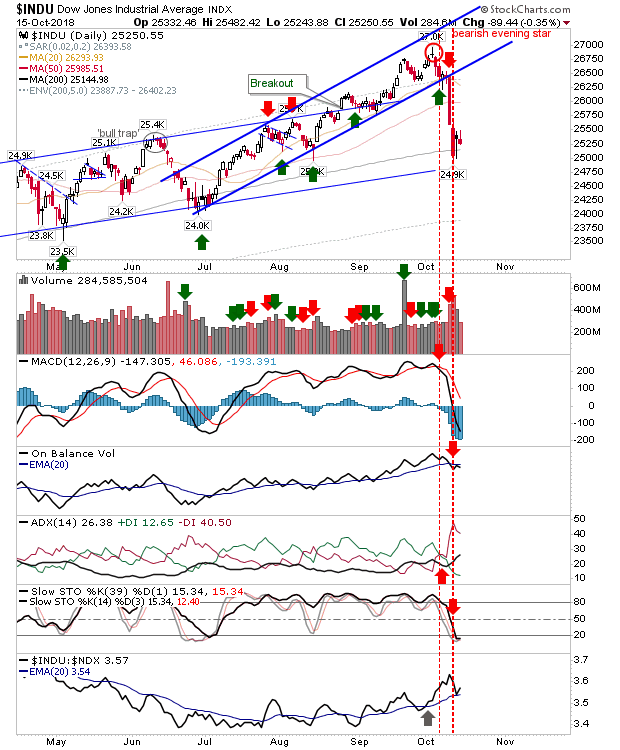

The Dow sits on the bullish side of the 200-day MA although technicals are not one to inspire confidence.

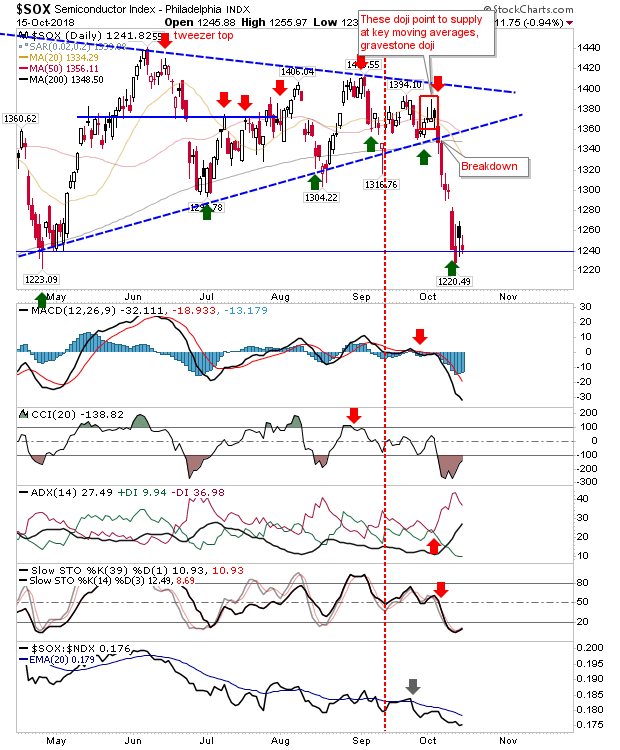

Of the potential long plays, the Semiconductor Index is one still playing for a bounce. It may spike lower but this looks best positioned to mount a tradable rally (with an initial target of 1,380s).

For tomorrow, longs can look to the Semiconductor Index but other indices may best wait for a low risk inside day (as part of a ‘coil’ pennant) to trade a swing play. While I think rallies look favored for indices in the short term I suspect they will struggle to maintain them when September congestion is reached.

Leave A Comment