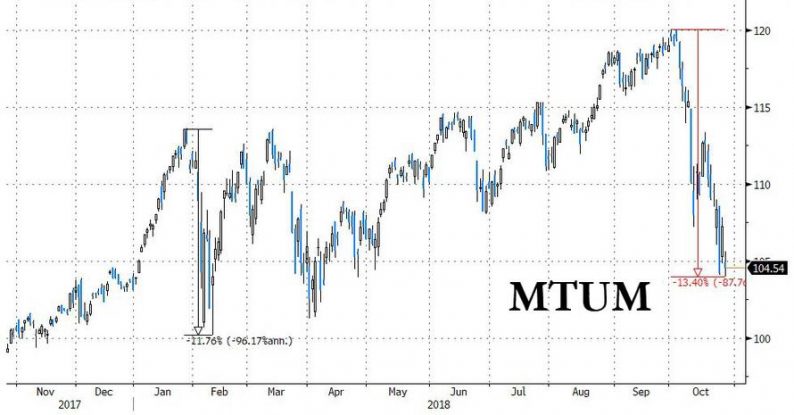

With most markets tumbling in the past month as the high-flying growth and tech names have been painfully grounded as today’s action in Amazon and Google vividly demonstrates, the past month has been especially painful for momentum traders, with the drop from the September highs now worse than that observed during the market’s February VIXtermination correction.

In fact, extending the chart, this is the worst drop in the iShares Momentum (MTUM) ETF on record.

And in a world in which every aspect of the market is repackaged for algo use, the collapse in momentum trading means that hedge funds using models to follow big market trends have been whiplashed as volatility has spiked; in fact according to Bloomberg, trend – and momentum chasers – are now among the biggest casualties of a stock rout that has accelerated worldwide.

Within this group, it is the group of trend-followers known as CTAs, or commodity trading advisers, that has been hit the hardest with Leda Braga’s BlueTrend hedge fund, GAM Holding AG’s Cantab unit and Man Group Plc’s AHL unit among those suffering steep losses in October.

While on paper, CTAs use computer-driven models to navigate markets and trade everything from equities to bonds to currencies to commodity futures, in reality, they simply chase momentum and try to isolate an upward (and occasionally) downward pattern which to piggyback on. Unfortunately for their programmers, with volatility surging, the market’s traditional patterns have all been shattered.

Computer-driven hedge funds were already headed for their worst year ever before this month’s volatility, “amid slowing corporate earnings, political turmoil in Italy and uncertainty over Brexit.” During the February correction, they tumbled more than 4% for their worst month since 2001, according to a Eurekahedge index that tracks the category. Meanwhile, as the SG CTA Index shows, after the October rout, the performance of trend followers is set to drop to a 4 year low.

Leave A Comment