The price of bitcoin got stuck in a very narrow range in the past week. The phenomenon puzzles many market analysts which got used to significant movements to the upside and to the downside. The daily change in BTC/USD prices had already narrowed down early in the month but recent days saw movements similar to those in bond markets, not Bitcoin. Will the crypto-craze return?

The Securities and Exchange Commission published the memorandum from the meeting on the Bitcoin Exchange Traded Fund (ETF) and said that the significant derivatives market is necessary for an approval. The futures market is almost one-year-old and looks quite mature. Will the next request succeed? Markets remain cautious and many analysts do not expect an ETF to come in 2018. The spring of 2019 may see such an approval.

A Bitcoin ETF is important in order to enable mainstream investors to jump into cryptocurrency markets.

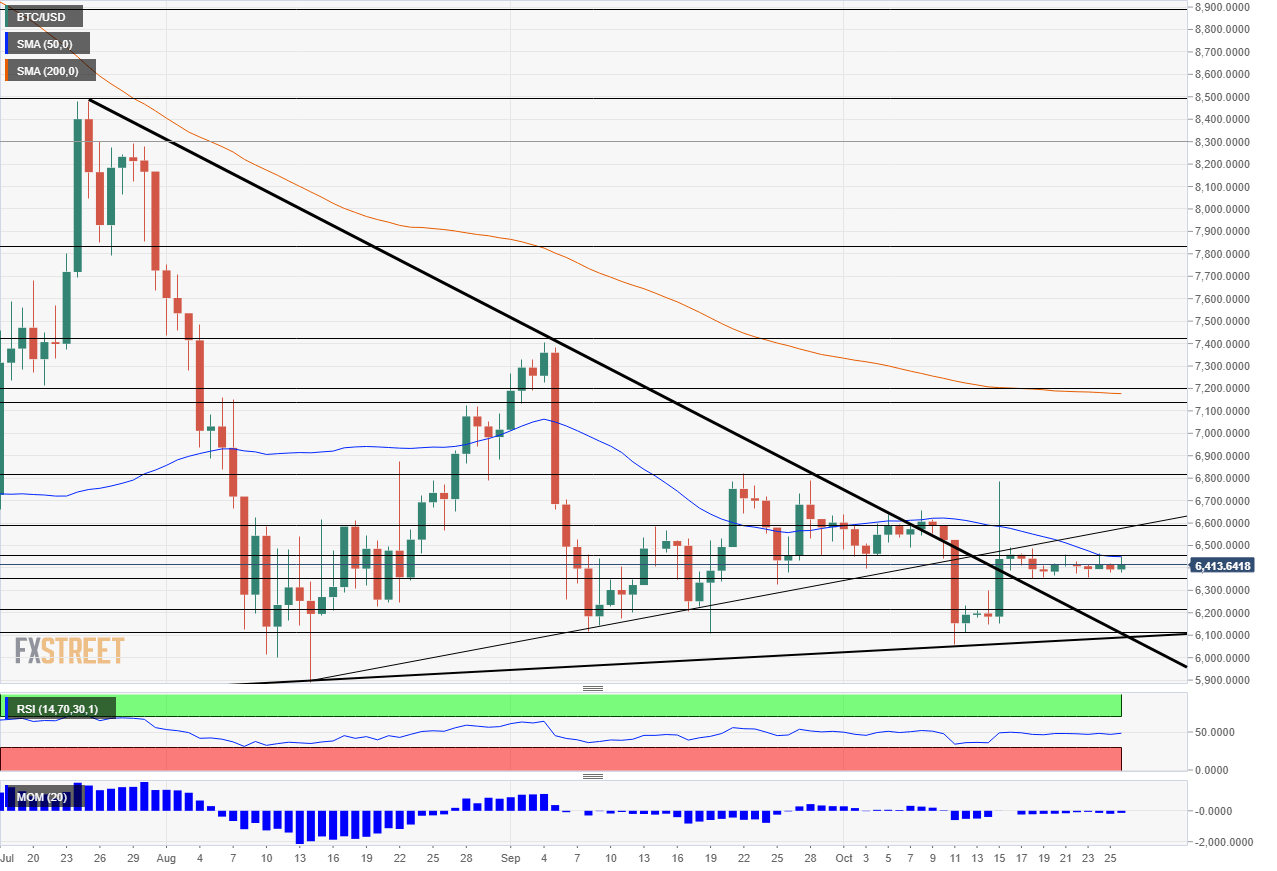

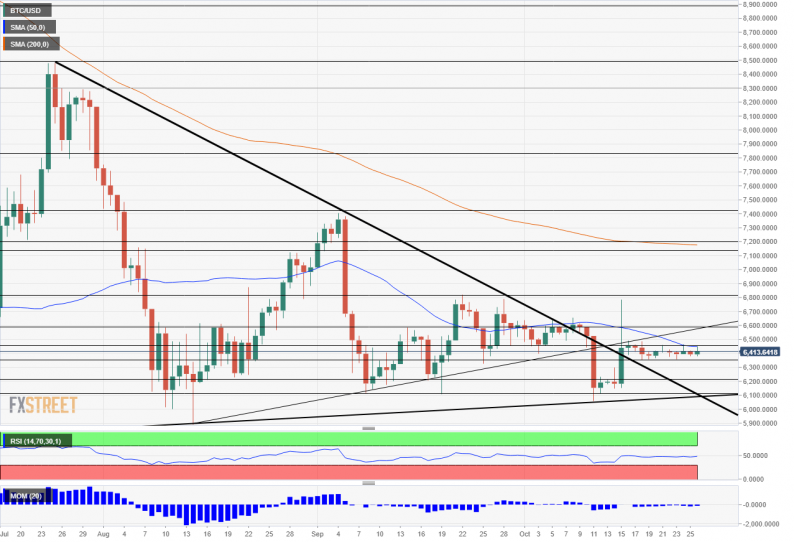

The BTC/USD is trading in a narrow range between $6,355 and $6,457 in recent days. Bitcoin is trading close to the 50-day Simple Moving Average, but just below. Momentum and the Relative Strength Index are totally flat.

Technical analysis textbooks suggest that periods of low volatility are followed by explosions. But to which direction?

Outside the current range, the technical levels have not changed since the previous outlook.

$6,600 capped the pair in recent days and also in early September. The 50-day SMA is around this level. $6,800 is a strong line of resistance. The BTC/USD halted twice around this line in September, and the level also served as support in late August.

$7,150 worked in both ways in late August and early September when the pair traded at higher ground, and it is closely followed by $7,200. $7,400 was the peak at the beginning of last month.

Below the uptrend support line, we find $6,300 that was a low point in late September. Further down, $6,200 was a cushion in August, and $6,100 was a the flash-crash low of mid-September. Below the round number of $6,000, we are down to the 2018 lows at $5,800.

Leave A Comment