The US markets opened rather weakly, based in large part on continuing disappointments in the overvalued big cap tech stocks, and the mispricing of the risks in the international trade and geopolitical conflict scenarios.

Trumpolini is keeping things lively on the international trade front with China and Mexico.

The markets broke down to their lows in the mid-afternoon, but managed to rally back a bit into the close.

It will be interesting to see how Asia and Europe will react to this shaky tableau of pigs with lipstick.

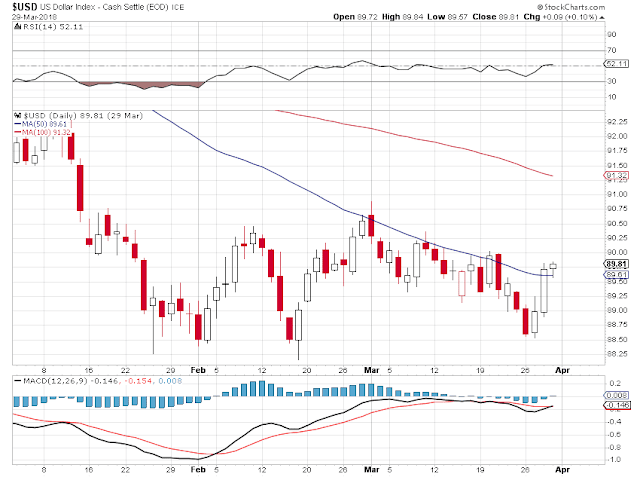

There was an obvious flight to safety in gold and silver, and the US Dollar as well as all three moved higher.

There will be a Non-Farm Payrolls report on Friday.

I have to say that despite the losses the US markets were rather well-behaved, and followed along with the support and resistance levels on my charts with a consistency that made me a little surprised.

In other words, despite the deep selling with the DJIA down almost 700 points during the day, there was very little panic in the air.

It may take a bit of a selling panic and bull capitulation to finally strike a bottom in these whipsawing markets we have been enjoyed for the past few weeks.

We had a wonderful Easter dinner yesterday, with turkey and all the trimmings for ourselves and some extended family. We had the windows open as it was in the 60’s with a very nice breeze and mild humidity.

Imagine our surprise when we woke this morning to about four inches of snow covering everything, even the roadways. Odd sort of snow for April.

More oddities may be seen in the days to come.

Leave A Comment