The last couple of weeks have been nothing short of astonishing for Ether (ETH), as the cryptocurrency hiked over 80% to reach a $4,200 all-time high. Even after a 7% correction, the gains accumulated in 2021 surpass 300%, and Ether currently holds a market capitalization that exceeds $450 billion.

In the face of such a mind-blowing performance, neither the futures contracts premium nor the options fear and greed indicator signal extreme optimism in the market. This data will likely lead some analysts to question whether traders are losing confidence in Ether’s future price prospects.

The fact that decentralized applications reached $90 billion in net value locked while crypto exchange Ether balances dropped to record lows adds additional demand for Ether and supports the current bullish narrative.

Professional traders also signaled interest as Ether futures open interest rose above $10 billion. At the same time, VanEck’s SEC filing for an ETH exchange-traded fund (ETF) further proves that the bullish outlook for Ether remains strong.

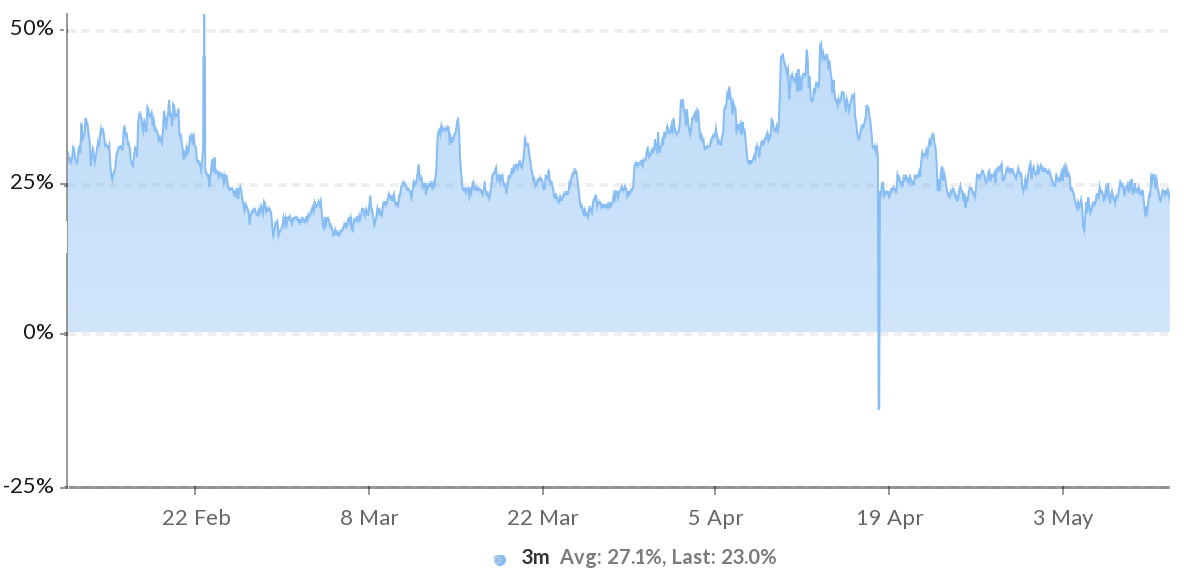

Ether’s futures premium is below the recent average

To confirm whether investors’ confidence dropped as Ether reached its all-time high, one should monitor the monthly contracts premium, known as the basis. Unlike perpetual contracts, these fixed-calendar futures do not have a funding rate. Therefore their price will vastly differ from regular spot exchanges.

By measuring the price gap between futures and the regular spot market, a trader can gauge the level of bullishness in the market. Whenever there’s excessive optimism from buyers, the three-month futures contract will trade at a 20% or higher annualized premium (basis).

A 23% basis level flirts with extreme optimism, but considering the recent rally, one would expect a much higher number. Therefore, one should also evaluate how options traders are pricing the downside risk.

The primary risk indicator for options is neutral

To assess a trader’s optimism level after Ether painted the $4,200 all-time high, one should look at the 25% delta skew. This indicator provides a reliable “fear and greed” analysis by comparing similar call (buy) and put (sell) options side by side.

The metric will turn positive when the neutral-to-bearish put options premium is higher than similar-risk call options. This situation is usually considered a “fear” scenario. On the other hand, a negative skew translates to a higher cost of upside protection and points toward bullishness.

Both derivatives indicators sit on the edge of a neutral-to-bullish zone, something unusual after a steady and positive performance. Therefore, one can conclude that there is literally no ‘over-excitement’ from pro traders.

Some might say it’s a “glass half full” point of view regarding the potential buyers’ leverage opportunity.

However, the same data can be interpreted as a lack of confidence from pro traders, fueling bears’ hopes of an eventual correction in Ether price. Unfortunately, there’s no way to tell right now as it remains unclear how soon the Ethereum fees problem can be solved.

he views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Leave A Comment