Declining Labor Momentum

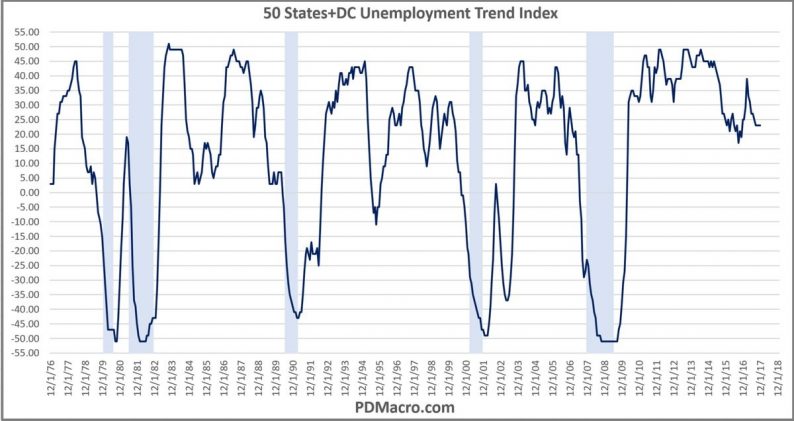

The chart below shows the net number of states with increasing or decreasing unemployment rates. This is like a breadth indicator for the labor market. As you can see, there are about 23 more states with decreasing unemployment rates than increasing rates. The number likely declined because of the weakness in energy from 2014-2016. It’s tough for the overall unemployment rate to go much lower since the labor market is near full employment. I’m very interested in what happens to the unemployment rate in the next 12 months because usually when unemployment increases year over year, it means a recession is afoot. That’s why it’s one of Jeffrey Gundlach’s favorite indicators. That will be tested because a few tenths of a percentage point increase shouldn’t necessarily mean the economy is about to fall off a cliff. The chart indicates that there have been many scenarios where the labor market breadth has been weak yet there was no recession.

The other indicator which is in the same situation is the Shiller PE. Stocks usually fall into a bear market when the Shiller PE falls year over year especially when it’s high. Next year might be an exception to that trend because 2008 earnings are about to come out of the trailing 10-year calculation. This will lower the multiple. Since there has only been one cycle which lasted 10 years, this scenario hasn’t happened much. The 2008 earnings were also particularly weak for a recession, making this expected decline unique.

When Will The Market Peak?

The chart below is a lesson in psychology. As you can see, Merrill Lynch asked fund managers in December and January when the stock market would peak. The percentage saying the market would peak in Q1 2018 fell by about 15% in one month. Two reasons for this are that Q1 2018 went from being the future to the present and that the sentiment improved. January saw a euphoric investor base, making few willing to stick their neck out and claim the market would crash. It’s easy to say stocks will peak at some point in the future, but it’s difficult to claim the current moment is the time it will peak.

Leave A Comment