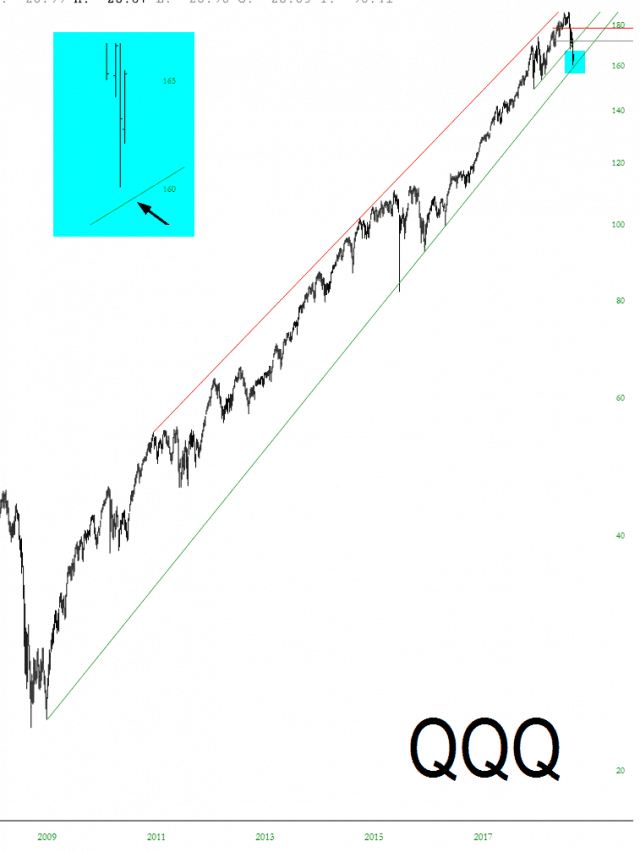

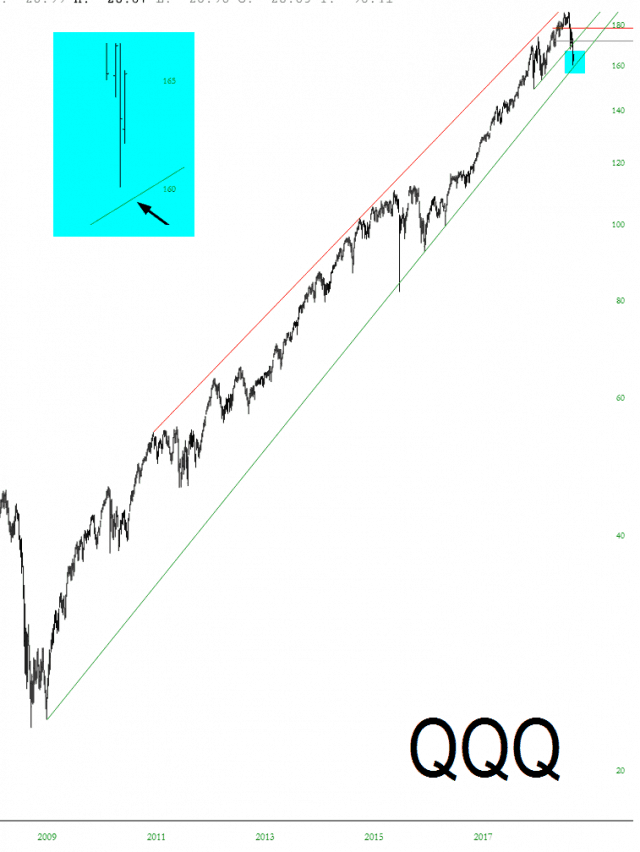

Yesterday, the Nasdaq got clobbered so hard that it did something it hasn’t done in years: it tagged its long-term supporting trendline. This line goes back to March 6, 2009, when this idiotic bull market started.

This is a “glass half-full/glass-half-empty” kind of situation. On the one hand, bulls could get excited by this event, claiming – quite plausibly! – that this is a fantastic time to buy, just like it was in February 2016 the last time the trendline was met. On the other hand, if some “shock event” happens – maybe Facebook (Tuesday after the close) or Apple (Thursday after the close), and this trendline is broken, well… let’s just say Slope’s surging popularity will just get surge-i-er.

Leave A Comment