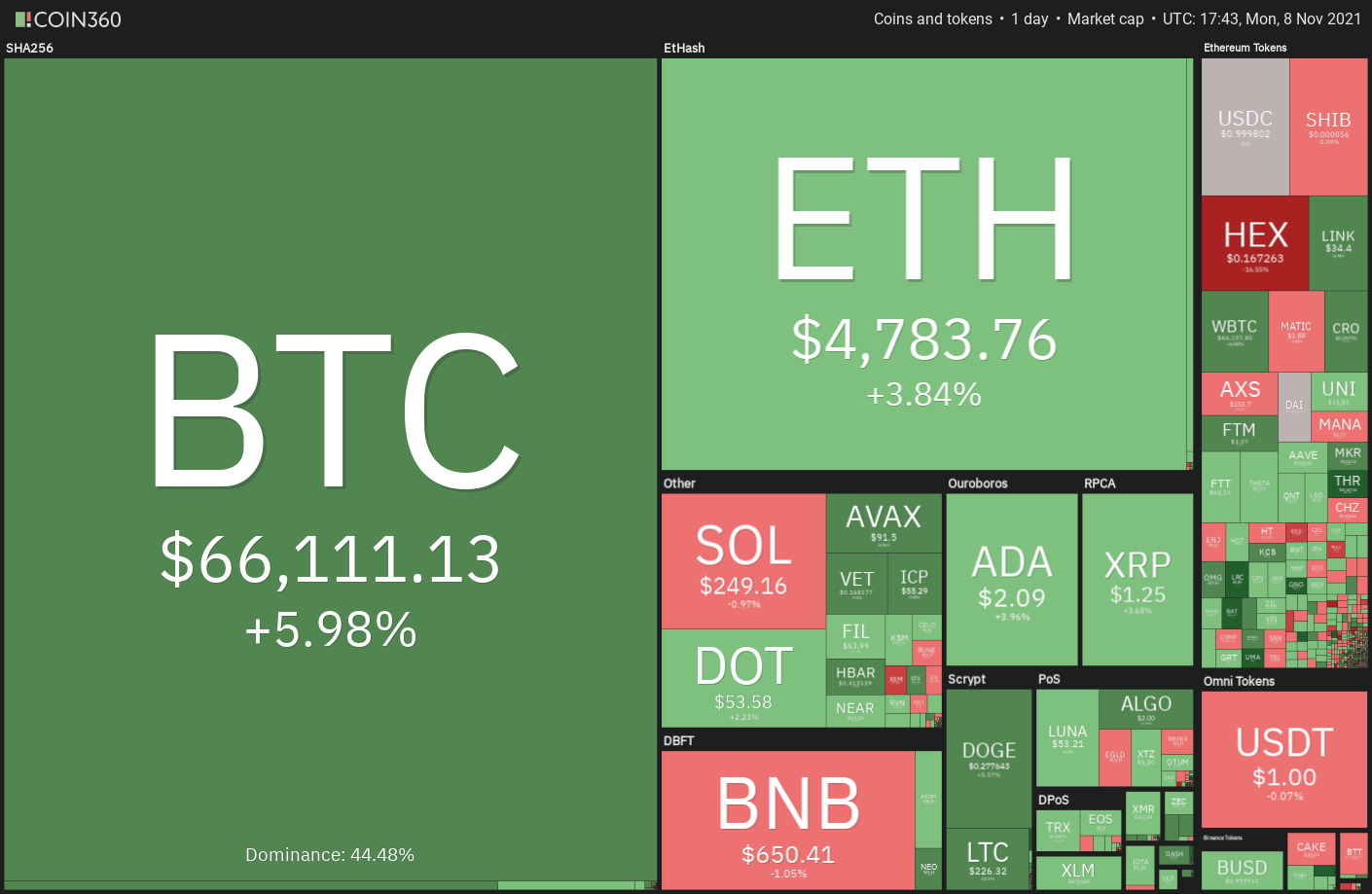

Bitcoin (BTC) is close to making a new all-time high and Ether (ETH) finally soared to hit a new high at $4,800. This pushed the total crypto market capitalization above $3 trillion for the first time ever on Nov. 8, according to data from CoinGecko.

Data from Santiment shows that Bitcoin whales holding between 10,000 BTC to 100,000 BTC in their wallets have been aggressively buying in the past few days. They have added 92,000 Bitcoin in the past 25 days out of which roughly 43,000 have been purchased in the past five days.

Could the bullish trend in Bitcoin and Ether pull the other major coins higher? Let’s study the charts of the top-10 cryptocurrencies to find out.

BTC/USDT

Bitcoin broke above the bullish flag pattern on Nov. 2, indicating the possible resumption of the uptrend. The bears repeatedly attempted to pull the price back inside the flag but could not break the support at the 20-day exponential moving average ($61,400).

The first target on the upside is $75,000 which may act as a resistance but if bulls overcome this hurdle, the pair could start its march toward the pattern target at $89,476.12.

Contrary to this assumption, if the price turns down from the overhead resistance, the pair could drop to the 20-day EMA. A break and close below this support could open the doors for a possible decline to the 50-day simple moving average ($55,284).

ETH/USDT

Ether rebounded off the breakout level at $4,375 on Nov. 6, indicating that bulls have flipped this level into support. The buying resumed on Nov. 7 and the bulls have pushed the price above the previous all-time high at $4,665.87 today.

A break and close above $5,000 could open the doors for a further rally to $5,283.17. The important support to watch on the downside is the 20-day EMA and it has not been broken since Oct. 1.

If this support cracks, it will signal that the bullish momentum may be weakening. The pair could then drop to $3,888.

BNB/USDT

Binance Coin (BNB) picked up momentum after breaking out of $518.90. The bears are attempting to defend the overhead resistance at $691.80 as seen from the long wick on the Nov. 7 candlestick.

Although the upsloping moving averages indicate advantage to buyers, the overbought levels on the RSI suggest that the pair could soon enter a minor consolidation or correction. The first support on the downside is $600.

If this support is breached, the pair could drop to the 20-day EMA ($549). Such a deep correction could delay the start of the next leg of the uptrend.

ADA/USDT

Cardano (ADA) had been trading between the 20-day EMA ($2.04) and the critical support at $1.87 for the past few days. Although the bears successfully defended the 20-day EMA, they could not sink the price below $1.87, indicating accumulation at lower levels.

A break and close above the resistance line will indicate that bulls are back in the game. The pair could then rise to $2.47 where the bears are likely to mount a stiff resistance.

Alternatively, if the price turns down from the downtrend line, the bears will again try to sink the pair below $1.87.

SOL/USDT

Solana (SOL) is in a strong uptrend and trading inside an ascending channel. The up-move is facing profit-booking near the resistance line of the channel but a positive sign is that the bulls have not given up much ground.

Alternatively, if the price breaks below the centerline, the pair could drop to the support line of the channel. A break below the channel could start a deeper correction to $200 and later to the 50-day SMA ($175).

XRP/USDT

XRP broke above the $1.24 overhead resistance today but the bulls are finding it difficult to sustain the breakout. This suggests that bears are active at higher levels.

This level could again act as a stiff resistance but if buyers overcome this hurdle, the bullish momentum could pick up.

On the contrary, if the price turns down from the current level, the pair could drop to the 20-day EMA. The selling could intensify if the support cracks and the pair may drop to $1.

DOT/USDT

Polkadot (DOT) bounced off the breakout level at $49.78 on Nov. 6, indicating that bulls are attempting to flip this level into support. The buyers will now attempt to push the price above $55.09 and resume the uptrend.

If the price turns down from the overhead resistance, the pair could remain range-bound between $49.78 and $55. A break and close below $49.78 will be the first indication that traders may be booking profits on their positions.

The pair could then drop to the 20-day EMA ($47.41). If the price rebounds off this level, the bulls will again try to resume the uptrend but if the support gives way, the pair may drop to the 50-day SMA ($38.92).

Related: Bitcoin retains $65K after Elon Musk sell-off sees BTC pass Tesla market cap

SHIB/USDT

SHIBA INU (SHIB) has been in a strong corrective phase in the past few days. Although the price rebounded from just below the 20-day EMA ($0.000053) on Nov. 5, the bulls are struggling to sustain the higher levels.

The longer the price sustains below the 20-day EMA, the greater is the possibility of a fall to the 50-day SMA ($0.000031).

A breakout and close above the downtrend line will be the first sign that the selling pressure may be reducing. The pair could then rise to $0.000065 and later to $0.000075.

DOGE/USDT

Dogecoin (DOGE) dipped below the 20-day EMA ($0.26) on Nov. 4, 5 and 6 but the long tail on the candlesticks suggests strong buying at lower levels.

If the price turns down from the current level, the bears will again try to pull the price below the 20-day EMA. If that happens, the DOGE/USDT pair could drop to the 50-day SMA ($0.24). A break below this support may result in a decline to $0.19.

AVAX/USDT

Avalanche (AVAX) is in a strong uptrend. The up-move picked up momentum after the price rose above the overhead resistance at $81. The bulls will now try to drive the price to $100.

However, if the price turns down from the current level, the pair could drop to the breakout level at $81. If bulls flip this level into support, the possibility of the continuation of the uptrend increases.

The first sign of weakness will be a break and close below the $81 support. The pair could then drop to the 20-day EMA, which is an important level for the bulls because a break below it could signal a short-term top has been made.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Market data is provided by HitBTC exchange.

Leave A Comment